Global Encoder Market - Key Trends & Drivers Summarized

Why Are Encoders Essential in Modern Automation and Control Systems?

Encoders are critical components in automation, robotics, and precision control systems, enabling accurate position, speed, and motion feedback for various applications. By converting mechanical motion into electrical signals, encoders provide real-time data that is essential for controlling machinery, robotics, conveyors, and motors. Common types of encoders include rotary, linear, optical, and magnetic encoders, each suited to different requirements for accuracy, durability, and environmental resilience. Industries such as manufacturing, automotive, aerospace, and healthcare rely heavily on encoders to ensure precise control over automated processes, improving productivity, accuracy, and safety.In industrial automation, encoders help monitor motor positions and speeds, providing data to control systems that maintain accuracy in high-speed and complex operations. Encoders are especially critical in robotics, where precise movements and positioning are required to execute tasks with high precision. With the rise of Industry 4.0 and smart manufacturing, encoders are becoming indispensable, providing the real-time feedback necessary for enhanced automation and predictive maintenance, ultimately optimizing equipment performance and reducing downtime.

How Are Technological Advancements Shaping the Encoder Market?

Technological advancements are enhancing the performance, durability, and versatility of encoders, making them more adaptable to various applications and environments. One of the most significant developments is the rise of optical and magnetic encoders, which offer high accuracy, immunity to environmental factors, and longer operational life. Optical encoders, for example, use light patterns to detect position, delivering exceptional resolution and accuracy, which is critical in high-precision applications like CNC machining, semiconductor manufacturing, and robotics. Magnetic encoders, on the other hand, are durable and can operate effectively in harsh conditions, including exposure to dust, moisture, and vibrations, making them ideal for heavy-duty applications.The integration of wireless and IoT capabilities is further transforming the encoder market, enabling remote monitoring and data transmission. IoT-enabled encoders allow real-time data collection, supporting predictive maintenance and operational insights that help avoid unexpected machine failures. Miniaturization is also a key trend, particularly in the medical device and consumer electronics sectors, where compact encoders are essential to fit within small, intricate designs without compromising performance. Additionally, advancements in high-resolution encoders are supporting the demands of emerging technologies like autonomous vehicles and robotic surgery, where precise motion control is crucial. Together, these technological advancements are expanding the applications and effectiveness of encoders, supporting their use across diverse and complex environments.

What Are the Key Applications of Encoders?

Encoders are used across various industries where precise measurement of position, speed, and direction is essential for operational accuracy. In the manufacturing sector, encoders play a vital role in controlling motorized systems in applications such as conveyor belts, packaging, CNC machines, and robotic arms. Encoders provide critical feedback on motor position and speed, enabling efficient control of automated machinery and ensuring precision in high-speed manufacturing processes. In the automotive industry, encoders are used in vehicle control systems, including steering, braking, and throttle systems, where they provide real-time position data to optimize vehicle performance and safety.In robotics, encoders are indispensable for motion control, supporting tasks that require fine-tuned movements, such as assembly, welding, and inspection. The aerospace and defense industries also rely on encoders for accurate positioning in applications like navigation systems, radar, and missile guidance. Additionally, in medical technology, encoders are integrated into equipment like MRI machines, robotic surgery systems, and infusion pumps, where precise control over positioning and motion is critical. These applications highlight the versatility of encoders, enabling reliable, high-precision control across industries where accuracy and efficiency are paramount.

What Is Driving Growth in the Encoder Market?

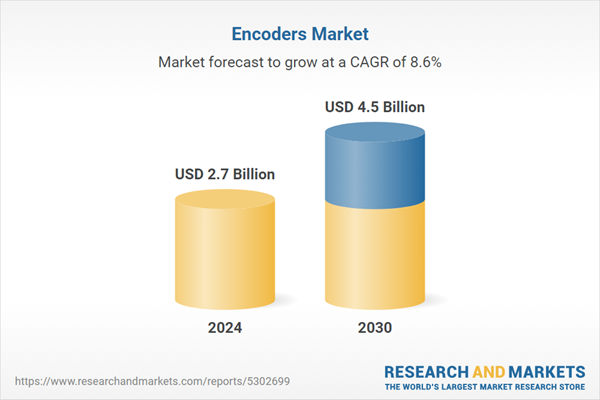

The growth in the encoder market is driven by the increasing demand for automation and precision control, advancements in encoder technology, and the expansion of IoT-enabled smart systems. As industries adopt automation to enhance productivity and reduce costs, the need for high-performance encoders is rising to ensure the accuracy and reliability of automated systems. The shift towards smart factories and Industry 4.0 has further spurred demand for IoT-enabled encoders, which provide real-time data for monitoring and predictive maintenance, helping to optimize equipment utilization and minimize downtime. Technological advancements, such as the development of high-resolution optical and magnetic encoders, are also supporting market growth by enabling more precise measurement and expanding application possibilities. The increased focus on robotics, particularly in logistics, manufacturing, and healthcare, is driving demand for encoders that can support intricate, precise movements. Additionally, the automotive industry's focus on safety and automation, including the development of electric and autonomous vehicles, is boosting demand for encoders to provide the necessary feedback for accurate control systems. Environmental and regulatory requirements are encouraging the adoption of energy-efficient and durable encoders, particularly in sectors where equipment must operate reliably in harsh conditions. Together, these factors - growing automation, technological advancements, IoT integration, and the expansion of precision-driven industries - are driving robust growth in the encoder market, establishing these devices as essential components for modern automation and control systems.Report Scope

The report analyzes the Encoders market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Rotary, Linear); Technology (Optical, Magnetic, Other Technologies); End-Use (Industrial, Automotive, Consumer Electronics, Food & Beverage, Medical, Other End-Uses).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Rotary Encoders segment, which is expected to reach US$2.6 Billion by 2030 with a CAGR of a 9.3%. The Linear Encoders segment is also set to grow at 7.7% CAGR over the analysis period.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Encoders Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Encoders Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Encoders Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Baumer Group, Dynapar Corporation, Faulhaber Group, Heidenhain GmbH, IFM Electronic GmbH and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Encoders market report include:

- Baumer Group

- Dynapar Corporation

- Faulhaber Group

- Heidenhain GmbH

- IFM Electronic GmbH

- Maxon Motor Ag

- Micronor Inc.

- Nidec Corporation

- Omron Automation

- Pepperl+Fuchs

- Pilz GmbH Co. Kg

- Posic

- Posital-Fraba Inc.

- Renishaw PLC

- Rockwell Automation Inc.

- Sensata Technologies

- Siko GmbH

- Turck Banner Singapore PTE Ltd

- US Digital

- Wachendorff Automation GmbH +Co Kg

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Baumer Group

- Dynapar Corporation

- Faulhaber Group

- Heidenhain GmbH

- IFM Electronic GmbH

- Maxon Motor Ag

- Micronor Inc.

- Nidec Corporation

- Omron Automation

- Pepperl+Fuchs

- Pilz GmbH Co. Kg

- Posic

- Posital-Fraba Inc.

- Renishaw PLC

- Rockwell Automation Inc.

- Sensata Technologies

- Siko GmbH

- Turck Banner Singapore PTE Ltd

- US Digital

- Wachendorff Automation GmbH +Co Kg

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 387 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.7 Billion |

| Forecasted Market Value ( USD | $ 4.5 Billion |

| Compound Annual Growth Rate | 8.6% |

| Regions Covered | Global |