Global Automotive Battery Sensor Market - Key Trends and Drivers Summarized

Why Are Automotive Battery Sensors Gaining So Much Attention in the Modern Auto Industry?

Automotive battery sensors have rapidly emerged as essential components in today's vehicles, particularly as the automotive landscape shifts toward energy-efficient models and intelligent, interconnected systems. But what specific role do these sensors play, and why are they crucial? An automotive battery sensor, typically installed directly onto the battery terminal, tracks and monitors critical parameters such as voltage, current, and temperature. These real-time metrics are integral to the battery's health, helping to manage the vehicle's electrical system and anticipate potential power issues before they escalate into costly repairs or performance downgrades. Beyond ensuring battery health, these sensors assist in enhancing the battery management system (BMS) by supplying data that allows the system to adjust settings for optimal energy distribution. This functionality is increasingly vital in electric and hybrid vehicles, where precise power monitoring is required to achieve energy efficiency and safety. As more automakers adopt electric powertrains, the demand for reliable, highly accurate battery sensors has surged, reflecting their growing importance in sustaining both traditional and advanced vehicle power systems.How Are Technological Advancements Shaping Automotive Battery Sensors?

Technological advances in sensor design, materials, and connectivity have redefined the capabilities of automotive battery sensors, making them significantly more precise, efficient, and multifunctional than their predecessors. Originally, battery sensors could only offer basic voltage readings, but as automotive electronics have evolved, sensors have had to keep pace, offering comprehensive data on a range of battery conditions. Today, modern sensors incorporate MEMS (Micro-Electro-Mechanical Systems) technology, making them smaller, more durable, and power-efficient. Enhanced algorithms and AI technology have also entered the field, allowing these sensors to predict battery degradation patterns, enabling proactive adjustments that extend battery life and enhance energy efficiency. Additionally, many battery sensors are now wirelessly connected, facilitating seamless integration with a vehicle's centralized control system for real-time data transmission. These advancements mean that the BMS has richer, more reliable data, ultimately resulting in better energy management for the entire vehicle. As global safety and environmental standards become more stringent, manufacturers are also developing sensors that meet rigorous standards for accuracy and reliability. This innovation trajectory points toward an era of highly resilient sensors that not only optimize battery life and performance but also meet regulatory demands, offering long-term benefits for both manufacturers and consumers.What Are the End-Use Applications of Automotive Battery Sensors?

Automotive battery sensors have become indispensable across a diverse range of applications, from private passenger vehicles to commercial trucks and electric vehicle (EV) fleets. One of their most crucial roles is in EVs, where battery monitoring is essential for determining the state of charge (SoC) and state of health (SoH) of lithium-ion batteries. This continuous assessment is key to ensuring a stable driving range, optimal performance, and safety. In commercial fleet management, companies use battery sensors to streamline operational efficiency through predictive maintenance, minimizing vehicle downtime by identifying battery issues before they become problematic. The adoption of battery sensors extends to high-end luxury vehicles, where they support sophisticated features such as advanced driver assistance systems (ADAS), climate control, and infotainment systems. High-performance vehicles also leverage these sensors to maintain optimal power flow, which directly impacts acceleration, handling, and overall driving experience. Furthermore, commercial applications in the logistics sector rely on battery sensors to improve fuel efficiency and reduce emissions. Across each of these applications, battery sensors prove their versatility and value, supporting a wide spectrum of vehicles with distinct energy needs and management requirements.What Drives the Growth in the Automotive Battery Sensor Market?

The growth in the automotive battery sensor market is driven by several factors, primarily influenced by the shift toward electrification, advanced vehicle intelligence, and tightening environmental regulations. With global emphasis on reducing emissions and enhancing fuel efficiency, EV adoption has become a major catalyst for the demand for battery sensors. These sensors are indispensable for electric and hybrid vehicles, as they enable sophisticated energy management needed to optimize driving range and reliability. In tandem, consumer interest in connected and smart vehicles has expanded the market, with buyers increasingly valuing real-time battery monitoring as a standard feature in modern cars. This consumer expectation has spurred automakers to heavily invest in battery sensor technology that integrates seamlessly into advanced BMS platforms, providing intelligent diagnostics and alert systems. Technological progress has also significantly contributed to this growth, with AI-enhanced diagnostics, improved wireless connectivity, and high-precision measurements allowing sensors to be more accurate and efficient than ever before. Regulatory requirements, particularly in Europe and North America, have also played a pivotal role, as these regions enforce stricter emissions and fuel standards. Additionally, the aftermarket segment has witnessed a rise in demand, especially among drivers looking to retrofit legacy vehicles with battery monitoring systems to extend battery life and enhance performance. Together, these trends underscore the essential role of battery sensors in the automotive industry and point to an upward trajectory in the market as electrification and technological sophistication continue to shape the future of mobility.Report Scope

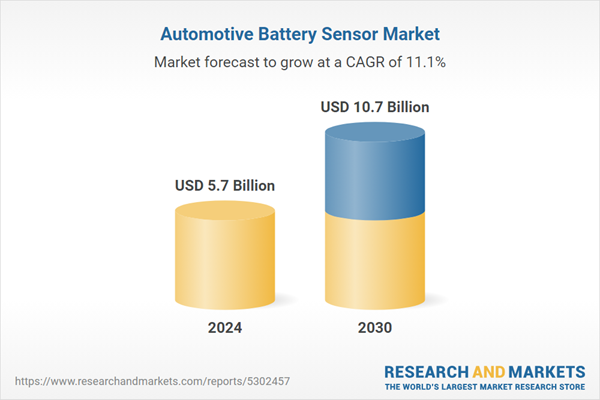

The report analyzes the Automotive Battery Sensor market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Voltage (12V, 24V, 48V); Communication Technology (LIN, CAN); End-Use (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the 12V Battery Sensor segment, which is expected to reach US$4.9 Billion by 2030 with a CAGR of a 12.1%. The 24V Battery Sensor segment is also set to grow at 10.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.5 Billion in 2024, and China, forecasted to grow at an impressive 14.6% CAGR to reach $2.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Automotive Battery Sensor Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Automotive Battery Sensor Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Automotive Battery Sensor Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AMS AG, Abertax Technologies, Analog Devices, Automotive Energy Supply Corporation, Autotec and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Automotive Battery Sensor market report include:

- AMS AG

- Abertax Technologies

- Analog Devices

- Automotive Energy Supply Corporation

- Autotec

- Avl

- Continental

- Csm Gmbh - Computer-Systeme-Messtechnik

- Delphi

- Denso

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AMS AG

- Abertax Technologies

- Analog Devices

- Automotive Energy Supply Corporation

- Autotec

- Avl

- Continental

- Csm Gmbh - Computer-Systeme-Messtechnik

- Delphi

- Denso

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 372 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 5.7 Billion |

| Forecasted Market Value ( USD | $ 10.7 Billion |

| Compound Annual Growth Rate | 11.1% |

| Regions Covered | Global |