Global Food Pathogen Testing Market - Key Trends & Drivers Summarized

Why Is Food Pathogen Testing Essential for Food Safety?

Food pathogen testing is critical for ensuring the safety of food products and protecting public health by detecting harmful microorganisms such as Salmonella, E. coli, Listeria, and Campylobacter that can cause foodborne illnesses. The testing process involves identifying the presence of pathogens in food products and processing environments to prevent contamination and outbreaks. This testing is a key part of food safety management systems, helping manufacturers comply with regulatory standards, minimize recalls, and maintain consumer trust. Given the global rise in foodborne illnesses, stringent food safety regulations have made pathogen testing an integral part of the food production process. Pathogen testing is conducted at various stages of the food production chain, including raw material inspection, production, processing, and packaging, to ensure the food supply remains safe from contamination. In high-risk categories such as meat, poultry, dairy, and ready-to-eat foods, regular testing is crucial to prevent cross-contamination and ensure product safety. The growing complexity of global food supply chains has further underscored the importance of rigorous pathogen testing, as food products may pass through multiple regions and regulatory environments before reaching consumers.What Technological Advancements Are Shaping the Food Pathogen Testing Market?

Technological advancements are transforming the food pathogen testing market by making the testing process faster, more accurate, and more reliable. One of the most significant innovations is the development of molecular diagnostic techniques, such as polymerase chain reaction (PCR) and next-generation sequencing (NGS), which offer rapid and highly sensitive detection of pathogens. PCR-based tests can identify specific DNA sequences associated with harmful microorganisms, providing quicker results compared to traditional culture methods. These rapid diagnostics allow food manufacturers to detect contamination earlier in the production process, reducing the risk of outbreaks and recalls. Automation is another key advancement, with robotic systems and AI-powered platforms streamlining the testing process and increasing throughput. Automated pathogen testing systems reduce manual errors, speed up testing times, and improve data accuracy, making it easier for food producers to maintain safety standards. Additionally, innovations in biosensor technology are allowing for real-time, on-site testing, giving manufacturers immediate feedback on pathogen levels during production. These advancements are making food pathogen testing more efficient, cost-effective, and scalable, helping companies better safeguard their food products and supply chains.Why Is the Demand for Food Pathogen Testing Increasing?

The demand for food pathogen testing is increasing due to several factors, including rising food safety concerns, more stringent regulatory requirements, and the growing complexity of the global food supply chain. As consumers become more aware of foodborne illnesses and their potential health risks, they are demanding greater transparency and safety in the food products they consume. This is especially true for fresh, raw, and minimally processed foods, which carry a higher risk of contamination. In response, food manufacturers are investing in more rigorous testing protocols to ensure product safety and maintain consumer trust. Stricter food safety regulations around the world are also driving demand for pathogen testing. Regulatory bodies like the U.S. Food and Drug Administration (FDA), the European Food Safety Authority (EFSA), and other regional agencies are enforcing stricter guidelines to control foodborne pathogens, requiring regular testing across various stages of production. In addition, the globalization of the food supply chain has increased the need for testing, as food products may travel across different regions, introducing more opportunities for contamination. To meet these challenges, food manufacturers must implement reliable and comprehensive pathogen testing programs.What Are the Key Growth Drivers for the Food Pathogen Testing Market?

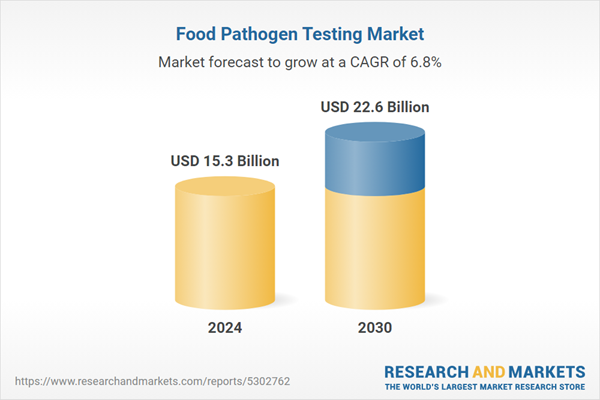

The growth of the food pathogen testing market is driven by several factors, including heightened food safety concerns, evolving regulations, and technological advancements that make testing more accessible and efficient. As foodborne illnesses remain a global concern, governments and regulatory agencies are enforcing stricter food safety standards, pushing food producers to adopt regular and comprehensive pathogen testing protocols. This is particularly important in high-risk food categories such as meat, poultry, dairy, and fresh produce, where contamination risks are higher. The increasing complexity of global food supply chains is another major growth driver, as the movement of food across multiple borders heightens the risk of contamination. This has led to a growing demand for rapid, accurate, and scalable pathogen testing solutions to monitor food safety throughout the supply chain. Additionally, technological innovations, such as PCR-based diagnostics, automated testing systems, and biosensors, are making it easier and more cost-effective for food producers to implement regular testing. With the continuous push for safer food products and more stringent regulatory requirements, the food pathogen testing market is expected to see robust growth in the coming years.Report Scope

The report analyzes the Food Pathogen Testing market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Salmonella, E.Coli, Listeria, Other Pathogens); Food Type (Meat & Poultry, Fruits & Vegetables, Processed Food, Dairy, Cereals & Grains).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Salmonella Testing segment, which is expected to reach US$8.9 Billion by 2030 with a CAGR of a 7.6%. The E.Coli Testing segment is also set to grow at 6.7% CAGR over the analysis period.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Food Pathogen Testing Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Food Pathogen Testing Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Food Pathogen Testing Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ALS Limited, Asurequality, Bureau Veritas S.A., Campden BRI, Det Norske Veritas As (Dnv) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 53 companies featured in this Food Pathogen Testing market report include:

- ALS Limited

- Asurequality

- Bureau Veritas S.A.

- Campden BRI

- Det Norske Veritas As (Dnv)

- Eurofins Scientific

- Genetic Id Na Inc.

- IFP Institut Für Produktqualität GmbH

- ILS Limited

- Intertek Group PLC

- Lloyd’s Register Quality Assurance Limited

- Microbac Laboratories, Inc.

- RapidBio Systems, Inc.

- SGS S.A.

- Silliker, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ALS Limited

- Asurequality

- Bureau Veritas S.A.

- Campden BRI

- Det Norske Veritas As (Dnv)

- Eurofins Scientific

- Genetic Id Na Inc.

- IFP Institut Für Produktqualität GmbH

- ILS Limited

- Intertek Group PLC

- Lloyd’s Register Quality Assurance Limited

- Microbac Laboratories, Inc.

- RapidBio Systems, Inc.

- SGS S.A.

- Silliker, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 299 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 15.3 Billion |

| Forecasted Market Value ( USD | $ 22.6 Billion |

| Compound Annual Growth Rate | 6.8% |

| Regions Covered | Global |