Global Fluid Loss Additives Market - Key Trends & Drivers Summarized

Why Are Fluid Loss Additives Essential in Oil and Gas Drilling?

Fluid loss additives play a crucial role in oil and gas drilling by preventing the unwanted loss of drilling fluids, also known as mud, into porous rock formations. Drilling fluids are vital for lubricating the drill bit, stabilizing the wellbore, and carrying cuttings to the surface. However, if these fluids are lost into the surrounding formations, it can lead to serious operational problems, including reduced drilling efficiency, wellbore instability, and even well collapse. Fluid loss additives are chemicals specifically designed to control the permeability of the drilling fluids, ensuring that they remain in the wellbore and perform their intended functions. The use of fluid loss additives is critical in maintaining wellbore integrity, especially in challenging drilling environments such as deep-water, high-pressure, and high-temperature wells. By preventing fluid loss, these additives help maintain well pressure, reduce non-productive time (NPT), and improve the overall safety and success of drilling operations. As the oil and gas industry increasingly moves toward more complex and deeper drilling operations, the demand for effective fluid loss additives is rising. This is particularly important in offshore drilling and unconventional resource extraction, where maintaining well control is essential for operational safety and cost efficiency.What Technological Advancements Are Enhancing the Performance of Fluid Loss Additives?

Technological advancements in the formulation of fluid loss additives are enhancing their performance in increasingly challenging drilling environments. One of the key developments is the creation of advanced synthetic and polymer-based additives that offer superior control over fluid loss, even under extreme conditions such as high pressure and high temperature (HPHT) wells. These additives provide better thermal stability and resistance to degradation, ensuring that they maintain their effectiveness throughout the drilling process. The use of nanotechnology in fluid loss additives is also emerging as a promising innovation, with nanoparticles being employed to plug micro-fractures in the wellbore and reduce permeability more effectively than traditional materials. Another significant advancement is the development of environmentally friendly fluid loss additives that meet the growing demand for sustainable drilling practices. Many of the traditional additives used in drilling fluids can have negative environmental impacts, particularly when drilling in sensitive areas such as offshore platforms. The introduction of biodegradable and non-toxic fluid loss additives is helping oil and gas companies comply with environmental regulations while still achieving optimal drilling performance. Additionally, advancements in smart fluids, which can adjust their properties in response to changes in well conditions, are further improving the ability of fluid loss additives to adapt to complex drilling environments.Why Is There Increasing Demand for High-Performance Fluid Loss Additives in Complex Drilling Operations?

The demand for high-performance fluid loss additives is increasing as oil and gas companies face more complex drilling operations, including deep-water drilling, high-temperature wells, and unconventional resource extraction. In these challenging environments, maintaining wellbore stability and controlling fluid loss is critical to the success of the operation. In deep-water drilling, for example, the pressure differentials between the wellbore and surrounding formations are much greater, making fluid loss more likely. Similarly, in high-temperature wells, many traditional fluid loss additives break down, leading to increased fluid loss and potential well control issues. Unconventional drilling operations, such as shale gas and tight oil extraction, also present unique challenges. These formations often have low permeability, making fluid loss control essential to prevent wellbore damage and ensure efficient hydraulic fracturing operations. High-performance fluid loss additives are specifically designed to withstand these extreme conditions, providing better control over fluid loss while maintaining the integrity of the wellbore. As exploration and production activities move into more complex and difficult-to-access reserves, the need for advanced fluid loss control solutions will continue to grow, driving demand for innovative additives that can meet the demands of modern drilling operations.What Are the Key Growth Drivers in the Fluid Loss Additives Market?

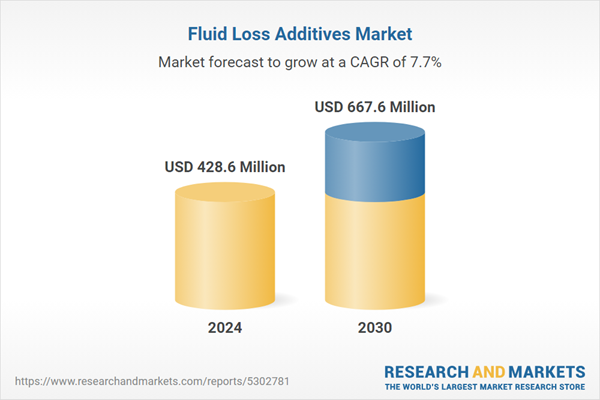

The growth in the fluid loss additives market is driven by several key factors, including the expansion of oil and gas exploration activities, particularly in deep-water and unconventional drilling, the increasing complexity of drilling operations, and the need for improved wellbore stability. As the global demand for oil and gas continues to rise, companies are venturing into more challenging drilling environments, where controlling fluid loss is essential for maintaining well integrity and optimizing production. Fluid loss additives are critical in preventing costly operational disruptions caused by fluid loss, and their importance is magnified in high-stakes drilling projects such as offshore wells. Additionally, the trend toward sustainable drilling practices is driving demand for eco-friendly fluid loss additives that minimize environmental impact. Regulatory pressures and corporate responsibility initiatives are encouraging oil and gas companies to adopt greener additives, particularly in sensitive ecosystems like offshore drilling regions. Technological advancements in additive formulations, including the development of high-performance synthetic and biodegradable additives, are also fueling market growth by providing more effective solutions for fluid loss control. As the oil and gas industry continues to evolve, the fluid loss additives market is expected to grow in response to the increasing need for efficient, reliable, and environmentally responsible drilling solutions.Report Scope

The report analyzes the Fluid Loss Additives market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Product Type (Synthetically Modified Natural Additives, Synthetic Additives, Natural Additives); Application (Drilling Fluid, Cement Slurry).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Synthetically Modified Natural Additives segment, which is expected to reach US$331.1 Million by 2030 with a CAGR of a 9%. The Synthetic Additives segment is also set to grow at 7.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $111.1 Million in 2024, and China, forecasted to grow at an impressive 11.3% CAGR to reach $161.9 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Fluid Loss Additives Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Fluid Loss Additives Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Fluid Loss Additives Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Ashland, Aubin Group, BASF SE, Chevron Phillips Chemical Company, Clariant and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Fluid Loss Additives market report include:

- Ashland

- Aubin Group

- BASF SE

- Chevron Phillips Chemical Company

- Clariant

- Dow Chemical Company

- Global Drilling Fluids and Chemicals Limited

- Halliburton

- Innospec

- Kemira OYJ

- Newpark Resources Inc.

- Nouryon

- Omnova Solutions

- Schlumberger Limited

- Solvay

- Tytan Organics Pvt., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ashland

- Aubin Group

- BASF SE

- Chevron Phillips Chemical Company

- Clariant

- Dow Chemical Company

- Global Drilling Fluids and Chemicals Limited

- Halliburton

- Innospec

- Kemira OYJ

- Newpark Resources Inc.

- Nouryon

- Omnova Solutions

- Schlumberger Limited

- Solvay

- Tytan Organics Pvt., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 277 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 428.6 Million |

| Forecasted Market Value ( USD | $ 667.6 Million |

| Compound Annual Growth Rate | 7.7% |

| Regions Covered | Global |