Global Food Processing Seals Market - Key Trends & Drivers Summarized

What Are Food Processing Seals, and Why Are They Vital in the Food Industry?

Food processing seals are indispensable components in the food manufacturing process, designed to create secure and sanitary barriers in equipment handling raw and processed food materials. These seals prevent cross-contamination between food products and the external environment, thus maintaining the integrity and safety of the food. They are typically used in critical processing equipment, including mixers, pumps, homogenizers, and rotary equipment, where moving parts interact with food substances. Their role in preventing leakage, contamination, and equipment malfunctions is crucial to upholding the standards of hygiene required in food production. Moreover, these seals must endure aggressive cleaning protocols, which involve exposure to high temperatures, steam, chemical detergents, and high-pressure washing, without deteriorating or shedding particles into the food. Materials used for these seals, such as elastomers, thermoplastics, and PTFE (polytetrafluoroethylene), are carefully selected based on their compliance with food safety regulations, their mechanical properties, and their resistance to extreme processing conditions. Regulatory bodies like the U.S. Food and Drug Administration (FDA), European Food Safety Authority (EFSA), and the 3-A Sanitary Standards provide stringent guidelines for materials that can come into direct contact with food. These seals must also be resistant to oils, fats, acids, and other substances found in food processing environments. The durability and performance of seals are essential not only for maintaining operational efficiency but also for reducing downtime, product spoilage, and ensuring a contamination-free production process, thereby minimizing health risks to consumers.How Is Technology Transforming the Food Processing Seals Industry?

The role of technology in transforming the food processing seals industry cannot be overstated. Over the last decade, technological advancements have revolutionized seal design and materials, leading to more durable, efficient, and cost-effective solutions for food processing plants. One of the most significant innovations has been the development of new food-grade materials that offer enhanced mechanical properties and superior resistance to a variety of challenging conditions, including extreme temperatures, high pressures, and aggressive cleaning chemicals. These materials, such as advanced fluoropolymers and perfluoroelastomers, are designed to withstand the rigorous demands of modern food processing, offering long-term stability and performance. Technological advancements have also introduced the concept of hygienic seal designs, which minimize crevices and eliminate potential harborage points for bacteria, fungi, and other contaminants. These seals are designed with easy-to-clean profiles, ensuring that they do not trap food particles during processing or cleaning, which can lead to microbial growth and contamination. Moreover, technology is enabling the integration of smart seals with embedded sensors that can monitor temperature, pressure, and wear levels in real-time. This innovation, aligned with the trend toward Industry 4.0, provides predictive maintenance capabilities, allowing operators to identify potential seal failures before they occur, thus preventing costly downtime and ensuring consistent product quality. Furthermore, the increased focus on sustainability has led to the development of seals that are eco-friendly and can be recycled or disposed of safely, reducing the environmental impact of the food processing industry.What Role Do Regulatory Standards and Consumer Expectations Play in the Food Processing Seals Market?

The food processing seals market is highly regulated, with strict standards governing the materials used and the performance characteristics required to ensure consumer safety and product integrity. Regulatory bodies such as the FDA in the United States, the European Commission's EC 1935/2004 regulation, and 3-A sanitary standards in the dairy industry, among others, impose stringent requirements on food contact materials to prevent contamination. These standards mandate that seals must be chemically inert, non-toxic, and free from substances that could migrate into food products. Compliance with these regulations is critical for food manufacturers to avoid costly recalls, legal penalties, and reputational damage. Manufacturers of food processing seals must undergo rigorous testing to ensure their products meet these standards, including testing for resistance to chemicals, thermal cycling, and mechanical wear. In addition to regulatory demands, shifting consumer expectations have also had a significant impact on the food processing seals market. Today's consumers are more health-conscious and demand higher levels of transparency regarding the safety and sustainability of the products they consume. This has led to a growing emphasis on clean-label products and the elimination of artificial additives and contaminants from the food supply chain. Seals that are free from harmful chemicals and can withstand the harsh sterilization processes used in organic and allergen-free food production are increasingly in demand. Additionally, consumers' expectations for environmentally responsible food production have driven the need for seals that are manufactured from sustainable materials, with a lower environmental footprint throughout their lifecycle. This has encouraged the development of recyclable and biodegradable seals that align with the broader trend toward eco-friendly packaging and processing.What Factors Are Driving the Growth in the Food Processing Seals Market?

The growth in the food processing seals market is driven by several factors, primarily centered around the expansion of the global food processing industry, advances in sealing technology, and changing consumer and regulatory landscapes. One of the most significant growth drivers is the increasing demand for processed and packaged foods worldwide. The growing urban population, busy lifestyles, and rising disposable incomes have led to a surge in the consumption of ready-to-eat meals, frozen foods, and snacks, which require high-performance sealing solutions to maintain product freshness and safety. As food processing companies expand their operations to meet this demand, the need for reliable and durable seals in equipment such as pumps, mixers, and conveyors has increased, fueling market growth. Additionally, the rising focus on automation and advanced machinery in food processing plants has driven the demand for seals that can perform under high pressure, extreme temperatures, and in continuous operation. The trend toward automated and continuous processing systems requires seals that can withstand higher levels of mechanical stress and prevent downtime, as interruptions can lead to significant financial losses. Technological innovations, such as the development of seals with improved resistance to wear and chemicals, are addressing these challenges and contributing to market growth.Another important growth driver is the increasing global regulatory scrutiny on food safety and hygiene. As governments and food safety authorities impose stricter regulations on food production, companies are compelled to adopt more robust sealing solutions that comply with these evolving standards. Furthermore, the growing awareness of food allergies, contamination risks, and the need for allergen-free production environments has led to a higher demand for seals that prevent cross-contamination and ensure safe food handling. In parallel, the sustainability movement within the food industry is also playing a role in driving demand for eco-friendly and biodegradable seals that reduce environmental impact. Together, these factors are shaping the future of the food processing seals market, with innovation and regulatory compliance at the forefront of industry growth.

Report Scope

The report analyzes the Food Processing Seals market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Material (Metals, Face Materials, Elastomers, Other Materials); Application (Bakery & Confectionery, Meat, Poultry & Seafood, Dairy Products, Alcoholic Beverages, Non-Alcoholic Beverages, Other Applications).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Metals Material segment, which is expected to reach US$1.9 Billion by 2030 with a CAGR of a 5.9%. The Face Materials segment is also set to grow at 4.9% CAGR over the analysis period.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Food Processing Seals Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Food Processing Seals Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Food Processing Seals Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

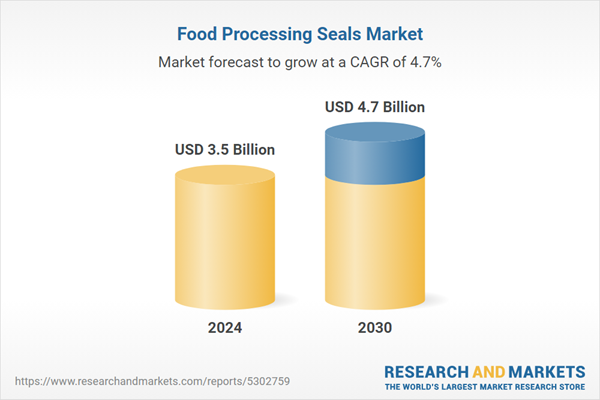

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as A.W. Chesterton Company, AESSEAL Plc, EnPro Industries, Inc., Flowserve Corporation, FMI SICHEM SRL and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 53 companies featured in this Food Processing Seals market report include:

- A.W. Chesterton Company

- AESSEAL Plc

- EnPro Industries, Inc.

- Flowserve Corporation

- FMI SICHEM SRL

- Freudenberg Group

- FTL Technology/IDEX

- IDEX Corporation

- James Walker

- Meccanotecnica Umbra S.p.A.

- Parker Hannifin

- Precision Associates, Inc

- SKF

- Smiths Group Plc

- Trelleborg AB

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- A.W. Chesterton Company

- AESSEAL Plc

- EnPro Industries, Inc.

- Flowserve Corporation

- FMI SICHEM SRL

- Freudenberg Group

- FTL Technology/IDEX

- IDEX Corporation

- James Walker

- Meccanotecnica Umbra S.p.A.

- Parker Hannifin

- Precision Associates, Inc

- SKF

- Smiths Group Plc

- Trelleborg AB

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 302 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.5 Billion |

| Forecasted Market Value ( USD | $ 4.7 Billion |

| Compound Annual Growth Rate | 4.7% |

| Regions Covered | Global |