Global Automotive Collision Repair Market - Key Trends and Drivers Summarized

How Has the Automotive Collision Repair Industry Evolved Over the Years?

The automotive collision repair industry has seen remarkable transformations over the past few decades, but what has driven these changes? Advances in vehicle design, new materials, and technology integration have reshaped the way collision repair shops operate. Vehicles today come with more complex structural designs, lightweight materials, and sophisticated electronics, all of which require specialized knowledge and tools to repair effectively. The industry has moved from simple panel replacement and repainting to intricate repair procedures that often involve recalibrating sensors, working with composite materials, and ensuring that electronic safety systems are fully functional after repairs. For example, advanced driver-assistance systems (ADAS) like lane departure warning and automatic emergency braking need precise recalibration after even minor collisions, significantly complicating the repair process. Additionally, automakers' proprietary repair guidelines and stringent repair standards have led repair shops to invest heavily in new equipment, training, and certification. This evolution in repair methods and requirements reflects the industry's need to keep pace with automotive innovations, ensuring that today's vehicles can be safely restored to pre-accident conditions.What Technological Advancements Are Shaping the Collision Repair Landscape?

The integration of new technology in collision repair has fundamentally changed the landscape, making the process more accurate and efficient, but what specific advancements are driving this shift? One of the most significant developments is the use of digital diagnostics and computerized estimation tools that allow technicians to quickly assess the extent of damage and plan repairs more precisely. These tools can identify hidden structural issues, electronic malfunctions, or sensor misalignments that might not be visible upon initial inspection. Additionally, 3D imaging and scanning technology enable repair shops to create accurate models of damaged areas, helping technicians devise detailed repair plans tailored to each vehicle. Another major innovation is the increased use of robotics and automation in collision repair, which speeds up tasks like welding, painting, and frame alignment while improving precision. Advanced materials such as high-strength steel, aluminum, and carbon fiber composites are also transforming repair techniques, as these materials require specific repair processes to maintain their structural integrity. Training and certifying technicians to handle these materials and technologies have become essential, leading to the rise of specialized repair programs and certifications that focus on modern vehicle structures, hybrid and electric vehicle systems, and complex electronic components. These technological advancements enable collision repair shops to work more efficiently, ensuring vehicles are safely and accurately restored.How Has the Rise of Electric Vehicles Impacted Collision Repair?

The shift toward electric vehicles (EVs) is dramatically impacting the collision repair industry, creating both challenges and opportunities for repair shops. EVs come with unique repair needs due to their electric powertrains, battery systems, and high-voltage components, which require specialized knowledge and safety protocols. When an EV is involved in a collision, technicians need to address both structural and electrical damage, necessitating additional safety measures to prevent electrical hazards during repairs. For instance, technicians are trained to disconnect and safely handle high-voltage systems before performing structural repairs. Battery placement and composition add complexity, as even minor damage to the battery casing can pose fire hazards and require complete battery replacement - a costly repair for both customers and insurance providers. Additionally, many EV models are designed with advanced materials like aluminum and carbon fiber to reduce weight and improve efficiency, which means repair shops need the right tools and techniques to handle these materials effectively. Repairing or recalibrating ADAS features after an accident is also crucial, as EVs often come equipped with an extensive array of sensors and automated systems that must function accurately for the vehicle to operate safely. The growing number of EVs on the road has led many repair shops to invest in technician training, specialized equipment, and certification programs, ensuring they can meet the demands of this evolving market.What Are the Key Factors Driving Growth in the Collision Repair Industry?

The growth in the automotive collision repair industry is driven by a range of factors, each related to evolving automotive technology, regulatory changes, and shifting consumer expectations. One primary driver is the increasing complexity of modern vehicles. With more advanced electronic systems, high-strength materials, and integrated safety features, today's vehicles require specialized repair processes that only certified and well-equipped shops can provide. Another major factor is the rise in the number of vehicles on the road combined with the growing prevalence of traffic accidents, which continues to drive demand for collision repair services. As vehicles become more technologically advanced, repair costs per accident are also rising, with even minor accidents often resulting in costly repairs due to the need for electronic diagnostics and system recalibration. The surge in electric vehicle adoption adds to this growth, as EVs require unique repairs that call for specialized knowledge and tools, encouraging repair shops to expand their capabilities. Additionally, insurance companies are increasingly partnering with certified repair networks, steering customers toward shops that can handle these advanced repair requirements. Consumer demand for fast, high-quality repairs and transparent service has also led repair shops to adopt digital tools for tracking repairs, offering real-time updates, and improving overall customer experience. Together, these factors underscore the growing need for sophisticated collision repair services that can address the demands of modern automotive technology while meeting safety and quality expectations.Report Scope

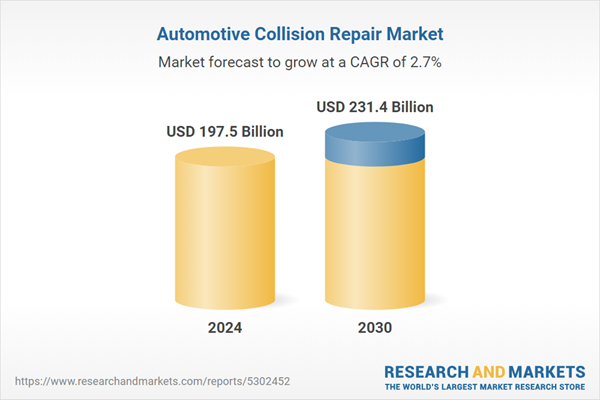

The report analyzes the Automotive Collision Repair market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Product Type (Automotive Spare Parts, Automotive Paints & Coatings, Automotive Consumables); Service Channel (Original Equipment (OE) Service Channel, Do-It-For-Me (DIFM) Service Channel, Do-It-Yourself (DIY) Service Channel); End-Use (Passenger Cars End-Use, Commercial Vehicles End-Use).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Automotive Spare Parts segment, which is expected to reach US$145.2 Billion by 2030 with a CAGR of 2.5%. The Automotive Paints & Coatings segment is also set to grow at 2.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $46 Billion in 2024, and China, forecasted to grow at an impressive 3.9% CAGR to reach $30.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Automotive Collision Repair Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Automotive Collision Repair Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Automotive Collision Repair Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 3M, Automotive Technology Products LLC (ATP.) (a subsidiary of Lodi Group of Monterrey), Continental AG, Denso Corporation, Faurecia and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Automotive Collision Repair market report include:

- 3M

- Automotive Technology Products LLC (ATP.) (a subsidiary of Lodi Group of Monterrey)

- Continental AG

- Denso Corporation

- Faurecia

- Federal-Mogul LLC

- Honeywell International, Inc.

- International Automotive Components Group

- Johnson Controls, Inc.

- Magna International Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M

- Automotive Technology Products LLC (ATP.) (a subsidiary of Lodi Group of Monterrey)

- Continental AG

- Denso Corporation

- Faurecia

- Federal-Mogul LLC

- Honeywell International, Inc.

- International Automotive Components Group

- Johnson Controls, Inc.

- Magna International Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 638 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 197.5 Billion |

| Forecasted Market Value ( USD | $ 231.4 Billion |

| Compound Annual Growth Rate | 2.7% |

| Regions Covered | Global |