Global Feed Amino Acids Market - Key Trends & Drivers Summarized

What Is Driving Demand for Feed Amino Acids in Animal Nutrition?

The demand for feed amino acids is increasing as livestock producers seek to improve animal health, growth rates, and feed efficiency in response to rising global demand for meat, dairy, and other animal products. Amino acids such as lysine, methionine, threonine, and tryptophan are essential nutrients in animal diets, promoting muscle development, enhancing immune function, and improving overall growth performance. With the intensification of livestock production to meet the growing protein needs of a burgeoning global population, amino acids have become a critical component of animal feed formulations. By optimizing protein content in feed, amino acids reduce the need for raw protein sources, such as soybean and fishmeal, thereby making animal farming more cost-effective and environmentally sustainable.Additionally, feed amino acids are increasingly used to enhance feed efficiency, particularly in the poultry, swine, and aquaculture sectors, where balanced diets are essential to achieve optimal growth and production levels. As farmers and producers focus on reducing feed costs without compromising nutritional quality, amino acids offer a practical solution by enhancing nutrient absorption and minimizing waste. This trend is particularly prominent in regions with high animal protein consumption, such as North America, Europe, and Asia, where producers are under pressure to meet demand while controlling production costs. The increased focus on maximizing animal productivity and profitability through efficient feed utilization is a major driver of the feed amino acids market.

How Are Technological Advancements Impacting the Production and Formulation of Feed Amino Acids?

Technological advancements in biotechnology and fermentation processes have significantly improved the production and formulation of feed amino acids, making them more affordable, effective, and accessible for animal nutrition. Advanced microbial fermentation techniques are now used to produce amino acids at a large scale with high yield and purity, which has helped to reduce production costs. Genetic engineering has also enabled the development of microbial strains that can produce specific amino acids more efficiently, contributing to the scalability of feed amino acid production. These improvements in manufacturing technology make it possible for feed companies to incorporate amino acids into a broader range of products, tailoring formulations to the nutritional needs of specific animal species and growth stages.Furthermore, advancements in precision feeding technologies are enabling more accurate amino acid supplementation in feed formulations. Through data-driven nutrition models and automated feed systems, producers can now precisely measure and control amino acid levels to ensure animals receive the right balance for optimal growth and health. Digital tools and nutritional analytics are allowing for the customization of amino acid levels based on individual animal requirements, reducing over - or under-supplementation and improving overall feed efficiency. These technological advancements are expanding the market potential of feed amino acids by enhancing their effectiveness and making them a practical component of modern livestock nutrition strategies.

What Role Do Sustainability and Environmental Concerns Play in Shaping the Feed Amino Acids Market?

Sustainability and environmental concerns are central to the growth of the feed amino acids market as producers and consumers alike become more aware of the environmental impact of livestock farming. One of the key benefits of amino acids in animal feed is their ability to optimize protein utilization, reducing the amount of crude protein needed and, consequently, decreasing nitrogen excretion. Excessive nitrogen release from animal manure is a major contributor to soil and water pollution, as well as greenhouse gas emissions. By incorporating amino acids into feed, livestock producers can minimize nitrogen output, contributing to more environmentally friendly farming practices. This benefit is particularly significant in regions with strict environmental regulations, where feed efficiency and waste reduction are mandated by law.Additionally, amino acids contribute to sustainable livestock farming by reducing the reliance on traditional protein sources such as soybean meal and fishmeal, whose production is associated with deforestation, overfishing, and high land use. By reducing demand for these inputs, amino acids help to mitigate some of the environmental impacts associated with protein production in the feed industry. This focus on sustainability aligns with global trends toward eco-friendly and responsible food production practices, and it positions feed amino acids as a critical component of sustainable animal agriculture. As environmental standards become more stringent and consumer expectations for sustainable practices grow, the feed amino acids market is likely to experience further growth driven by the demand for sustainable and efficient livestock nutrition solutions.

What Factors Are Driving Growth in the Feed Amino Acids Market?

The growth in the feed amino acids market is driven by a combination of increasing protein demand, advances in nutritional science, and a heightened focus on environmental sustainability. As global meat consumption continues to rise, livestock producers are under pressure to maximize production efficiency, leading to increased adoption of amino acid supplementation to improve growth rates and feed conversion ratios. This is particularly important in high-consumption markets like North America, Europe, and Asia-Pacific, where the demand for animal protein is substantial and production costs are closely managed. The shift toward amino acid supplementation allows for better protein management, enhancing productivity and profitability in livestock farming.In addition to rising protein demand, regulatory policies that promote sustainable livestock production are contributing to the market's expansion. Many governments and environmental agencies have set targets to reduce greenhouse gas emissions and waste pollution in agriculture, and feed amino acids offer a practical solution for producers seeking to meet these standards. Advances in amino acid production technology, including microbial fermentation and precision supplementation, have further enabled widespread adoption, making amino acids a viable choice for animal nutrition. These factors, combined with the growing emphasis on sustainable farming practices, are driving the robust growth of the feed amino acids market, positioning it as an essential component in the future of animal agriculture.

Report Scope

The report analyzes the Feed Amino Acids market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Source (Plant, Animal); Product Type (Lysine, Methionine, Threonine, Tryptophan, Other Product Types); Livestock (Poultry, Swine, Ruminants, Aquatic, Other Livestocks).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Plant Source segment, which is expected to reach US$46.4 Billion by 2030 with a CAGR of a 7.9%. The Animal Source segment is also set to grow at 6.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $8.9 Billion in 2024, and China, forecasted to grow at an impressive 11.4% CAGR to reach $12.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Feed Amino Acids Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Feed Amino Acids Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Feed Amino Acids Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Adisseo France Sas., Advanced Animal Nutrition Pty Ltd., Ajinomoto Co. Inc., Archer Daniels Midland Company (ADM), Cj Cheiljedang and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Feed Amino Acids market report include:

- Adisseo France Sas.

- Advanced Animal Nutrition Pty Ltd.

- Ajinomoto Co. Inc.

- Archer Daniels Midland Company (ADM)

- Cj Cheiljedang

- Evonik Ind

- Global Bio-Chem

- Kemin Industries

- Land O’lakes, Inc

- Meihua Holdings

- Novus

- Sumitomo Chemical Company Limited

- Sunrise Nutrachem

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Adisseo France Sas.

- Advanced Animal Nutrition Pty Ltd.

- Ajinomoto Co. Inc.

- Archer Daniels Midland Company (ADM)

- Cj Cheiljedang

- Evonik Ind

- Global Bio-Chem

- Kemin Industries

- Land O’lakes, Inc

- Meihua Holdings

- Novus

- Sumitomo Chemical Company Limited

- Sunrise Nutrachem

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 384 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

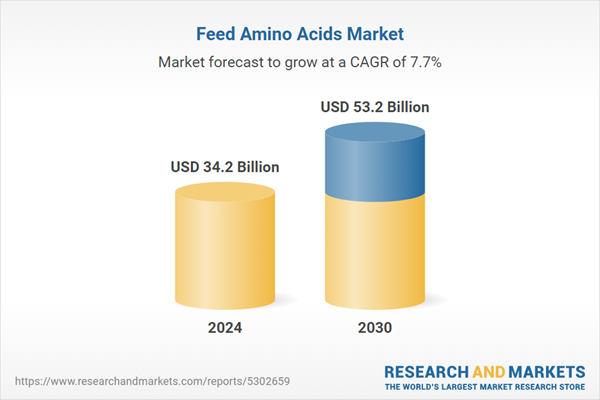

| Estimated Market Value ( USD | $ 34.2 Billion |

| Forecasted Market Value ( USD | $ 53.2 Billion |

| Compound Annual Growth Rate | 7.7% |

| Regions Covered | Global |