Global Electronic Drug Delivery Systems Market - Key Trends & Drivers Summarized

Why Are Electronic Drug Delivery Systems Revolutionizing Healthcare?

Electronic drug delivery systems are transforming healthcare by enabling precise, controlled, and personalized medication administration, improving treatment adherence and patient outcomes. Unlike traditional methods, electronic drug delivery systems use advanced technology to ensure accurate dosing, adjust delivery rates, and monitor usage patterns, making them essential in managing chronic diseases such as diabetes, cardiovascular conditions, and pain management. These systems, which include wearable infusion pumps, inhalers, and implantable devices, allow healthcare providers to administer medications at optimal intervals, often through pre-programmed schedules. For patients, these devices offer ease of use, greater autonomy, and improved adherence to prescribed regimens, which is especially important in treatments requiring long-term consistency.The growing prevalence of chronic diseases and the shift toward personalized medicine have heightened the demand for electronic drug delivery systems. These systems enhance patient engagement by providing real-time data on medication administration and enabling adjustments tailored to individual needs. In diabetes management, for instance, electronic insulin pumps provide continuous glucose monitoring and automated insulin delivery, reducing the risk of complications and improving quality of life. The rising focus on patient-centered care, combined with advancements in digital health technologies, positions electronic drug delivery systems as a critical component of modern healthcare, driving their adoption across diverse therapeutic areas.

How Are Technological Advancements Shaping the Electronic Drug Delivery Systems Market?

Technological advancements are rapidly enhancing the functionality and versatility of electronic drug delivery systems, making them more precise, adaptable, and user-friendly. One of the most significant developments is the integration of Internet of Things (IoT) capabilities, allowing these devices to connect seamlessly with smartphones, wearables, and digital health platforms. IoT-enabled drug delivery systems provide real-time monitoring and remote management, enabling healthcare providers to track patient adherence, adjust dosages, and intervene when necessary. These connected systems also allow patients to monitor their own usage patterns and health metrics, supporting greater autonomy and engagement in their healthcare.Miniaturization and advances in microelectronics have also allowed for the development of smaller, less intrusive devices, such as patch-based drug delivery systems, which are easier to wear and more discreet. Additionally, artificial intelligence (AI) and machine learning are being incorporated into electronic drug delivery systems to predict optimal dosing schedules and personalize treatment regimens based on individual health data. Rechargeable and long-lasting battery technology is further enhancing device usability, particularly for implantable devices, reducing the frequency of device replacement and maintenance. Together, these technological advancements are making electronic drug delivery systems more efficient, reliable, and supportive of individualized care, expanding their applications in both acute and chronic care settings.

What Are the Key Applications of Electronic Drug Delivery Systems?

Electronic drug delivery systems have broad applications across several therapeutic areas, addressing the needs of patients with chronic conditions as well as those requiring acute, precisely controlled medication delivery. In diabetes care, electronic insulin pumps and glucose monitors enable continuous glucose monitoring (CGM) and insulin delivery, significantly enhancing the ability of patients to manage their condition effectively. These devices automatically adjust insulin doses based on real-time glucose readings, reducing the risks associated with blood sugar fluctuations. Pain management is another key application, with wearable infusion pumps delivering controlled doses of analgesics, making them especially valuable for patients recovering from surgery or managing chronic pain conditions.In respiratory care, smart inhalers deliver precise doses of medication for patients with asthma and chronic obstructive pulmonary disease (COPD), ensuring optimal drug delivery to the lungs while monitoring usage patterns. Oncology is also a growing area for electronic drug delivery systems, where implantable devices provide continuous, controlled doses of chemotherapy, reducing the need for frequent hospital visits and improving patient comfort. Additionally, implantable drug delivery systems are used in neurological treatments, such as the administration of medications for Parkinson's disease, where precise, consistent dosing is crucial to managing symptoms. These applications illustrate the versatility of electronic drug delivery systems in supporting personalized, reliable treatment regimens for a wide range of medical conditions.

What Is Driving Growth in the Electronic Drug Delivery Systems Market?

The growth in the electronic drug delivery systems market is driven by several key factors, including the rising incidence of chronic diseases, advancements in digital health technology, the shift toward personalized medicine, and the increasing focus on patient-centered care. The prevalence of chronic diseases, such as diabetes, cardiovascular disease, and respiratory conditions, has created a pressing need for more effective and patient-friendly treatment options. Electronic drug delivery systems, which offer precise, consistent medication administration, are becoming essential in managing these conditions, enhancing patient adherence and reducing healthcare costs associated with disease complications.Technological advancements, particularly in IoT, AI, and miniaturization, are enabling more sophisticated and user-friendly electronic drug delivery devices, making them accessible to a broader range of patients and healthcare providers. The demand for personalized medicine is also fueling growth, as these systems allow for customizable dosing and real-time data collection, which supports individualized treatment plans. Additionally, the emphasis on improving patient experience and engagement has accelerated the adoption of electronic drug delivery systems, as these devices provide patients with greater control over their healthcare and support better adherence to treatment.

The trend toward remote patient monitoring, bolstered by telehealth and digital health initiatives, is further driving demand for electronic drug delivery systems that can be managed and monitored remotely. Government and regulatory support for digital health solutions, along with increased investment in smart medical devices, are further contributing to market growth. Together, these factors - rising chronic disease prevalence, technological advancements, patient-centered care, and personalized medicine - are propelling the expansion of the electronic drug delivery systems market, establishing it as a key pillar in the future of healthcare.

Report Scope

The report analyzes the Electronic Drug Delivery Systems market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Product Type (Wearable Infusion Pumps, Auto Injectors, Injection Pens, Inhalers); Application (Diabetes, Cardiovascular Disease, Respiratory Disorders, Multiple Sclerosis, Other Applications).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Wearable Infusion Pumps segment, which is expected to reach US$8.7 Billion by 2030 with a CAGR of a 7.9%. The Auto Injectors segment is also set to grow at 8.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.5 Billion in 2024, and China, forecasted to grow at an impressive 12% CAGR to reach $5.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Electronic Drug Delivery Systems Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Electronic Drug Delivery Systems Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Electronic Drug Delivery Systems Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Amgen, Inc., Astrazeneca PLC, Bayer AG, Canè SPA, Companion Medical and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Electronic Drug Delivery Systems market report include:

- Amgen, Inc.

- Astrazeneca PLC

- Bayer AG

- Canè SPA

- Companion Medical

- Debiotech S.A.

- F.Hoffmann-La Roche, Ltd.

- Findair SP. Z O. O.

- Insulet Corporation

- Medtronic PLC

- Merck Group

- Novo Nordisk

- Tandem Diabetes Care, Inc.

- United Therapeutics Corporation

- Vicentra B.V.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Amgen, Inc.

- Astrazeneca PLC

- Bayer AG

- Canè SPA

- Companion Medical

- Debiotech S.A.

- F.Hoffmann-La Roche, Ltd.

- Findair SP. Z O. O.

- Insulet Corporation

- Medtronic PLC

- Merck Group

- Novo Nordisk

- Tandem Diabetes Care, Inc.

- United Therapeutics Corporation

- Vicentra B.V.

Table Information

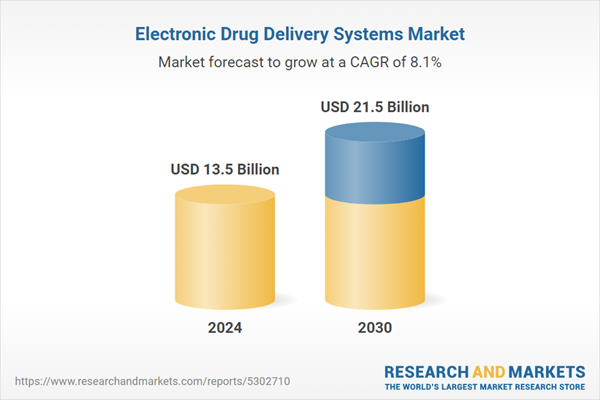

| Report Attribute | Details |

|---|---|

| No. of Pages | 288 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 13.5 Billion |

| Forecasted Market Value ( USD | $ 21.5 Billion |

| Compound Annual Growth Rate | 8.1% |

| Regions Covered | Global |