Global Automotive Flooring Market - Key Trends and Drivers Summarized

Why Is Automotive Flooring Essential for Vehicle Comfort and Durability?

Automotive flooring is a critical element in vehicle design, significantly impacting both the comfort and durability of the vehicle interior. Flooring materials must withstand regular foot traffic, environmental debris, moisture, and fluctuations in temperature, all while providing a comfortable, aesthetically pleasing surface for passengers. Beyond its primary function as a protective layer, automotive flooring contributes to noise reduction by dampening road and engine sounds, enhancing the in-cabin experience. Common materials used in automotive flooring include carpets, vinyl, rubber, and increasingly, eco-friendly and recyclable options like thermoplastics and sustainable composites. These materials are chosen not only for their durability but also for their ease of cleaning, a key factor for both everyday drivers and those with special needs, such as families or commercial fleet operators. High-quality flooring solutions maintain their appearance and functionality over time, resisting wear and tear from regular use. As vehicle interiors become more of a focal point for comfort and luxury, automotive flooring is emerging as an area where manufacturers can elevate the passenger experience through improved material choices, design, and functional performance.How Are Material Innovations Impacting Automotive Flooring Design?

Advancements in materials science have led to transformative changes in automotive flooring, with new materials offering improved durability, lighter weight, and enhanced sustainability. High-performance carpets made from recycled materials or bio-based fibers are now widely available, meeting the automotive industry's sustainability goals while retaining durability and aesthetic appeal. Thermoplastic elastomers (TPEs) are increasingly popular due to their lightweight and recyclable properties, which contribute to vehicle weight reduction, fuel efficiency, and lower emissions, particularly valuable for electric vehicles (EVs). Flooring designs now often incorporate multi-layer composites with integrated sound-dampening layers that reduce road and engine noise, enhancing cabin quietness. Additionally, materials like advanced rubber and polyurethane have been introduced for their resistance to moisture, chemicals, and extreme temperatures, extending the flooring's lifespan and making it easier to clean and maintain. Some flooring solutions are now equipped with anti-bacterial and anti-odor properties, reflecting a growing consumer preference for hygiene and interior air quality. As material innovations continue to evolve, automotive flooring solutions are becoming more versatile, allowing manufacturers to create interiors that combine luxury with durability while meeting environmental standards.What Role Does Automotive Flooring Play in Vehicle Safety and Functionality?

Automotive flooring contributes to vehicle safety and functionality by providing stability, insulation, and protection to the vehicle interior. The flooring serves as a secure surface for foot traction, which is crucial for driver control and passenger safety, especially in wet or icy conditions. Rubberized mats and textured surfaces help minimize slippage, reducing the likelihood of accidents inside the vehicle. Flooring also acts as an insulative barrier, protecting the vehicle's interior from extreme temperatures, road vibrations, and mechanical noise, thereby enhancing the safety and comfort of the cabin environment. This insulation is especially vital in electric vehicles, where noise from mechanical components is lower, and any remaining sounds become more noticeable. Additionally, well-engineered flooring solutions protect the vehicle's underbody and electrical systems from moisture and corrosion, extending the life of essential components and preventing costly repairs. Flooring materials with thermal insulation properties are becoming essential in climates with extreme temperatures, as they help regulate the cabin's climate and improve HVAC efficiency. As the automotive industry prioritizes passenger comfort and vehicle longevity, the functionality of flooring materials goes beyond mere aesthetics, playing an integral role in overall vehicle performance, safety, and durability.What Is Driving the Growth in the Automotive Flooring Market?

The growth in the automotive flooring market is driven by several factors, including increasing consumer demand for luxury interiors, advancements in material technology, and a shift toward sustainability. As consumers prioritize comfort and premium design features in their vehicles, demand for high-quality, noise-reducing, and visually appealing flooring options has surged. Additionally, advancements in materials science are introducing lighter, more durable, and eco-friendly options, aligning with the automotive industry's goals of vehicle weight reduction and sustainability. As electric and hybrid vehicles become more popular, the need for lightweight, thermally insulating flooring materials has increased, as these vehicles benefit from weight reduction and efficient climate control. Furthermore, the trend toward shared mobility and ride-hailing services has boosted demand for durable flooring solutions that can withstand heavy and repetitive use, prompting manufacturers to prioritize high-wear-resistant materials that can maintain their appearance over time. Sustainability also plays a central role, as eco-conscious consumers and regulatory bodies push for environmentally friendly materials; manufacturers are responding with recycled fibers, biodegradable options, and sustainably sourced thermoplastics. Together, these consumer, technological, and environmental factors are driving robust growth in the automotive flooring market, making it an increasingly dynamic and innovative field within automotive design.Report Scope

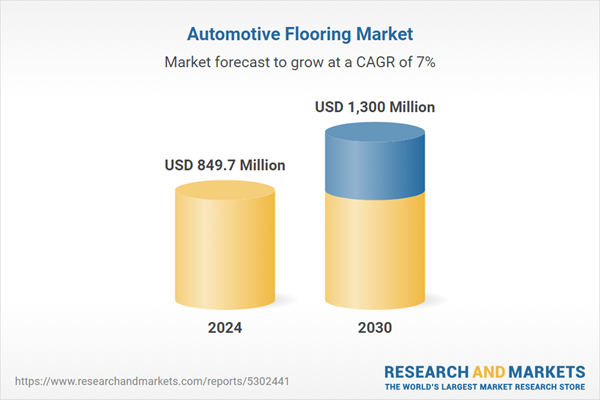

The report analyzes the Automotive Flooring market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Material (Polyurethane, Polypropylene, Nylon, Rubber, Other Materials); Product (Carpets, Mats); End-Use (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Polyurethane Material segment, which is expected to reach US$397.7 Million by 2030 with a CAGR of a 8%. The Polypropylene Material segment is also set to grow at 7.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $219.5 Million in 2024, and China, forecasted to grow at an impressive 10.4% CAGR to reach $302.3 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Automotive Flooring Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Automotive Flooring Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Automotive Flooring Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 3M Company, AGM Automotive, LLC, Auto Custom Carpets Inc., Autotech Nonwovens, ConForm Automotive and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Automotive Flooring market report include:

- 3M Company

- AGM Automotive, LLC

- Auto Custom Carpets Inc.

- Autotech Nonwovens

- ConForm Automotive

- DuPont

- Feltex Automotive

- GAHH LLC

- German Auto Tops Inc.

- Lear Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M Company

- AGM Automotive, LLC

- Auto Custom Carpets Inc.

- Autotech Nonwovens

- ConForm Automotive

- DuPont

- Feltex Automotive

- GAHH LLC

- German Auto Tops Inc.

- Lear Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 377 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 849.7 Million |

| Forecasted Market Value ( USD | $ 1300 Million |

| Compound Annual Growth Rate | 7.0% |

| Regions Covered | Global |