Global Automotive Engineering Services Outsourcing (ESO) Market - Key Trends and Drivers Summarized

Why Is Automotive Engineering Services Outsourcing (ESO) Becoming Essential in the Industry?

Automotive Engineering Services Outsourcing (ESO) has become a critical strategy for automotive companies worldwide, allowing them to access specialized expertise, reduce costs, and accelerate innovation. ESO enables Original Equipment Manufacturers (OEMs) and suppliers to focus on their core operations while leveraging the engineering capabilities of external partners for complex, resource-intensive tasks. These services range from vehicle design, prototyping, and testing to more advanced fields like autonomous driving systems, electric powertrain development, and connectivity solutions. With the rapid pace of technological change in the automotive industry, particularly with advancements in electric vehicles (EVs), connected cars, and autonomous driving, companies are under immense pressure to innovate faster than ever. However, the internal development of such sophisticated technology can be both time-consuming and costly, especially for traditional manufacturers transitioning to digital and autonomous mobility solutions. By outsourcing engineering services, automotive companies can bridge capability gaps, access the latest engineering tools and talent, and bring new products to market more swiftly, all while managing costs more effectively. As the automotive industry becomes more complex, ESO has emerged as a critical component for staying competitive in this transformative landscape.How Are Technological Advancements Influencing the Demand for ESO?

Technological advancements are significantly driving demand for engineering services outsourcing in the automotive industry, as companies strive to integrate cutting-edge technologies in their vehicles. With the advent of electric vehicles, autonomous systems, and connected car solutions, the automotive industry is undergoing a digital transformation that requires highly specialized knowledge in areas like artificial intelligence, machine learning, and sensor technology. These fields often fall outside the traditional expertise of automotive manufacturers, making ESO a valuable solution for integrating these capabilities. Service providers specializing in ESO offer expertise in advanced simulation, digital twins, and software development, enabling automakers to design and test new systems with remarkable precision before physical prototyping. As a result, ESO helps companies reduce development cycles, cut costs associated with physical testing, and expedite product rollouts. Additionally, the rise of cybersecurity and over-the-air software updates, essential for the safety and functionality of connected and autonomous vehicles, has heightened the demand for specialized outsourcing partners who can provide the technical know-how and infrastructure required to secure and maintain these complex systems. By leveraging the latest in simulation, digital technology, and advanced software solutions, ESO providers are empowering automotive companies to keep pace with industry demands for more intelligent, safe, and sustainable vehicles.What Role Does ESO Play in Enhancing Efficiency and Flexibility in Automotive Development?

Automotive ESO plays a crucial role in enhancing both the efficiency and flexibility of vehicle development, enabling companies to respond more nimbly to evolving market demands and regulatory pressures. By outsourcing engineering services, OEMs and suppliers can better manage resources, allocate talent to high-priority projects, and scale up or down based on project needs. This approach is especially valuable in an industry where product lifecycles are shrinking, and the pressure to innovate quickly has intensified. For instance, regulatory standards concerning emissions, safety, and fuel efficiency require automakers to continuously evolve their designs, often necessitating expertise in areas like lightweight materials, aerodynamics, and fuel-efficient technologies. ESO providers are equipped to handle such demands, offering flexible service models that allow automotive companies to stay agile in response to new requirements. Moreover, the need for rapid prototyping, iterative testing, and software updates calls for a streamlined development process that is difficult to achieve in-house without significant investment. By outsourcing these engineering services, companies can expedite their design, testing, and validation phases, allowing them to innovate and adapt swiftly in a highly competitive market. In addition, ESO partnerships can mitigate risks by leveraging the experience of specialized firms with a track record in specific engineering disciplines, which helps automotive companies maintain a competitive edge without stretching internal resources too thin.What Is Driving the Growth in the Automotive ESO Market?

The growth in the automotive ESO market is driven by several factors, including the rapid evolution of vehicle technology, increasing regulatory demands, and shifting consumer expectations. A primary growth driver is the accelerating pace of innovation in electric and autonomous vehicles, both of which require extensive R&D and specialized engineering expertise that many automotive companies prefer to outsource for efficiency and cost savings. Additionally, the regulatory landscape in the automotive sector is becoming more stringent, with tighter standards on emissions, safety, and data security, necessitating constant updates and adaptations in vehicle design and technology. These regulatory demands are challenging for manufacturers to meet in-house, leading to a rise in ESO partnerships that provide dedicated teams for compliance-driven engineering work. Consumer expectations are also playing a significant role, as buyers increasingly expect vehicles with the latest technological advancements, such as enhanced infotainment systems, autonomous driving capabilities, and advanced safety features. To meet these expectations, automotive companies are relying on ESO providers for expertise in software development, cybersecurity, and AI-driven vehicle systems. The ongoing trend of digitalization within the automotive industry further fuels ESO growth, as traditional manufacturers look to transform themselves digitally by tapping into external engineering resources. By allowing automakers to innovate rapidly, ensure compliance, and meet consumer demands, ESO is positioned to grow as an indispensable component of the automotive industry's future.Report Scope

The report analyzes the Automotive Engineering Services Outsourcing (ESO) market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Service (Prototyping, Designing, System Integration, Testing, Other Services); Location (Onshore, Offshore); Application (Powertrain & After-Treatment, Body & Chassis, Infotainment & Connectivity, Autonomous Driving / ADAS, Other Applications).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Prototyping Service segment, which is expected to reach US$62.7 Billion by 2030 with a CAGR of a 8.2%. The Designing Service segment is also set to grow at 10.7% CAGR over the analysis period.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Automotive Engineering Services Outsourcing (ESO) Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Automotive Engineering Services Outsourcing (ESO) Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Automotive Engineering Services Outsourcing (ESO) Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

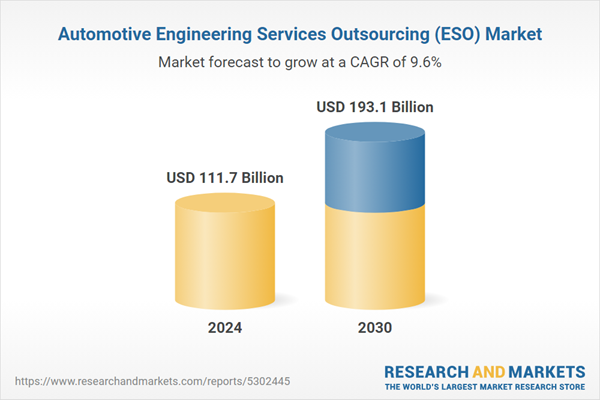

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Altair Engineering, Inc., Alten Gmbh, Altran, Asap Holding Gmbh, Avl and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Automotive Engineering Services Outsourcing (ESO) market report include:

- Altair Engineering, Inc.

- Alten Gmbh

- Altran

- Asap Holding Gmbh

- Avl

- Bertrandt

- Edag Engineering Gmbh

- Esg Elektroniksystem- Und Logistik-Gmbh

- Fev Group

- Gigatronik

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Altair Engineering, Inc.

- Alten Gmbh

- Altran

- Asap Holding Gmbh

- Avl

- Bertrandt

- Edag Engineering Gmbh

- Esg Elektroniksystem- Und Logistik-Gmbh

- Fev Group

- Gigatronik

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 233 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 111.7 Billion |

| Forecasted Market Value ( USD | $ 193.1 Billion |

| Compound Annual Growth Rate | 9.6% |

| Regions Covered | Global |