Global Electric Vehicle Adhesives Market - Key Trends & Drivers Summarized

What Is Driving the Demand for Adhesives in Electric Vehicles?

The growing adoption of electric vehicles (EVs) has sparked an increased demand for specialized adhesives, which are essential for lightweight, durable, and energy-efficient vehicle designs. EV adhesives are used extensively in battery systems, interior and exterior panels, and assembly processes, where they replace traditional fasteners like bolts and welds. By reducing the need for heavier mechanical fasteners, adhesives help to lower the overall weight of the vehicle, contributing to extended range and improved battery performance. This weight reduction is particularly crucial in EVs, where range and energy efficiency are top priorities. Adhesives also offer flexibility in bonding various materials, including lightweight composites, metals, and plastics, which are used to construct EVs. The ability to securely bond dissimilar materials is especially valuable in the EV industry, where manufacturers are constantly experimenting with new materials to optimize performance and reduce vehicle weight.Additionally, adhesives play a vital role in thermal management within EV batteries. They help in heat dissipation and vibration dampening, which is critical to ensuring battery longevity and vehicle safety. In battery packs, adhesives bond cooling plates and modules, ensuring efficient heat transfer and minimizing overheating risks. The demand for adhesives with thermal conductivity, high-temperature resistance, and vibration absorption capabilities is thus on the rise as manufacturers prioritize battery safety and performance. As EV production scales globally, the role of adhesives in improving structural integrity and thermal management is increasingly recognized, making them a key material in electric vehicle manufacturing.

How Are Technological Advancements Enhancing EV Adhesives?

The electric vehicle adhesives market is benefiting from technological advancements that improve performance characteristics, such as thermal conductivity, electrical insulation, and environmental resistance. One significant advancement is the development of high-performance, two-component adhesives, which cure at room temperature and offer strong adhesion even under extreme conditions. These adhesives are ideal for bonding battery components, as they withstand high temperatures and resist chemical corrosion. Another innovation is the creation of adhesives with enhanced thermal conductivity, allowing for better heat dissipation in battery systems. These materials help prevent overheating and increase battery efficiency, addressing one of the major challenges in EV battery design.The adoption of structural adhesives that offer high-strength bonding is also transforming EV assembly, as they eliminate the need for mechanical fasteners, thus reducing weight and improving aerodynamics. Additionally, advancements in curing processes, such as UV-curable adhesives, are reducing production time, allowing for faster manufacturing cycles and increasing overall efficiency. These adhesives are particularly valuable in bonding EV battery modules and cell-to-cell applications, where fast and reliable adhesion is crucial. Furthermore, solvent-free and low-VOC adhesives are gaining traction in response to environmental regulations, enabling manufacturers to meet sustainability goals. Together, these innovations are enhancing the functionality of EV adhesives, supporting their widespread adoption in next-generation electric vehicles.

What Are the Key Applications of Adhesives in Electric Vehicles?

Adhesives are essential in several critical applications within electric vehicles, including battery assembly, powertrain bonding, and interior and exterior structural bonding. In battery assembly, adhesives are used to secure battery cells, modules, and packs, providing structural stability and ensuring efficient thermal management. Adhesives with high thermal conductivity are especially important in battery packs, as they facilitate heat dissipation and prevent overheating. Additionally, adhesives contribute to waterproofing and shock resistance in battery enclosures, which protects battery integrity and extends the overall lifespan of the vehicle. In powertrains, adhesives bond electric motors, inverters, and other components, providing reliable, vibration-resistant connections that improve efficiency and reduce maintenance needs.Interior and exterior components, such as panels, doors, and dashboards, also rely on adhesives to provide lightweight, durable bonds. By eliminating the need for screws and bolts, adhesives contribute to a seamless design and reduce the weight of the vehicle. In addition to structural applications, adhesives are used in wire management systems, where they secure cables and protect sensitive electronics from vibration and impact. This versatility makes adhesives a critical component in EV manufacturing, supporting everything from safety and efficiency to aesthetics and performance.

What Is Driving Growth in the Electric Vehicle Adhesives Market?

The growth in the electric vehicle adhesives market is driven by several factors, including the rising adoption of electric vehicles, the demand for lightweight materials, and advancements in thermal management solutions. As global EV adoption continues to expand, manufacturers are looking for ways to optimize vehicle weight, efficiency, and durability, and adhesives offer a solution that aligns with these goals. The shift toward lightweight materials, such as composites and plastics, further increases the need for specialized adhesives capable of bonding dissimilar materials securely. Government regulations focused on reducing emissions and promoting EVs are also fueling demand for adhesives, as manufacturers seek to reduce vehicle weight and enhance battery efficiency.Additionally, advancements in adhesive technology, particularly in thermal conductivity and curing processes, are supporting the adoption of adhesives in EV battery systems. The demand for adhesives that can withstand high temperatures and provide effective thermal management is essential as EV batteries become more powerful and compact. The expansion of the EV market, coupled with technological innovations in adhesives, is driving strong growth in this sector, positioning adhesives as a key material for future EV development.

Report Scope

The report analyzes the Electric Vehicle Adhesives market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Vehicle Type (Plug-in Hybrid Electric Vehicle, Battery Electric Vehicle); Application (Pack & Module Bonding, Thermal Interface Bonding, Battery Cell Encapsulation, Other Applications).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

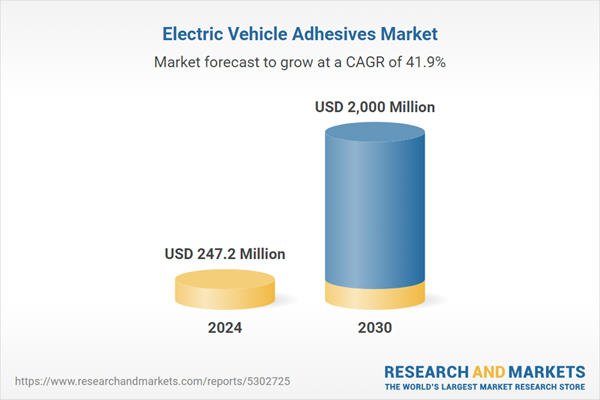

- Market Growth: Understand the significant growth trajectory of the Plug-in Hybrid Electric Vehicle segment, which is expected to reach US$716.7 Million by 2030 with a CAGR of a 35.9%. The Battery Electric Vehicle segment is also set to grow at 46.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $75.5 Million in 2024, and China, forecasted to grow at an impressive 39% CAGR to reach $271.2 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Electric Vehicle Adhesives Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Electric Vehicle Adhesives Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Electric Vehicle Adhesives Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 3M Company, Antala, Bostik, DELO Industrie Klebstoffe GmbH & Co. KGaA, Dymax Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Electric Vehicle Adhesives market report include:

- 3M Company

- Antala

- Bostik

- DELO Industrie Klebstoffe GmbH & Co. KGaA

- Dymax Corporation

- Evonik Industries AG

- H.B. Fuller Company

- Henkel Adhesive Technologies

- Henkel France SA

- Henkel Japan Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M Company

- Antala

- Bostik

- DELO Industrie Klebstoffe GmbH & Co. KGaA

- Dymax Corporation

- Evonik Industries AG

- H.B. Fuller Company

- Henkel Adhesive Technologies

- Henkel France SA

- Henkel Japan Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 177 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 247.2 Million |

| Forecasted Market Value ( USD | $ 2000 Million |

| Compound Annual Growth Rate | 41.9% |

| Regions Covered | Global |