Global X-ray based Robots Market - Key Trends and Drivers Summarized

How Are X-ray Based Robots Revolutionizing Medical Diagnostics?

X-ray based robots are at the forefront of a revolution in medical diagnostics, combining cutting-edge robotics with advanced imaging technology to offer unprecedented precision, efficiency, and flexibility in healthcare settings. These robots are specifically designed to enhance the capabilities of traditional X-ray machines by allowing for automated, highly precise positioning during diagnostic procedures. Unlike conventional X-ray devices that often require manual adjustments and patient repositioning, X-ray based robots can automatically align themselves to capture images from multiple angles without disrupting the patient. This not only improves patient comfort but also significantly increases the accuracy of the images captured. In complex medical cases such as spinal assessments, orthopedic surgeries, and cardiovascular diagnostics, the ability of X-ray based robots to deliver consistent, high-quality images from challenging angles is invaluable. By reducing the likelihood of human error, these systems help ensure that diagnostic results are reliable, improving clinical decision-making and patient outcomes. Moreover, their use in real-time imaging during surgeries allows surgeons to make immediate adjustments based on highly detailed visuals, ultimately enhancing surgical precision and reducing recovery times.What Technological Advancements Are Enhancing X-ray Based Robots?

Technological advancements have greatly expanded the capabilities of X-ray based robots, enabling them to deliver more sophisticated and accurate imaging solutions across various fields. One of the most significant breakthroughs is the integration of artificial intelligence (AI) and machine learning into these systems. AI algorithms are now being used to analyze X-ray images in real-time, providing immediate diagnostic insights that were previously only achievable through human interpretation. For example, AI can help detect abnormalities, such as tumors or fractures, with a high degree of accuracy, acting as a second set of eyes for radiologists and reducing the likelihood of missed diagnoses. Additionally, the development of 3D X-ray imaging technology has further enhanced the capabilities of these robots, allowing them to capture volumetric images that provide a comprehensive, three-dimensional view of the body's internal structures. This is especially useful in surgical planning, where detailed, accurate images are critical to successful outcomes. Another important technological advancement is the miniaturization of X-ray components, which has enabled the development of more compact and mobile X-ray based robots. These smaller units can be used in confined spaces like emergency rooms or operating theaters, providing critical imaging support without the need for large, fixed machines.How Are X-ray Based Robots Expanding Beyond Healthcare?

While X-ray based robots have found a natural home in healthcare, their potential applications are far-reaching, extending into industries such as manufacturing, security, and aerospace. In the manufacturing sector, X-ray based robots are widely used for non-destructive testing (NDT), a method that allows engineers to inspect the internal structures of materials and components without causing damage. This is particularly critical in industries like automotive and aerospace, where even the smallest structural defect can lead to catastrophic failures. X-ray based robots can efficiently scan complex parts, ensuring they meet stringent safety and quality standards. By automating the inspection process, these robots reduce human error, increase throughput, and save time, making production lines more efficient and reliable. In the security industry, X-ray based robots are becoming indispensable at airports, border crossings, and high-security facilities. These robots are used to scan luggage, cargo, and vehicles for hidden threats such as explosives, weapons, or contraband. Their ability to automate these tasks ensures that security personnel can focus on more critical decision-making roles while maintaining a high level of inspection accuracy. The versatility of X-ray based robots, combined with their ability to deliver precise, real-time imaging, is driving their adoption across a growing number of industries, where safety, quality control, and automation are key priorities.What Is Driving Growth in the X-ray Based Robots Market?

The growth in the X-ray based robots market is driven by several factors, notably the rapid advancements in robotic technology, the increasing demand for precise, non-invasive diagnostic tools, and the expanding need for automated systems in industrial applications. In the healthcare sector, there is a growing demand for minimally invasive procedures that can deliver accurate, real-time imaging to improve patient outcomes. X-ray based robots meet this need by providing highly detailed images that guide surgeons during complex operations, allowing for more precise interventions with reduced recovery times. Additionally, the rising prevalence of chronic diseases, including cardiovascular disorders and orthopedic issues, has heightened the demand for advanced imaging solutions that can diagnose and monitor these conditions effectively. As healthcare systems around the world continue to prioritize early detection and preventive care, the adoption of X-ray based robots in hospitals and clinics is expected to increase. In the industrial sector, the growing focus on quality control and safety is driving the adoption of X-ray based robots for non-destructive testing. Industries such as aerospace, automotive, and electronics rely on these robots to ensure that their products meet strict safety and performance standards, helping to avoid costly recalls and failures. The integration of AI and machine learning into X-ray based robots is also a key growth driver, as these technologies enhance the robots' ability to analyze complex data in real-time, reducing the need for human intervention and increasing operational efficiency. Furthermore, the rising awareness of workplace safety and the need to comply with stringent environmental and safety regulations are pushing industries to adopt more automated, precise solutions like X-ray based robots. As automation becomes a cornerstone of modern manufacturing and healthcare, the market for X-ray based robots is poised for sustained growth, fueled by the need for enhanced accuracy, safety, and efficiency across multiple sectors.Report Scope

The report analyzes the X-ray based Robots market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Segment (X-Ray-Based Robots).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Regional Analysis

Gain insights into the U.S. market, valued at $1.4 Billion in 2024, and China, forecasted to grow at an impressive 9% CAGR to reach $1.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global X-ray based Robots Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global X-ray based Robots Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

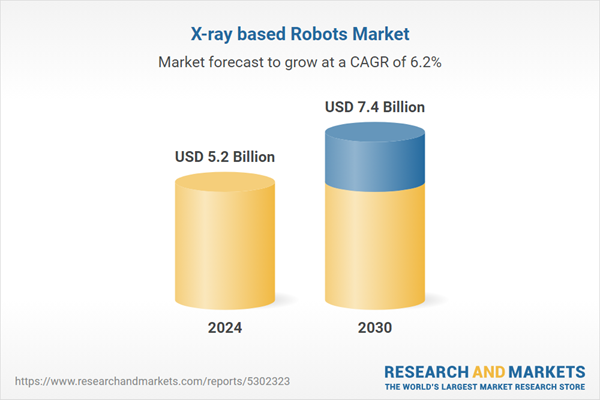

- How is the Global X-ray based Robots Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as EMD Medical Technologies, Eurocolumbus s.r.l., GE Healthcare, Hologic Inc., Intermedical S.r.l. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this X-ray based Robots market report include:

- EMD Medical Technologies

- Eurocolumbus s.r.l.

- GE Healthcare

- Hologic Inc.

- Intermedical S.r.l.

- Medtronic

- Philips Healthcare

- Shimadzu Corporation

- Siemens Healthcare

- Simad S.r.l.

- Stephanix S.A Technix

- Ziehm Imaging GMBH

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- EMD Medical Technologies

- Eurocolumbus s.r.l.

- GE Healthcare

- Hologic Inc.

- Intermedical S.r.l.

- Medtronic

- Philips Healthcare

- Shimadzu Corporation

- Siemens Healthcare

- Simad S.r.l.

- Stephanix S.A Technix

- Ziehm Imaging GMBH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 138 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 5.2 Billion |

| Forecasted Market Value ( USD | $ 7.4 Billion |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |