Global Feed Antioxidants Market - Key Trends & Drivers Summarized

What Is Driving the Demand for Feed Antioxidants in Animal Nutrition?

The demand for feed antioxidants is growing as livestock producers seek to improve animal health, shelf life of feed, and overall productivity in response to the increasing global demand for animal protein. Feed antioxidants play a crucial role in preventing oxidative rancidity in feed ingredients, especially in high-fat feeds and vitamins, thereby preserving feed quality and nutrient content. This preservation helps prevent the loss of essential nutrients, ensuring that livestock receive a stable and balanced diet, which directly impacts their growth and health. With rising feed costs, producers aim to maximize feed efficiency, making antioxidants an important additive for extending feed shelf life and reducing feed waste.Moreover, antioxidants in animal feed also support the immune health of livestock, improving resilience against diseases. Antioxidants such as vitamins E and C, selenium, and synthetic compounds like ethoxyquin and BHT (butylated hydroxytoluene) combat free radicals within the body, protecting cells from oxidative stress. This is especially beneficial in intensive farming environments where animals may experience higher levels of stress. The livestock industry, particularly in regions with high meat and dairy consumption like North America, Europe, and Asia, is increasingly adopting feed antioxidants to support animal welfare, enhance productivity, and ensure cost-effectiveness, all of which are key to meeting consumer expectations for high-quality, sustainably produced protein.

How Are Technological Advancements Impacting the Production and Application of Feed Antioxidants?

Technological advancements in feed formulation and antioxidant production are improving the effectiveness and application of feed antioxidants, making them more accessible and beneficial across livestock sectors. Innovations in encapsulation technology, for example, enable the controlled release of antioxidants within the animal's digestive system, enhancing bioavailability and efficacy. Microencapsulation helps protect the antioxidants from degradation in the feed and ensures they are gradually released, maximizing their impact on the animal's immune system and reducing waste. These encapsulation techniques are particularly useful for natural antioxidants, which are more susceptible to degradation than synthetic ones, helping extend the shelf life of feed and ensuring a consistent nutrient supply.Additionally, advancements in synthetic antioxidant formulation have led to the development of more stable and efficient products. Research into the specific antioxidant needs of different species and stages of growth has resulted in customized formulations tailored to meet specific nutritional requirements. Precision feeding technologies are also emerging, enabling producers to add antioxidants at optimal levels, improving feed efficiency and nutrient retention. The adoption of data analytics in animal nutrition further supports this trend, as it enables the monitoring of antioxidant levels and their effects on animal health in real time. These technological advancements are expanding the use and effectiveness of feed antioxidants, making them an integral part of modern animal nutrition strategies focused on health and productivity.

What Role Do Health Trends and Sustainability Concerns Play in Shaping the Feed Antioxidants Market?

Health trends and sustainability concerns are increasingly shaping the feed antioxidants market as consumers and producers focus on improving animal welfare, reducing waste, and producing more sustainable meat and dairy products. Antioxidants help maintain feed stability, reducing spoilage and extending shelf life, which aligns with sustainability goals by minimizing waste. In addition, feed antioxidants contribute to animal health by enhancing immunity and reducing oxidative stress, which supports disease resistance and improves overall animal welfare. As consumer demand for “clean label” and sustainably produced meat and dairy grows, the industry is adopting feed antioxidants as part of comprehensive health management programs that support animal well-being and meet market demands. Furthermore, sustainability concerns are driving the trend toward natural antioxidants, such as rosemary extract, tocopherols, and ascorbic acid, which are perceived as safer and more environmentally friendly alternatives to synthetic antioxidants. These natural antioxidants are appealing to consumers who prioritize animal welfare and the environmental impact of their food choices. Regulatory bodies are also encouraging the use of natural feed additives, as they are generally considered safe for animals, humans, and the environment. By aligning with these health and sustainability trends, the feed antioxidants market is well-positioned to support the industry's shift towards greener and more responsible animal production practices.What Factors Are Driving Growth in the Feed Antioxidants Market?

The growth in the feed antioxidants market is driven by the increasing need to preserve feed quality, support animal health, and reduce waste within the livestock sector. As the global demand for meat, dairy, and poultry products rises, livestock producers are focusing on cost-effective strategies to improve feed efficiency and maintain nutrient quality. Feed antioxidants play an essential role in preserving essential nutrients in animal feed, preventing spoilage, and ensuring that livestock receive high-quality nutrition throughout their growth cycle. This is particularly important in markets with intensive livestock production, where feed quality can significantly impact animal performance and profitability. Regulatory and consumer shifts towards natural and sustainable additives further bolster the market, as producers increasingly adopt natural antioxidants to meet demand for environmentally friendly and safe animal products. The adoption of innovative technologies, such as encapsulation and precision feeding, has enhanced the bioavailability and effectiveness of feed antioxidants, making them a viable option for a wide range of feed formulations. Additionally, the focus on animal welfare and sustainable production practices is expected to continue driving demand for feed antioxidants, as they support both the health of livestock and the long-term viability of animal agriculture. Together, these factors contribute to the growth and diversification of the feed antioxidants market, making it a key component of the animal nutrition and health sector.Report Scope

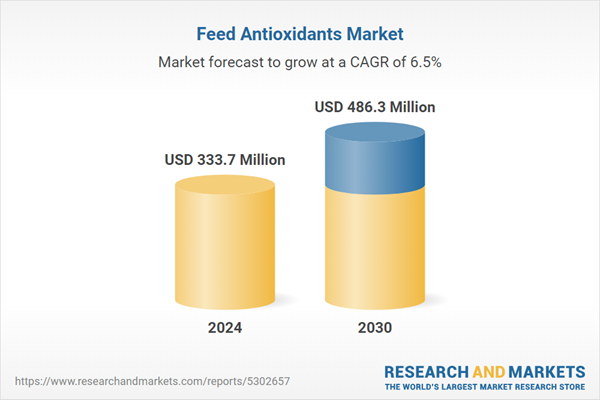

The report analyzes the Feed Antioxidants market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Form (Dry, Liquid); Type (BHA, BHT, Ethoxyquin, Carotenoids, Other Types); Animal (Poultry, Cattle, Swine, Aquaculture, Pets).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Dry Form segment, which is expected to reach US$327.1 Million by 2030 with a CAGR of a 6.8%. The Liquid Form segment is also set to grow at 5.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $86.3 Million in 2024, and China, forecasted to grow at an impressive 9.8% CAGR to reach $114.7 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Feed Antioxidants Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Feed Antioxidants Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Feed Antioxidants Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Adisseo, Alltech, Archer Daniels Midland Company (Adm), BASF, Bertol Company and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Feed Antioxidants market report include:

- Adisseo

- Alltech

- Archer Daniels Midland Company (Adm)

- BASF

- Bertol Company

- BTSA

- Caldic

- Camlin Fine Sciences

- Cargill

- Foodsafe Technologies

- Industrial Tecnica Pecuária

- Kemin

- Koninklijke Dsm N.V.

- Novus International

- Nutreco

- Oxiris Chemicals

- Perstorp

- Vdh Chem Tech Pvt.Ltd.

- Videka

- Zhejiang Medicine Co. Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Adisseo

- Alltech

- Archer Daniels Midland Company (Adm)

- BASF

- Bertol Company

- BTSA

- Caldic

- Camlin Fine Sciences

- Cargill

- Foodsafe Technologies

- Industrial Tecnica Pecuária

- Kemin

- Koninklijke Dsm N.V.

- Novus International

- Nutreco

- Oxiris Chemicals

- Perstorp

- Vdh Chem Tech Pvt.Ltd.

- Videka

- Zhejiang Medicine Co. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 384 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 333.7 Million |

| Forecasted Market Value ( USD | $ 486.3 Million |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Global |