Global Aspiration & Biopsy Needles Market - Key Trends and Drivers Summarized

Are Aspiration & Biopsy Needles the Key to Better Diagnostic Precision?

Aspiration and biopsy needles have become essential tools in diagnostic medicine, playing a pivotal role in the detection and assessment of various diseases, including cancer and infectious conditions. These needles enable healthcare providers to extract tissue or fluid samples directly from specific parts of the body, allowing for targeted analysis that helps in confirming diagnoses, staging diseases, and developing treatment plans. Aspiration needles are primarily used to withdraw fluid, often from cysts or abscesses, whereas biopsy needles are designed to obtain solid tissue samples from organs such as the liver, lungs, or breast. With advancements in design and technology, modern aspiration and biopsy needles are increasingly precise and minimally invasive, ensuring accurate sampling with minimal disruption to surrounding tissues. This precision is crucial for early detection, as it allows clinicians to identify abnormal cells before they spread, leading to better treatment outcomes. The latest needle designs incorporate ultrathin structures that reduce complications, thereby improving patient comfort and safety. As a result, aspiration and biopsy needles have become indispensable tools for healthcare professionals striving to provide fast, reliable diagnoses with minimal patient risk.How Are Technological Innovations Transforming Aspiration & Biopsy Needle Development?

The development of aspiration and biopsy needles has been revolutionized by advancements in material science and precision engineering, which have greatly enhanced both the accuracy and safety of these diagnostic tools. Modern needles are now crafted from high-strength materials that provide both flexibility and durability, allowing them to navigate complex anatomical structures without bending or breaking. Some of these needles are coated with advanced materials that reduce friction, facilitating smoother insertion and minimizing patient discomfort during procedures. Additionally, the integration of imaging-guided technologies such as ultrasound and CT guidance has transformed the diagnostic landscape, allowing real-time visualization of the needle's path. This guidance is especially valuable in cases where the target tissue is small, deep-seated, or located near critical structures, as it enables the collection of highly targeted tissue samples. Innovations in needle-tip technology have further enhanced diagnostic precision, with micro-engineered tips that facilitate more accurate extraction of cell and tissue samples. These developments, including fine-needle aspiration (FNA) and core-needle biopsy (CNB) options, allow clinicians to access difficult-to-reach areas with confidence, reducing the need for repeat procedures. Through these technological advancements, aspiration and biopsy needles are becoming more sophisticated and adaptable to a variety of complex medical scenarios, providing clinicians with the tools needed for high-precision diagnostics with fewer complications.Why Are Aspiration & Biopsy Needles Becoming Increasingly Popular Among Patients and Healthcare Providers?

The popularity of aspiration and biopsy needles among patients and healthcare providers is rising as they offer a minimally invasive and highly accurate approach to diagnostics, especially in comparison to traditional surgical biopsies. For patients, the use of these needles means a faster recovery time, less pain, and minimal scarring, as these procedures do not require large incisions or prolonged hospital stays. Procedures utilizing fine-needle aspiration or core-needle biopsy can often be completed on an outpatient basis, making them convenient and cost-effective for patients and healthcare facilities alike. These needle-based diagnostics are increasingly preferred for early disease detection, particularly in oncology, where a timely and accurate diagnosis can significantly impact treatment options and outcomes. The rise of preventive healthcare and early screening has also contributed to the demand for these procedures, as more patients become aware of the importance of early detection. For healthcare providers, the accuracy, safety, and ease of these modern needles align with the push toward patient-centered, minimally invasive care. The improved design and functionality of these needles streamline diagnostic workflows, allowing for more reliable results, which is especially critical in specialties like oncology and infectious disease. The increased accuracy of these needles reduces the need for repeat procedures, saving time and resources for both patients and providers, thus cementing their status as vital tools in modern diagnostics.What Factors Are Fueling the Growth of the Aspiration & Biopsy Needles Market?

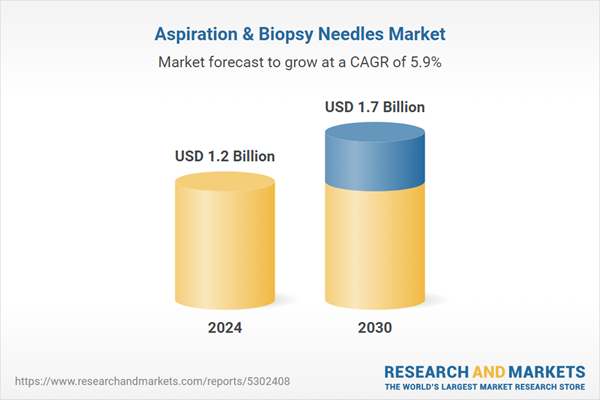

The growth in the aspiration and biopsy needles market is driven by several factors, particularly advancements in technology, increased demand in diagnostic applications, and evolving patient and provider preferences. The global rise in the prevalence of chronic diseases, including cancer and autoimmune conditions, has created a substantial demand for precision diagnostic tools. Aspiration and biopsy needles meet this demand by offering the accuracy needed to confirm and monitor these conditions effectively, supporting early detection and tailored treatment plans. Additionally, technological innovations, such as real-time imaging guidance, micro-engineered needle tips, and ergonomically enhanced designs, are making these needles more user-friendly and precise. These advancements allow for more targeted tissue sampling, higher procedural success rates, and reduced patient discomfort. Minimally invasive procedures are increasingly favored by both patients and healthcare systems, as they are associated with shorter recovery times, reduced costs, and lower complication rates. Growing public awareness regarding the benefits of early cancer screening has also led to higher utilization rates of aspiration and biopsy procedures, with hospitals and diagnostic centers investing in advanced needle technologies to meet this demand. Favorable regulatory policies in healthcare and increased funding in emerging markets have further boosted the accessibility and affordability of these diagnostic tools, enabling a broader range of patients to benefit from their use. These multifaceted dynamics, supported by rapid technological progress and growing consumer awareness, are collectively driving the aspiration and biopsy needles market forward, positioning it for sustained growth in the years ahead.Report Scope

The report analyzes the Aspiration & Biopsy Needles market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Product Type (Biopsy Needles, Aspiration Needles); Procedure (Image-Guided Procedures, Nonimage-Guided Procedures); Application (Tumor / Cancer Applications, Wound Applications, Other Applications); End-Use (Hospitals, Diagnostic Clinics & Pathology Laboratories, Ambulatory Surgery Centers, Research & Academic Institutes).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Regional Analysis

Gain insights into the U.S. market, valued at $305.5 Million in 2024, and China, forecasted to grow at an impressive 9% CAGR to reach $381.4 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Aspiration & Biopsy Needles Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Aspiration & Biopsy Needles Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Aspiration & Biopsy Needles Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Argon Medical Devices, Inc., Becton, Dickinson and Company (BD), Boston Scientific Corporation, Cardinal Health, Inc., CONMED Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Aspiration & Biopsy Needles market report include:

- Argon Medical Devices, Inc.

- Becton, Dickinson and Company (BD)

- Boston Scientific Corporation

- Cardinal Health, Inc.

- CONMED Corporation

- Cook Group Incorporated

- HAKKO CO.,LTD Medical Device Division

- INRAD Inc.

- Medtronic, Plc

- Merit Medical Systems

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Argon Medical Devices, Inc.

- Becton, Dickinson and Company (BD)

- Boston Scientific Corporation

- Cardinal Health, Inc.

- CONMED Corporation

- Cook Group Incorporated

- HAKKO CO.,LTD Medical Device Division

- INRAD Inc.

- Medtronic, Plc

- Merit Medical Systems

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 462 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.2 Billion |

| Forecasted Market Value ( USD | $ 1.7 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |