Global Facade Systems Market - Key Trends & Growth Drivers Summarized

What Are Facade Systems and Why Are They Crucial for Modern Architecture?

Facade systems are exterior building components that form the outer shell or envelope of a structure, serving both functional and aesthetic purposes. These systems are critical in modern architecture, as they enhance the building's visual appeal while providing insulation, protection from weather elements, and energy efficiency. Facade systems come in various materials and types, including curtain walls, cladding, and insulated panels, allowing architects and designers to achieve unique, innovative designs that reflect the building's purpose and identity. They play a significant role in commercial, residential, and industrial buildings by ensuring durability, weather resistance, and structural integrity. The increasing emphasis on sustainable and energy-efficient buildings has also highlighted the role of facade systems, which can significantly reduce heating and cooling costs by regulating thermal exchange.Facades are essential for environmental control, with modern systems incorporating advanced materials that minimize energy loss and improve indoor climate management. Furthermore, facade systems are integral to high-rise buildings and urban developments, where they provide wind resistance and protection against environmental hazards. As cities prioritize green building standards, facades equipped with energy-saving technologies like double-glazing, solar panels, and natural ventilation mechanisms have become indispensable. These features not only reduce operational costs but also help buildings comply with global sustainability standards, making facade systems a cornerstone in contemporary architectural design and sustainable urban planning.

How Are Technological Innovations Shaping the Facade Systems Market?

The facade systems market is experiencing rapid advancements due to technological innovations that enhance functionality, sustainability, and aesthetic possibilities. One of the key advancements is the use of smart and adaptive facade materials, such as dynamic glass, which can adjust its transparency based on external light conditions. These “smart” facades enhance energy efficiency by minimizing the need for artificial lighting and regulating indoor temperature, a feature that is increasingly in demand for green-certified buildings. Another innovation is the integration of photovoltaic panels into facade systems, transforming building exteriors into energy-generating surfaces. These solar-integrated facades provide renewable energy, helping buildings reduce their carbon footprint while meeting energy demands.Advancements in materials science, such as the use of lightweight composites, aluminum, and high-performance glass, have improved the durability and resilience of facade systems while allowing for larger, unobstructed windows. Automation and digital control systems are also being incorporated into facade systems, enabling the regulation of lighting, ventilation, and shading based on weather patterns and occupancy levels. Moreover, 3D printing and modular construction techniques are transforming facade installation, making it more cost-effective, customizable, and faster. These technological improvements not only enhance the performance and aesthetics of facades but also make them more adaptable to changing environmental conditions, contributing to the rise of smart, sustainable buildings.

Why Are New Applications for Facade Systems Emerging Across Building Types?

The versatility of facade systems is driving their adoption in a wider range of building types, from commercial skyscrapers to residential complexes and institutional buildings. In commercial architecture, facades are being designed with features such as reflective glass, external shading devices, and responsive materials to create energy-efficient office spaces with an appealing aesthetic. These systems allow commercial buildings to meet stringent energy standards while offering high-end visual appeal, making facades essential for branding and architectural distinction in competitive urban landscapes. In the residential sector, facade systems are now used to improve insulation, reduce energy costs, and increase property value, with many housing developments opting for facades that align with local aesthetic and environmental regulations.Additionally, the trend toward mixed-use developments has driven demand for adaptable facade systems that cater to both commercial and residential needs within a single building. Institutional buildings, including hospitals, schools, and government offices, are also adopting advanced facade systems for their environmental control and energy efficiency benefits. In healthcare, for instance, facades that enhance natural light and control temperature help create comfortable and healing environments for patients. For educational buildings, facades equipped with solar shading and natural ventilation systems are being used to create sustainable learning environments. As these applications expand, facade systems are increasingly tailored to meet the unique requirements of each sector, driving their relevance across diverse building types.

What's Driving the Growth of the Global Facade Systems Market?

The growth in the facade systems market is driven by multiple factors, including the demand for energy-efficient buildings, urbanization, and regulatory pressures for sustainable construction. As governments worldwide enforce stricter building codes aimed at reducing energy consumption, there is a rising demand for facade systems that improve insulation and energy efficiency. Facade systems that incorporate double glazing, thermal insulation, and integrated shading solutions help buildings meet regulatory standards and qualify for green certifications such as LEED and BREEAM. Additionally, as urbanization accelerates, particularly in emerging markets, there is a surge in high-rise and commercial building projects that require durable, weather-resistant facade systems.The shift towards smart buildings and sustainable architecture is another significant driver, as architects and developers prioritize materials and technologies that reduce environmental impact. Innovations in renewable energy integration, such as photovoltaic facades, are gaining popularity, enabling buildings to generate electricity and reduce dependence on external power sources. Consumer demand for aesthetically pleasing and functional buildings is further fueling the market, as facades are key to enhancing the visual appeal and brand identity of structures. Together, these factors reflect a growing emphasis on high-performance, sustainable, and aesthetically distinctive building exteriors, positioning facade systems as essential components in modern architectural design and urban development.

Report Scope

The report analyzes the Facade Systems market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Cladding, EIFS, Siding, Curtain wall); End-Use (Residential, Non-Residential).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Cladding segment, which is expected to reach US$267.8 Billion by 2030 with a CAGR of a 10.6%. The EIFS segment is also set to grow at 9.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $108.3 Billion in 2024, and China, forecasted to grow at an impressive 13.6% CAGR to reach $183.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Facade Systems Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Facade Systems Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Facade Systems Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Asahi Glass, BASF, Boral Limited, Central Glass, Dryvit Systems Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Facade Systems market report include:

- Asahi Glass

- BASF

- Boral Limited

- Central Glass

- Dryvit Systems Inc.

- Etex Group

- Georgia-Pacific LLC

- James Hardie Industries PLC

- Kingspan PLC

- Knauf

- Louisiana Pacific Corporation

- Nichiha Corporation

- Nippon Sheet Glass

- Parexgroup SA

- Saint-Gobain

- SHERA

- Sto SE & Co KGaA

- Terraco Group

- Universal Cement Corporation (UCC)

- USG Corporation

- Vinh Tuong Industrial Corporation (VTI)

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Asahi Glass

- BASF

- Boral Limited

- Central Glass

- Dryvit Systems Inc.

- Etex Group

- Georgia-Pacific LLC

- James Hardie Industries PLC

- Kingspan PLC

- Knauf

- Louisiana Pacific Corporation

- Nichiha Corporation

- Nippon Sheet Glass

- Parexgroup SA

- Saint-Gobain

- SHERA

- Sto SE & Co KGaA

- Terraco Group

- Universal Cement Corporation (UCC)

- USG Corporation

- Vinh Tuong Industrial Corporation (VTI)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 285 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

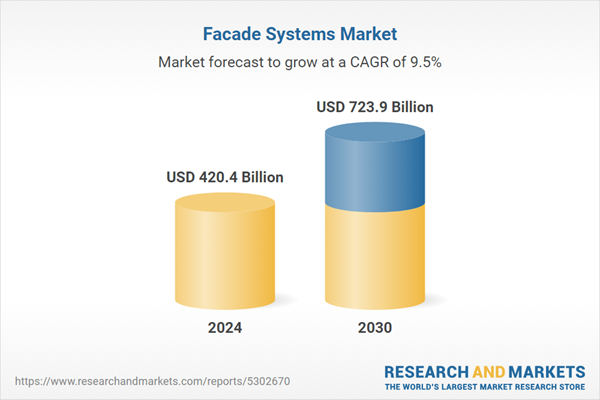

| Estimated Market Value ( USD | $ 420.4 Billion |

| Forecasted Market Value ( USD | $ 723.9 Billion |

| Compound Annual Growth Rate | 9.5% |

| Regions Covered | Global |