Global Flat Steel Market - Key Trends & Drivers Summarized

Why Is Flat Steel in High Demand Across Industrial Sectors?

Flat steel, a crucial component in manufacturing and construction industries, is experiencing robust demand due to its versatility and strength. Flat steel products, which include plates, sheets, and coils, are widely used in sectors such as automotive, construction, and machinery manufacturing. The ability to produce flat steel in a variety of thicknesses and grades makes it suitable for a broad range of applications, from building infrastructure to producing consumer goods. Its usage is especially prominent in the construction industry for creating beams, frames, and structural components that require both strength and durability. Additionally, in the automotive sector, flat steel is essential for producing vehicle bodies, engines, and structural parts due to its malleability and resistance to wear and tear. The global demand for flat steel is further supported by the ongoing industrialization and urbanization, particularly in developing regions. Emerging economies are witnessing a boom in construction activities, with the need for residential, commercial, and industrial infrastructure projects driving up the consumption of flat steel products. Moreover, government initiatives in various countries to modernize aging infrastructure and build new urban centers have spurred demand for high-quality, durable materials like flat steel. In the manufacturing sector, flat steel's importance in producing machinery, appliances, and electrical equipment makes it a backbone of industrial growth. As industries worldwide strive to improve efficiency and reduce costs, flat steel remains a key material, favored for its high strength-to-weight ratio and recyclability.What Technological Advances Are Shaping the Flat Steel Market?

Advancements in flat steel production technologies are driving market growth by improving product quality and efficiency in production processes. One significant innovation is the development of high-strength, low-alloy (HSLA) flat steel, which offers superior strength without increasing weight. This type of steel is particularly valued in the automotive and aerospace industries, where reducing vehicle weight is crucial for improving fuel efficiency and lowering emissions. Another notable technological improvement is the use of electric arc furnaces (EAF) in steel production, which allows for greater energy efficiency and reduces greenhouse gas emissions. This method uses scrap steel as a primary raw material, contributing to the circular economy and promoting sustainable practices within the steel industry. Additionally, digitalization and automation in steel mills are enhancing production capabilities, allowing manufacturers to produce flat steel with more precise specifications and greater consistency. Technologies such as advanced robotics, artificial intelligence (AI), and machine learning are being integrated into production lines to monitor quality, optimize processes, and reduce downtime. In particular, the use of real-time data analytics is helping producers manage supply chains more effectively, reducing waste and ensuring timely delivery of products to end users. These innovations are positioning flat steel as a sustainable, high-performance material, driving its adoption across various industries. As environmental regulations become more stringent, flat steel manufacturers are also investing in research to develop cleaner production methods, further boosting the market.How Are Market Trends in Key Sectors Impacting Flat Steel Demand?

The flat steel market is highly influenced by trends in key end-use sectors, particularly construction, automotive, and machinery manufacturing. In construction, the increasing demand for high-rise buildings and infrastructure projects is driving the need for strong, lightweight, and corrosion-resistant flat steel products. In regions like Asia-Pacific and the Middle East, rapid urbanization is fueling investments in large-scale infrastructure projects, such as bridges, roads, and railways, which heavily rely on flat steel. Additionally, the growing focus on green building practices is leading to the development of energy-efficient materials, including flat steel products designed with enhanced thermal properties to support sustainable construction. In the automotive sector, the shift toward electric vehicles (EVs) is reshaping demand for flat steel. Automakers are seeking materials that provide strength without adding excess weight, and advanced flat steel products, such as HSLA steel, are helping to meet this requirement. As manufacturers aim to reduce the overall weight of vehicles to improve battery efficiency and increase the range of EVs, flat steel is playing a critical role in new vehicle designs. The machinery and equipment manufacturing sectors also contribute significantly to flat steel demand, especially in the production of heavy industrial equipment, electrical appliances, and energy infrastructure components. These industries require flat steel for its durability, flexibility, and ability to withstand high-stress environments, further cementing its role in global industrial supply chains.What Are the Key Factors Driving the Growth of the Flat Steel Market?

The growth in the flat steel market is driven by several factors, including increased construction activities, expanding automotive production, and technological advancements in steel manufacturing. In construction, rising investments in infrastructure development, especially in emerging economies, are propelling the demand for flat steel products used in building frames, roofing, and other structural applications. Additionally, the automotive industry's transition to electric vehicles (EVs) and lightweight materials is creating new opportunities for advanced flat steel solutions. Automakers are increasingly adopting flat steel for its strength, recyclability, and ability to reduce vehicle weight, contributing to the overall market growth. Moreover, the push for sustainable manufacturing practices is driving demand for flat steel produced through energy-efficient processes, such as those using electric arc furnaces (EAF). The growing awareness of environmental issues and the implementation of stricter emissions regulations are encouraging steel producers to adopt cleaner technologies, which, in turn, are enhancing the appeal of flat steel in eco-conscious markets. Technological innovations, such as the development of HSLA steel and the use of AI in production processes, are further enhancing product quality and expanding the range of applications for flat steel across different sectors. This combination of factors positions the flat steel market for continued growth in the coming years.Report Scope

The report analyzes the Flat Steel market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Material (Carbon Steel, Alloy Steel, Stainless Steel, Tool Steel); Process (Basic Oxygen Furnace, Electric Arc Furnace); Type (Sheets & Strips, Plates); Application (Building & Infrastructure, Automotive & Other Transport, Mechanical Equipment, Other Applications).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Carbon Steel segment, which is expected to reach US$345.4 Billion by 2030 with a CAGR of a 5.8%. The Alloy Steel segment is also set to grow at 4.9% CAGR over the analysis period.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Flat Steel Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Flat Steel Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Flat Steel Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

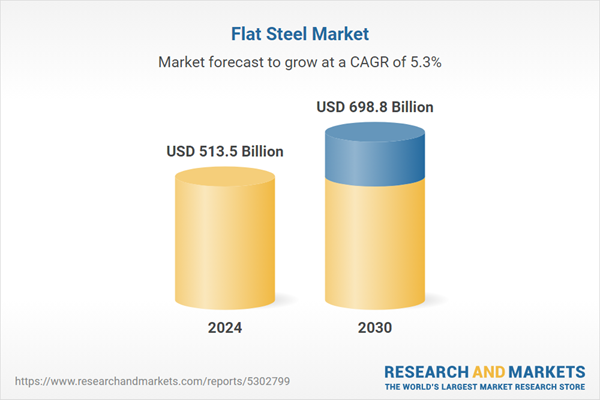

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Allegheny Technologies, ArcelorMittal, China Baowu Steel Group Corporation Limited, Essar Steel, HBIS Group and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Flat Steel market report include:

- Allegheny Technologies

- ArcelorMittal

- China Baowu Steel Group Corporation Limited

- Essar Steel

- HBIS Group

- Hyundai Steel Co., Ltd.

- JFE Steel Corporation

- Nippon Steel & Sumitomo Metal Corporation

- POSCO

- Shougang Group Co., Ltd.

- SSAB AB

- Tata Steel

- ThyssenKrupp AG

- United States Steel Corporation

- Voestalpine Group

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Allegheny Technologies

- ArcelorMittal

- China Baowu Steel Group Corporation Limited

- Essar Steel

- HBIS Group

- Hyundai Steel Co., Ltd.

- JFE Steel Corporation

- Nippon Steel & Sumitomo Metal Corporation

- POSCO

- Shougang Group Co., Ltd.

- SSAB AB

- Tata Steel

- ThyssenKrupp AG

- United States Steel Corporation

- Voestalpine Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 471 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 513.5 Billion |

| Forecasted Market Value ( USD | $ 698.8 Billion |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Global |