Global Food Processing Ingredients Market - Key Trends & Drivers Summarized

What Are Food Processing Ingredients, and Why Are They Essential?

Food processing ingredients are critical components used to transform raw materials into consumable food products through various physical, chemical, and biological methods. These ingredients encompass a wide range, including emulsifiers, preservatives, flavor enhancers, stabilizers, colorants, sweeteners, and enzymes, all of which serve to enhance the texture, taste, appearance, and shelf life of processed foods. As the global food industry continues to expand and innovate, the importance of these ingredients becomes increasingly prominent. Food processing ingredients not only ensure that foods remain fresh and safe for consumption but also cater to growing consumer demand for convenience, quality, and nutritional value. The rise of processed foods has made it imperative to use ingredients that meet stringent regulatory standards, as food safety and consumer health remain paramount in modern-day food production. Manufacturers are also leaning toward the use of clean-label ingredients, which are more natural and less processed, reflecting a broader trend toward transparency and health-conscious consumption.How Are Technological Advancements Shaping the Food Processing Ingredient Market?

Technological innovation has been a key driver in the development and application of food processing ingredients. Advances in biotechnology, nanotechnology, and food engineering have allowed for the creation of highly specialized ingredients that serve functional purposes, such as improving nutrient content, extending product shelf life, and enhancing sensory properties. For instance, enzymes are increasingly being used to modify the structure of carbohydrates and proteins in food, leading to more stable, healthier, and tastier products. Additionally, advancements in encapsulation techniques are helping preserve sensitive ingredients like vitamins and probiotics during processing, ensuring that their beneficial properties are retained until the point of consumption. Another critical area of innovation is the use of natural preservatives and clean-label additives, driven by consumer demand for minimally processed, natural products. As regulatory frameworks around artificial additives tighten, the industry is turning toward plant-based and microbial ingredients that offer similar functional benefits without compromising safety and quality. This trend aligns with broader efforts toward sustainable food production, making technological progress essential for future market growth.Why Are Changing Consumer Preferences Influencing the Demand for Food Processing Ingredients?

Consumer behavior plays a pivotal role in shaping the demand for food processing ingredients. There is a growing preference for healthier, organic, and sustainably sourced food products, which has shifted industry practices toward the use of more natural ingredients. In addition, consumers today are more knowledgeable about food labels and actively seek products free from artificial additives, preservatives, and genetically modified organisms (GMOs). This has led to a surge in demand for clean-label products, which emphasize natural and recognizable ingredients. Simultaneously, the global increase in lifestyle diseases, such as obesity and diabetes, has further driven the demand for functional food ingredients that offer health benefits, such as low-calorie sweeteners, fiber, and plant-based proteins. Moreover, busy lifestyles and urbanization have fueled the demand for convenient, ready-to-eat, and frozen food products, which rely heavily on food processing ingredients to maintain quality and freshness. The desire for exotic flavors and unique food experiences has also increased the use of flavor enhancers and texturizers, as consumers become more adventurous with their food choices.What Are the Key Drivers of Growth in the Food Processing Ingredients Market?

The growth in the food processing ingredients market is driven by several factors that align with evolving consumer preferences, technological advancements, and industry trends. One of the primary drivers is the increasing global demand for convenience foods, fueled by urbanization, hectic lifestyles, and the rise in dual-income households. This has led to a growing need for ingredients that maintain product stability, flavor, and freshness over longer periods. The shift toward plant-based diets and alternative proteins is another major growth driver, as consumers seek out healthier and more sustainable food options. This has spurred the development of plant-derived food processing ingredients, such as plant-based emulsifiers, stabilizers, and thickeners, which cater to the rising demand for vegan and vegetarian products. Technological innovations, particularly in enzyme technology, continue to drive the market forward by improving food quality and reducing waste. Additionally, the expansion of the clean-label movement and the push for transparency in ingredient sourcing are compelling manufacturers to adopt more natural and minimally processed ingredients. Global regulatory trends, such as stricter guidelines on artificial additives and preservatives, also play a role in shaping the market, as companies must adapt to meet these evolving standards. Lastly, the rising awareness of environmental sustainability and the impact of food production on the planet has created a demand for eco-friendly and resource-efficient ingredients, which are poised to shape the future of the food processing industry.Report Scope

The report analyzes the Food Processing Ingredients market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Source (Natural, Synthetic); Form (Dry, Liquid); End-Use (Modified Starch & Starch Derivatives, Protein, Food Stabilizers, Emulsifiers, Yeast, Enzymes, Other Types).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Natural Ingredients segment, which is expected to reach US$63.1 Billion by 2030 with a CAGR of a 7.4%. The Synthetic Ingredients segment is also set to grow at 4.3% CAGR over the analysis period.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Food Processing Ingredients Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Food Processing Ingredients Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

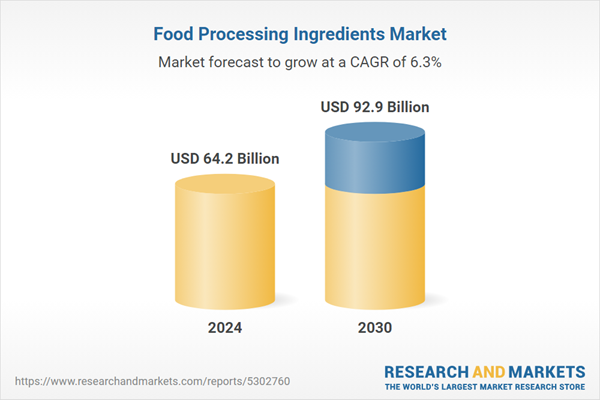

- How is the Global Food Processing Ingredients Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Archer Daniels Midland Company, Arla Foods, Ashland Global Holdings Inc., Associated British Foods PLC, Cargill and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 53 companies featured in this Food Processing Ingredients market report include:

- Archer Daniels Midland Company

- Arla Foods

- Ashland Global Holdings Inc.

- Associated British Foods PLC

- Cargill

- CHR. Hansen Holdings A/S

- Dupont

- Glanbia PLC

- Ingredion Incorporated

- KB Ingredients, LLC

- Kemin Industries, Inc.

- Kerry Group

- Koninklijke DSM N.V.

- Nexira

- Tate & Lyle PLC

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Archer Daniels Midland Company

- Arla Foods

- Ashland Global Holdings Inc.

- Associated British Foods PLC

- Cargill

- CHR. Hansen Holdings A/S

- Dupont

- Glanbia PLC

- Ingredion Incorporated

- KB Ingredients, LLC

- Kemin Industries, Inc.

- Kerry Group

- Koninklijke DSM N.V.

- Nexira

- Tate & Lyle PLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 392 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 64.2 Billion |

| Forecasted Market Value ( USD | $ 92.9 Billion |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Global |