Global Electronic Films Market - Key Trends & Drivers Summarized

Why Are Electronic Films Essential in Advanced Electronics and Displays?

Electronic films are critical components in modern electronics, providing essential properties like conductivity, insulation, protection, and flexibility across various devices, from smartphones and tablets to solar cells and flexible displays. These thin films, which are often made from materials like polyimide, polyethylene terephthalate (PET), and indium tin oxide (ITO), are engineered to provide durability, transparency, and electrical functionality, making them ideal for applications in touchscreens, sensors, and flexible circuits. Electronic films serve as protective barriers, conductive layers, or dielectric insulators, depending on the device's requirements. For instance, in touchscreens, conductive films ensure accurate touch responsiveness, while transparent films enable clear visual displays.The rising demand for high-performance electronic devices, particularly in consumer electronics and automotive displays, is amplifying the role of electronic films. Flexible and transparent films are especially important as the trend toward foldable and flexible devices gains traction. Moreover, electronic films are pivotal in protecting components from environmental factors like moisture, dust, and UV exposure, which enhances device longevity and reliability. As industries push toward more compact, lightweight, and multi-functional devices, electronic films offer the material properties necessary to support these advanced technologies, making them essential to next-generation electronic design.

How Are Technological Advances Shaping the Electronic Films Market?

Technological advancements are driving innovations in electronic films, improving their performance, flexibility, and durability. One of the most impactful advancements is the development of ultra-thin and transparent conductive films, which are used in high-resolution displays and touchscreens. Materials like indium tin oxide (ITO), silver nanowires, and carbon nanotubes are enabling new levels of transparency and conductivity, ideal for applications in high-end displays and flexible electronics. These materials are more conductive and flexible than traditional films, providing manufacturers with options for next-generation devices, such as foldable phones, curved displays, and wearable electronics. Additionally, organic electronic films, which use organic polymers, are gaining popularity for flexible electronics, offering stretchability and lighter weight, crucial for devices where form factor is a key feature.Nanotechnology is also advancing electronic films, improving their strength, flexibility, and resistance to environmental stress. Nanocoatings, for instance, enhance the protective properties of films, adding scratch and corrosion resistance while maintaining transparency and electrical properties. Improved barrier films are also emerging, offering enhanced resistance to oxygen and moisture, which is essential for the longevity of devices exposed to varying environmental conditions, such as solar cells and outdoor displays. Together, these technological advancements are expanding the applications and capabilities of electronic films, enabling them to meet the increasingly sophisticated demands of modern electronic devices.

What Are the Key Applications of Electronic Films?

Electronic films have a wide range of applications across consumer electronics, automotive displays, energy storage, and renewable energy. In consumer electronics, films are commonly used in touchscreens, OLED displays, and flexible circuits, providing transparency, conductivity, and flexibility. For example, smartphones, tablets, and wearables rely on electronic films to ensure touch sensitivity, clarity, and durability. As devices become more compact and multifunctional, electronic films help manufacturers deliver high performance without compromising on size or weight.In the automotive industry, electronic films are used in advanced driver-assistance systems (ADAS) displays, infotainment screens, and interior touch panels. These films support the functionality and longevity of touch-sensitive and high-resolution displays that operate under extreme conditions, such as temperature fluctuations and UV exposure. Renewable energy applications, particularly solar cells, also benefit from electronic films. Conductive and transparent films are applied in photovoltaic cells to enhance energy efficiency and protect against environmental damage. Additionally, electronic films are used in energy storage devices, such as batteries and capacitors, where they provide insulation and improve charge retention. These applications demonstrate the versatility and necessity of electronic films across various sectors, from consumer electronics to automotive and renewable energy.

What Is Driving Growth in the Electronic Films Market?

The growth in the electronic films market is driven by several factors, including the rapid expansion of consumer electronics, advancements in flexible and foldable devices, and increased demand for high-performance displays in automotive and industrial sectors. The booming consumer electronics market, driven by demand for smartphones, tablets, wearables, and high-resolution displays, is a primary growth driver, as these devices rely heavily on electronic films for functionality and durability. The trend toward thinner, lighter, and more feature-rich devices has amplified the need for advanced film materials that offer both strength and flexibility.Advancements in flexible electronics and foldable devices are also significantly boosting demand for electronic films. As manufacturers develop next-generation devices with flexible screens and foldable displays, the need for films that can maintain functionality under repeated bending and stretching has grown. These developments are particularly important in consumer electronics and automotive industries, where curved and flexible displays are becoming standard.

Additionally, the rise of electric vehicles (EVs) and renewable energy applications, such as solar cells, is driving demand for electronic films that provide insulation, protection, and conductivity in harsh environments. Governments worldwide are incentivizing renewable energy projects and EV adoption, spurring growth in industries that heavily use electronic films. Together, these factors - expansion of the electronics market, advancements in flexible technology, increased demand for high-performance displays, and renewable energy growth - are driving robust growth in the electronic films market, positioning these films as fundamental components in the future of digital and sustainable technology.

Report Scope

The report analyzes the Electronic Films market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Product Type (Non-Conductive, Conductive); Material (Polymer, ITO on Glass, ITO on PET, Metal Mesh, Other Materials); Application (Electronic Display, Printed Circuit Boards, Semiconductors, Other Applications).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Non-Conductive Films segment, which is expected to reach US$9.9 Billion by 2030 with a CAGR of a 7.4%. The Conductive Films segment is also set to grow at 6.6% CAGR over the analysis period.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Electronic Films Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Electronic Films Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Electronic Films Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

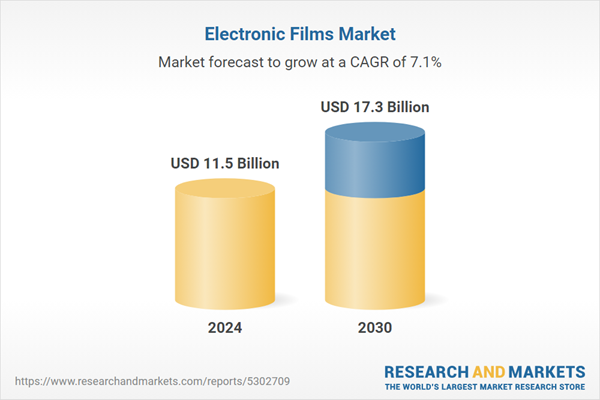

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 3M, C3 Nano, Canatu Oy, Coveris, Daikin and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Electronic Films market report include:

- 3M

- C3 Nano

- Canatu Oy

- Coveris

- Daikin

- Dontech Inc.

- Dow, Inc.

- DuPont de Nemours, Inc.

- Eastman Chemical Company

- Gunze

- Mitsubishi Chemical Holdings

- Nitto Denko Corporation

- Oike & Co. Ltd.

- SABIC

- Saint-Gobain S.A.

- SKC Inc.

- TDK Corporation

- Teijin Ltd.

- The Chemours Company

- Toray Industries Inc.

- Toyobo Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M

- C3 Nano

- Canatu Oy

- Coveris

- Daikin

- Dontech Inc.

- Dow, Inc.

- DuPont de Nemours, Inc.

- Eastman Chemical Company

- Gunze

- Mitsubishi Chemical Holdings

- Nitto Denko Corporation

- Oike & Co. Ltd.

- SABIC

- Saint-Gobain S.A.

- SKC Inc.

- TDK Corporation

- Teijin Ltd.

- The Chemours Company

- Toray Industries Inc.

- Toyobo Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 375 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 11.5 Billion |

| Forecasted Market Value ( USD | $ 17.3 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Global |