Global Automotive HVAC Market - Key Trends and Drivers Summarized

Why Is Automotive HVAC Essential for Vehicle Comfort and Performance?

Automotive HVAC (Heating, Ventilation, and Air Conditioning) systems are essential for creating a comfortable, controlled environment within a vehicle, directly influencing the quality of the in-cabin experience. By regulating temperature, humidity, and air circulation, HVAC systems provide year-round comfort regardless of external weather conditions, ensuring the cabin remains warm during winter months and cool in the summer heat. This temperature control is critical not only for passenger comfort but also for driver focus and alertness, as maintaining a stable cabin climate reduces fatigue during long drives. Beyond comfort, HVAC systems also serve functional purposes, such as defrosting and defogging windows, which are essential for maintaining visibility and driving safety. Modern HVAC systems in vehicles incorporate advanced features like dual or tri-zone climate control, enabling passengers in different areas of the cabin to set individual temperature preferences. As automotive interiors become increasingly complex and comfort-oriented, HVAC systems have evolved into sophisticated climate management systems that enhance both the driving and passenger experience, establishing themselves as indispensable components of modern vehicle design.How Are Technological Advancements Transforming Automotive HVAC Systems?

Technological advancements in HVAC systems have made them more efficient, intelligent, and environmentally friendly, aligning with the automotive industry's focus on reducing energy consumption and emissions. One significant innovation is the use of heat pumps, especially in electric and hybrid vehicles, to manage cabin temperature without placing a heavy drain on the battery. Heat pumps are more efficient than traditional resistance heating, allowing EVs to maintain range by using less energy to heat or cool the cabin. Additionally, variable-speed compressors and electronically controlled expansion valves have replaced older, fixed-speed components, enabling HVAC systems to adjust their output based on the exact thermal load, reducing energy waste and improving overall efficiency. The integration of sensors, such as humidity, temperature, and air quality sensors, enables intelligent climate control, where the system can automatically adjust settings to optimize cabin comfort and air purity. Advanced filtration systems are also being adopted, especially in urban areas, to capture particulates and allergens, improving the quality of the air circulated in the cabin. In high-end models, systems with UV light and ionizers are even being introduced to neutralize bacteria and viruses. As automotive HVAC systems evolve, they are becoming more adaptable to the energy and environmental needs of today's vehicles, making them smarter, greener, and more responsive to passenger comfort.What Role Do HVAC Systems Play in Electric and Hybrid Vehicles?

In electric and hybrid vehicles, HVAC systems are crucial for thermal management not only within the cabin but also for the vehicle's battery and electronic systems, making them a key component of the overall vehicle operation. Unlike traditional internal combustion engine (ICE) vehicles, which can utilize engine heat to warm the cabin, EVs and hybrids rely entirely on their battery for climate control, leading to unique challenges in maintaining range and efficiency. HVAC systems in EVs are often optimized with energy-efficient heat pumps that can cool and heat the cabin with minimal impact on battery life. Since these vehicles are highly sensitive to power consumption, advanced HVAC designs are essential to maximize battery range by using intelligent climate controls that adjust according to cabin and external temperatures. Moreover, in extreme conditions, HVAC systems may prioritize battery thermal management over cabin climate to prevent overheating or excessive cooling, which is essential for maintaining battery health and safety. Many EV and hybrid models integrate HVAC systems into the vehicle's battery thermal management, using shared cooling loops or liquid-cooled heat exchangers to keep the battery within optimal operating temperatures. This balance between passenger comfort and battery efficiency demonstrates the critical role that HVAC systems play in electric and hybrid vehicles, as they ensure both cabin comfort and powertrain longevity.What Is Driving the Growth in the Automotive HVAC Market?

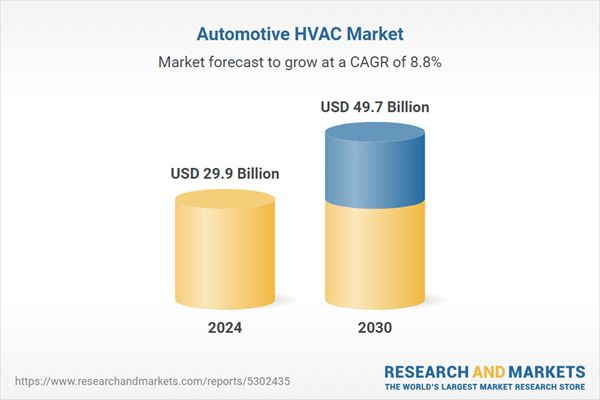

The growth in the automotive HVAC market is driven by rising consumer expectations for in-cabin comfort, the increase in electric and hybrid vehicle adoption, and advancements in energy-efficient HVAC technologies. As consumers seek greater comfort and convenience, the demand for advanced climate control features like multi-zone air conditioning, air purifiers, and humidity control has surged, particularly in luxury and mid-range vehicle segments. Additionally, the shift towards electric and hybrid vehicles has led to a need for more efficient HVAC systems, as traditional heating and cooling methods can significantly impact battery performance and range. This has accelerated innovation in HVAC technologies tailored to electric powertrains, such as heat pumps and smart energy management systems, which optimize climate control while conserving battery power. The automotive industry's commitment to sustainability is also a key factor, with regulations pushing manufacturers to reduce refrigerant emissions and adopt eco-friendly materials. Consequently, new refrigerants with lower global warming potential (GWP), such as R1234yf, are being increasingly adopted to meet environmental standards. Advanced air quality features have become another significant trend, especially as urbanization exposes drivers to higher levels of pollutants; manufacturers are responding with air filtration systems that capture allergens, particulates, and odors. These technological and regulatory factors, combined with shifting consumer preferences, are fueling rapid growth in the automotive HVAC market as manufacturers develop solutions that enhance comfort, meet environmental standards, and adapt to the demands of the modern, electrified automotive landscape.Report Scope

The report analyzes the Automotive HVAC market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Technology (Automatic, Manual); End-Use (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Automatic Technology segment, which is expected to reach US$31.8 Billion by 2030 with a CAGR of a 9.1%. The Manual Technology segment is also set to grow at 8.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $7.7 Billion in 2024, and China, forecasted to grow at an impressive 12.7% CAGR to reach $12.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Automotive HVAC Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Automotive HVAC Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Automotive HVAC Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Air International Thermal Systems, Brose Fahrzeugteile GmbH & Co. Kg., Calsonic Kansei, Delphi automotive, DelStar Technologies and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Automotive HVAC market report include:

- Air International Thermal Systems

- Brose Fahrzeugteile GmbH & Co. Kg.

- Calsonic Kansei

- Delphi automotive

- DelStar Technologies

- Denso Corporation

- Engineered Plastic Components

- Hanon Systems

- Japan Climate Systems Corporation

- Johnson Electric

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Air International Thermal Systems

- Brose Fahrzeugteile GmbH & Co. Kg.

- Calsonic Kansei

- Delphi automotive

- DelStar Technologies

- Denso Corporation

- Engineered Plastic Components

- Hanon Systems

- Japan Climate Systems Corporation

- Johnson Electric

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 275 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 29.9 Billion |

| Forecasted Market Value ( USD | $ 49.7 Billion |

| Compound Annual Growth Rate | 8.8% |

| Regions Covered | Global |