Global Life Science Tools Market - Key Trends & Drivers Summarized

Life science tools encompass a broad spectrum of technologies and instruments used in the study of biological systems. These tools include advanced laboratory instruments, reagents, consumables, and software used in research and clinical settings. Key components of life science tools are genomics and proteomics technologies, which involve DNA sequencing and protein analysis respectively. These tools have revolutionized fields such as biotechnology, pharmaceuticals, and diagnostics by enabling more precise and efficient research methodologies. High-throughput screening, mass spectrometry, and advanced imaging techniques are integral to life science research, providing detailed insights into cellular and molecular processes. The integration of these tools with bioinformatics allows researchers to analyze large datasets, leading to significant advancements in understanding diseases and developing targeted therapies. The global market is expected to gain further from increasing attention on monoclonal antibodies for cancer therapy. In the recent years, a large number of monoclonal antibodies have secured the regulatory approval for treatment of different forms of cancer. These approvals for diagnosis and cancer therapy are slated to expand the application scope of biologics.One of the major innovations in life science tools is the advent of next-generation sequencing (NGS) technologies. NGS has dramatically reduced the cost and time required for sequencing genomes, facilitating large-scale genomic projects and personalized medicine approaches. Another critical advancement is CRISPR-Cas9, a gene-editing technology that has opened new avenues for genetic research and therapy. Additionally, single-cell analysis tools are enabling scientists to study the heterogeneity of cell populations in unprecedented detail, which is crucial for understanding complex diseases such as cancer. The development of lab-on-a-chip technologies has miniaturized and automated many laboratory processes, increasing efficiency and reducing the need for large sample volumes. These innovations are supported by robust software tools that manage and interpret the vast amounts of data generated, making it possible to derive actionable insights from complex biological information.

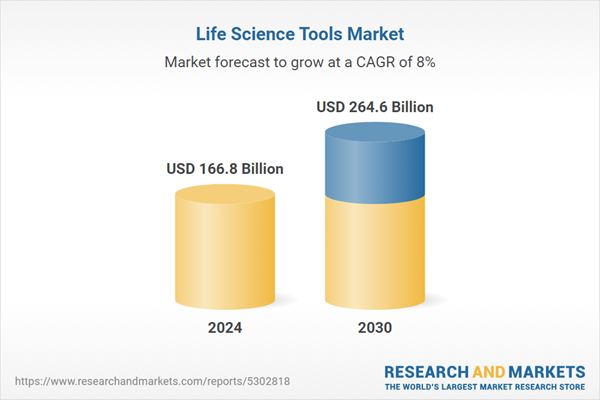

The growth in the life science tools market is driven by several factors, including the increasing demand for personalized medicine, rising investments in research and development, and advancements in technology. Personalized medicine, which tailors treatments to individual genetic profiles, relies heavily on genomic and proteomic tools, driving demand in these areas. Significant funding from government bodies, private organizations, and venture capitalists is fueling research initiatives and the development of new tools. Technological advancements, such as the development of AI and machine learning algorithms, are enhancing data analysis capabilities and speeding up the discovery process. The growing prevalence of chronic diseases and the need for innovative diagnostic and therapeutic solutions are also key drivers. Furthermore, the expansion of biotechnology and pharmaceutical industries, coupled with the increasing adoption of life science tools in emerging markets, is contributing to market growth. As these tools become more accessible and integrated into various research and clinical applications, their impact on health and disease management continues to grow, propelling further advancements in the field.

Report Scope

The report analyzes the Life Science Tools market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Technology (Cell Biology, Genomics, Proteomics, Other Technologies); End-Use (Healthcare, Biopharmaceutical Companies, Government & Academics, Other End-Uses).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Cell Biology Technology segment, which is expected to reach US$84.6 Billion by 2030 with a CAGR of 7.1%. The Genomics Technology segment is also set to grow at 8.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $58.6 Billion in 2024, and China, forecasted to grow at an impressive 12% CAGR to reach $31.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Life Science Tools Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Life Science Tools Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Life Science Tools Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Abbott Laboratories Inc., Agilent Technologies, Inc., Becton, Dickinson and Company, Bio-Rad Laboratories, Inc., Bruker Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 295 companies featured in this Life Science Tools market report include:

- Abbott Laboratories Inc.

- Agilent Technologies, Inc.

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- Bruker Corporation

- Carl Zeiss AG

- Eppendorf SE

- F. Hoffmann-La Roche AG

- Hitachi High-Tech Corporation

- Illumina, Inc.

- Merck KGaA

- Oxford Instruments plc

- PerkinElmer Inc.

- QIAGEN N.V.

- Shimadzu Corporation

- Thermo Fisher Scientific Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abbott Laboratories Inc.

- Agilent Technologies, Inc.

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- Bruker Corporation

- Carl Zeiss AG

- Eppendorf SE

- F. Hoffmann-La Roche AG

- Hitachi High-Tech Corporation

- Illumina, Inc.

- Merck KGaA

- Oxford Instruments plc

- PerkinElmer Inc.

- QIAGEN N.V.

- Shimadzu Corporation

- Thermo Fisher Scientific Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 487 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 166.8 Billion |

| Forecasted Market Value ( USD | $ 264.6 Billion |

| Compound Annual Growth Rate | 8.0% |

| Regions Covered | Global |