Global Fire Protection Materials in Construction Market - Key Trends & Drivers Summarized

What Are Fire Protection Materials and Why Are They Essential in Construction?

Fire protection materials are specialized products used in construction to prevent, contain, or slow the spread of fire within buildings, providing critical protection for both occupants and structural integrity. These materials, which include fire-resistant coatings, sprays, sealants, insulation, and intumescent paints, are integral to passive fire protection strategies that enhance a building's ability to withstand fire for longer periods, enabling safe evacuation and minimizing damage. Fire protection materials are applied to structural components such as steel beams, walls, floors, and ceilings, creating fire-rated barriers that comply with building codes and regulations. In high-occupancy buildings, such as residential complexes, commercial offices, hospitals, and educational institutions, fire protection materials are crucial to ensure that buildings meet safety standards and provide a safe environment for occupants.With rapid urbanization and the development of high-rise structures, demand for fire protection materials is growing, especially in regions with strict building codes and safety regulations, such as North America, Europe, and parts of Asia-Pacific. The construction of high-risk facilities, such as industrial plants, oil refineries, and airports, also requires advanced fire protection measures, further driving the need for specialized materials that enhance fire safety. As modern construction projects focus on safety, durability, and compliance, fire protection materials are becoming essential components of building design and structural planning.

How Are Technological Advancements Enhancing Fire Protection Materials in Construction?

Technological advancements in material science and fire protection engineering are revolutionizing fire protection materials, making them more effective, versatile, and environmentally friendly. Innovations in fire-resistant coatings, such as intumescent paints, enable materials to expand when exposed to heat, creating insulating barriers that protect underlying structures. These coatings are increasingly used in steel structures, as they can delay structural failure by insulating against extreme temperatures. Other developments include fire-resistant gypsum boards and concrete additives that enhance structural fire performance, providing effective fire barriers for walls and floors. These materials not only meet regulatory standards but also offer aesthetic flexibility, as they can be integrated into various architectural designs without compromising visual appeal.Additionally, environmentally sustainable fire protection materials, such as non-toxic and VOC-free options, are gaining traction as the construction industry emphasizes eco-friendly practices. Advances in nanotechnology are also enhancing fire protection materials by improving their thermal resistance and reducing weight, making them ideal for high-rise and sustainable building projects. By combining fire resistance with aesthetic and environmental benefits, modern fire protection materials are meeting the complex needs of contemporary construction, offering robust solutions that align with both safety and sustainability goals.

What Role Do Regulatory Standards and Building Codes Play in Shaping the Fire Protection Materials Market?

Regulatory standards and building codes are key drivers in the fire protection materials market, as construction projects must comply with stringent fire safety regulations to ensure occupant safety and structural resilience. Regulatory bodies such as NFPA (National Fire Protection Association), UL (Underwriters Laboratories), and ASTM (American Society for Testing and Materials) establish guidelines and codes that dictate fire resistance requirements for various building materials. Non-compliance with these codes can lead to significant penalties, project delays, and even revocation of occupancy permits, motivating construction firms to adopt fire protection materials that meet regulatory standards. Building codes often require that specific components, such as structural steel, concrete, and partitions, achieve a minimum fire rating, ensuring they can resist fire for a specified duration.In addition to safety regulations, the trend toward sustainability in construction has influenced building codes to favor environmentally friendly fire protection materials. Green building certifications, such as LEED (Leadership in Energy and Environmental Design), now prioritize low-VOC, sustainable fire protection products, driving demand for materials that align with both safety and environmental criteria. As building regulations evolve to address new safety and sustainability concerns, the demand for certified fire protection materials continues to grow, making them a fundamental part of compliance in modern construction projects.

What Factors Are Driving Growth in the Fire Protection Materials Market in Construction?

The growth in the fire protection materials in construction market is driven by several factors, including the tightening of global building and fire safety codes, increasing urbanization and vertical construction, and the rising emphasis on occupant safety and property resilience. Technological innovations in material engineering, particularly in intumescent and ablative coatings, are expanding application versatility while reducing installation time and cost. The growing role of building information modeling (BIM) and digital compliance documentation is also helping streamline fire safety design and product specification across complex projects.End-use expansion in high-risk sectors such as energy infrastructure, data centers, and industrial processing plants is accelerating the adoption of high-performance fireproofing materials. The global push toward green buildings and sustainable construction is further contributing to demand for fire-resistant products that are non-toxic, energy-efficient, and recyclable. As climate change intensifies the risk of wildfires and extreme events, fire protection materials are expected to play an increasingly critical role in safeguarding the built environment, ensuring code compliance, and enhancing the long-term durability of structures.

Report Scope

The report analyzes the Fire Protection Materials in Construction market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Product (Fire Protection Sealants, Fire Protection Sprays, Fire Protection Sheets / Boards, Fire Protection Putty, Fire Protection Mortars, Other Products); End-Use (Commercial Construction End-Use, Industrial Construction End-Use, Residential Construction End-Use).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Fire Protection Sealants segment, which is expected to reach US$3 Billion by 2030 with a CAGR of 9.3%. The Fire Protection Sprays segment is also set to grow at 8.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.1 Billion in 2024, and China, forecasted to grow at an impressive 11.4% CAGR to reach $1.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Fire Protection Materials in Construction Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Fire Protection Materials in Construction Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Fire Protection Materials in Construction Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 3M, Akzo Nobel N.V., BASF SE, Contego International Inc. (US), Den Braven (The Netherlands) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 66 companies featured in this Fire Protection Materials in Construction market report include:

- 3M

- Akzo Nobel N.V.

- BASF SE

- Contego International Inc. (US)

- Den Braven (The Netherlands)

- Dufaylite Developments LTD (UK)

- ETEX

- Fire Protection Coatings Limited (UK)

- Group

- Hempel Group (Denmark)

- Isolatek International

- Morgan Advanced Materials

- No-Burn Inc.(US)

- PPG Industries Inc. (US)

- Rectorseal (US)

- Rolf Kuhn GmbH.(Germany)

- Sika Group (Switzerland)

- Specified Technologies Inc.

- Supremex Equipments (India)

- Tenmat LTD. (UK)

- The Sherwin-Williams Company (US)

- Tremco Incorporated

- USG Corporation

- W. R. Grace & Co. (US)

- Walraven (The Netherlands)

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M

- Akzo Nobel N.V.

- BASF SE

- Contego International Inc. (US)

- Den Braven (The Netherlands)

- Dufaylite Developments LTD (UK)

- ETEX

- Fire Protection Coatings Limited (UK)

- Group

- Hempel Group (Denmark)

- Isolatek International

- Morgan Advanced Materials

- No-Burn Inc.(US)

- PPG Industries Inc. (US)

- Rectorseal (US)

- Rolf Kuhn GmbH.(Germany)

- Sika Group (Switzerland)

- Specified Technologies Inc.

- Supremex Equipments (India)

- Tenmat LTD. (UK)

- The Sherwin-Williams Company (US)

- Tremco Incorporated

- USG Corporation

- W. R. Grace & Co. (US)

- Walraven (The Netherlands)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 312 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

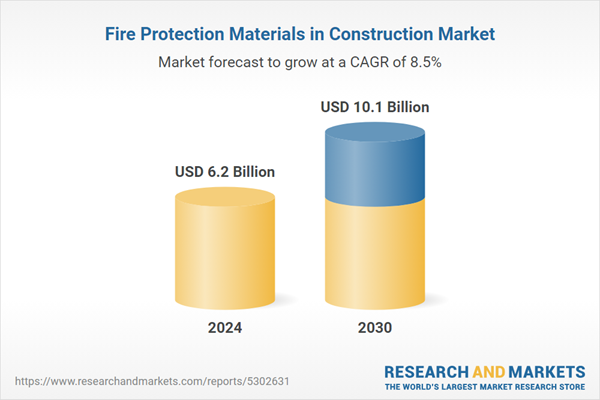

| Estimated Market Value ( USD | $ 6.2 Billion |

| Forecasted Market Value ( USD | $ 10.1 Billion |

| Compound Annual Growth Rate | 8.5% |

| Regions Covered | Global |