Global Explosive Trace Detection (ETD) Market - Key Trends & Growth Drivers Summarized

What Is Explosive Trace Detection (ETD) and Why Is It Critical for Security?

Explosive Trace Detection (ETD) technology is an essential component of modern security frameworks, enabling the rapid identification of explosive materials by detecting microscopic traces of chemicals associated with explosive compounds. ETD systems play a crucial role in maintaining public safety, particularly in high-risk areas such as airports, government facilities, mass transit hubs, and military bases. These systems analyze particles from surfaces or airborne traces and provide results within seconds, allowing security personnel to respond quickly to potential threats. By leveraging advanced technologies like ion mobility spectrometry (IMS), mass spectrometry, and colorimetric methods, ETD equipment can detect a wide array of explosives, from conventional types to homemade improvised explosive devices (IEDs). The sensitivity and reliability of ETD systems make them indispensable in sectors where security is paramount, enhancing the capability to intercept potential threats before they escalate.As global security challenges grow, ETD technology is increasingly used in a variety of environments beyond traditional security settings. Critical infrastructure such as power plants, water treatment facilities, and public events are now equipped with ETD systems to mitigate risks from domestic and international threats. Moreover, ETD systems are pivotal for law enforcement and military operations, as they allow for quick screening in field operations where safety and speed are essential. With the evolving nature of security threats, ETD technology has become an essential asset for government and private organizations seeking proactive measures to protect people, assets, and critical infrastructure.

How Are Technological Advancements Enhancing ETD Capabilities?

The ETD market is benefiting from rapid advancements in technology that are enhancing the sensitivity, speed, and portability of detection devices. Modern ETD systems now incorporate artificial intelligence (AI) and machine learning (ML) algorithms to improve the accuracy of explosive identification, reduce false positives, and analyze complex chemical signatures more efficiently. These algorithms learn from data over time, adapting to detect emerging explosives and enabling continuous improvement in detection accuracy. In addition, improvements in mass spectrometry have allowed ETD devices to identify a broader range of explosive materials with higher precision, which is essential for detecting trace amounts in crowded or high-risk environments.Miniaturization and portability advancements are also transforming the ETD market. Handheld ETD devices, which are increasingly lightweight and compact, are now being used by security personnel in mobile and field settings, enabling them to detect explosives on-site quickly. Additionally, the integration of IoT and cloud connectivity allows ETD systems to transmit real-time data to centralized command centers, facilitating coordinated responses to potential threats. These mobile and connected systems are particularly valuable for large-scale events, border checkpoints, and field operations where rapid response is critical. With innovations in sensors, AI, and connectivity, ETD technology is becoming more adaptable, efficient, and accessible, supporting its adoption across a wider range of security applications.

Why Are New Applications for ETD Emerging Across Sectors?

The need for robust security solutions has extended ETD applications beyond traditional areas, with new sectors adopting ETD technology to meet increased safety standards and mitigate emerging risks. In the transportation sector, for instance, ETD is not limited to airports but is now a common security measure in railways, subways, and bus terminals to protect against the rising threat of terrorism in public spaces. The healthcare sector is also adopting ETD to secure hospitals and research facilities, particularly where hazardous substances are handled, as these locations require stringent measures to prevent unauthorized access to potentially dangerous materials. Furthermore, ETD technology is increasingly used at major public events, such as concerts, sporting events, and political rallies, where large crowds make traditional security protocols challenging to implement effectively.The energy and utilities sectors, especially within critical infrastructure such as oil refineries, power plants, and water facilities, are also turning to ETD technology to guard against sabotage and terrorism. These sectors often involve the use of hazardous chemicals and materials that require protection from malicious threats, and ETD offers an efficient and reliable solution for monitoring and protecting these vulnerable locations. Additionally, as more organizations prioritize workplace safety, ETD is being implemented in corporate and manufacturing facilities to monitor for explosives and hazardous materials, ensuring a safe environment for employees. The expanding applications across these diverse sectors highlight ETD technology's flexibility and critical role in a world where security requirements are evolving to address complex threats in both public and private domains.

What's Driving the Growth of the Global ETD Market?

The growth in the global ETD market is driven by several factors, including rising security concerns, technological advancements, and increased government regulations. The threat of terrorism and the prevalence of domestic security risks have led to heightened demand for reliable ETD systems in high-risk environments, such as airports, government buildings, and public transit hubs. This demand is supported by technological innovations that enhance detection capabilities, including AI integration, which improves accuracy and reduces false positives. Additionally, advancements in mobile and handheld ETD devices have expanded the market by enabling security personnel to conduct on-the-spot inspections in a wide variety of settings, from large-scale events to border checkpoints, enhancing flexibility and response times.Government mandates and security regulations worldwide are also a critical growth driver, as regulatory bodies require stringent screening processes across sectors, from transportation to critical infrastructure. In many regions, security regulations have become more stringent in response to rising global security threats, prompting investments in ETD technology by both public and private sectors. The need for streamlined, efficient security processes has led to partnerships between ETD manufacturers and security agencies, accelerating innovation and the adoption of cutting-edge ETD solutions. Additionally, with the rise of IoT and digital connectivity, ETD devices with real-time data transmission capabilities are becoming popular, allowing for coordinated responses and enhanced threat detection accuracy. Together, these factors underscore the importance of ETD technology in safeguarding lives and infrastructure, driving sustained market growth as industries and governments increasingly prioritize advanced security solutions.

Report Scope

The report analyzes the Explosive Trace Detection (ETD) market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Product Type (Handheld, Portable / Movable, Fixed Point / Standalone); Application (Public Safety & Law Enforcement, Military & Defense, Transportation & Logistics, Commercial, Other Applications).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

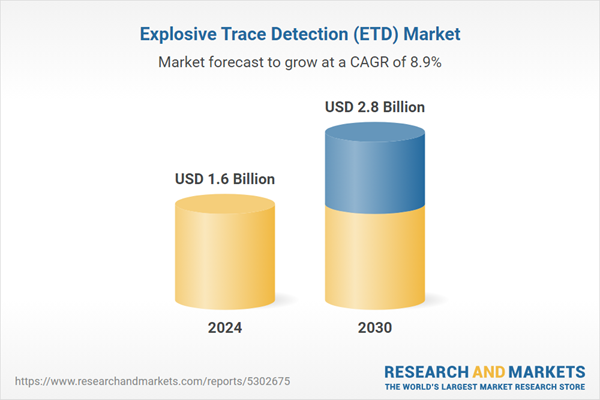

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Handheld Product segment, which is expected to reach US$1.2 Billion by 2030 with a CAGR of a 8.9%. The Portable / Movable Product segment is also set to grow at 9.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $426.4 Million in 2024, and China, forecasted to grow at an impressive 12.8% CAGR to reach $685.6 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Explosive Trace Detection (ETD) Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Explosive Trace Detection (ETD) Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Explosive Trace Detection (ETD) Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Autoclear US (Formerly Control Screening LLC), Biosensor Applications AB, DetectaChem LLC, Electronic Sensor Technology, Hitachi Ltd and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 37 companies featured in this Explosive Trace Detection (ETD) market report include:

- Autoclear US (Formerly Control Screening LLC)

- Biosensor Applications AB

- DetectaChem LLC

- Electronic Sensor Technology

- Hitachi Ltd

- ICx Technologies (Flir)

- Implant Sciences Corp.

- Ion Applications Inc.

- Ketech Defence

- Mistral Security Inc

- Morpho Detection Inc.

- NUCTECH Co. Ltd

- Red X Defense

- SCANNA MSC Ltd.

- Scent Detection Technologies

- Scintrex Trace

- Sibel Ltd

- Smiths Detection

- Syagen Technology

- Thermo Fisher Scientific Inc.

- Westminster International Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Autoclear US (Formerly Control Screening LLC)

- Biosensor Applications AB

- DetectaChem LLC

- Electronic Sensor Technology

- Hitachi Ltd

- ICx Technologies (Flir)

- Implant Sciences Corp.

- Ion Applications Inc.

- Ketech Defence

- Mistral Security Inc

- Morpho Detection Inc.

- NUCTECH Co. Ltd

- Red X Defense

- SCANNA MSC Ltd.

- Scent Detection Technologies

- Scintrex Trace

- Sibel Ltd

- Smiths Detection

- Syagen Technology

- Thermo Fisher Scientific Inc.

- Westminster International Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 280 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.6 Billion |

| Forecasted Market Value ( USD | $ 2.8 Billion |

| Compound Annual Growth Rate | 8.9% |

| Regions Covered | Global |