Global Cranes Rental Market - Key Trends & Drivers Summarized

What Is Cranes Rental, and Why Is It a Preferred Choice for Infrastructure Projects?

Cranes rental refers to the leasing of cranes and lifting equipment to industries such as construction, manufacturing, logistics, oil and gas, and infrastructure development. These cranes are essential for lifting heavy materials, machinery, and components in large-scale construction projects and industrial settings. Renting cranes instead of purchasing them outright has become a preferred choice for many companies because it offers flexibility, reduces overhead costs, and eliminates the need for long-term maintenance commitments. The cranes rental market includes different types of cranes such as mobile cranes, tower cranes, crawler cranes, and rough-terrain cranes, each serving specific applications based on project requirements.The growth of infrastructure projects around the world, coupled with increasing construction activities, has significantly boosted the demand for crane rental services. The rental model is particularly advantageous for companies that require cranes for short-term or specialized projects, such as building high-rise structures or installing wind turbines. By opting for crane rentals, companies can choose from a wide range of crane types and sizes, thus aligning their equipment needs with specific project timelines and scopes without committing large amounts of capital to purchase heavy machinery. This model also allows access to the latest and most advanced crane technology without the financial burden of ownership.

How Are Technological Advancements and Trends Shaping the Cranes Rental Market?

Technological advancements and emerging industry trends are playing a major role in shaping the cranes rental market, making crane operations safer, more efficient, and more sustainable. One of the key advancements is the increasing adoption of telematics and Internet of Things (IoT) technology in cranes, which allows rental companies and contractors to monitor crane operations remotely. Telematics provides real-time data on crane performance, fuel consumption, and operational parameters, helping operators optimize crane usage and reduce downtime. This technology also aids in predictive maintenance, minimizing the risk of unexpected breakdowns and ensuring higher equipment availability.Another significant trend in the cranes rental market is the growing focus on eco-friendly and fuel-efficient cranes. With increased regulations on emissions and environmental impact, rental companies are investing in cranes that consume less fuel and produce fewer emissions. Hybrid and electric cranes are being introduced to cater to projects with stringent sustainability requirements. Furthermore, the digital transformation of the construction industry, including the use of Building Information Modeling (BIM) and advanced project planning tools, is driving the demand for crane rental services that can integrate seamlessly with these technologies. Digital twins and AI-powered project simulations are also helping to optimize crane positioning and lift planning, improving the efficiency of crane usage in complex construction projects.

Where Are Cranes Rental Predominantly Used, and How Is Demand Evolving?

Cranes rental services are predominantly used in construction, infrastructure development, oil and gas, mining, and heavy manufacturing sectors. The construction and infrastructure sectors are the largest consumers of crane rental services, as cranes are essential for lifting heavy building materials, constructing bridges, and assembling structural elements. The cranes rental market is particularly strong in regions experiencing rapid urbanization and infrastructure development, such as the Asia-Pacific, Middle East, and Africa. Countries like China, India, and those in the Gulf Cooperation Council (GCC) are witnessing significant investments in infrastructure projects, which has driven the demand for crane rentals.The demand for crane rental services is evolving as construction projects become larger and more complex. The rise of modular construction methods, where large prefabricated modules are assembled on-site, has led to an increase in demand for high-capacity cranes capable of handling heavy lifts. The global push for renewable energy, particularly in the wind energy sector, is also contributing to increased demand for cranes capable of installing wind turbine components at significant heights. The trend towards hiring specialized cranes for specific projects rather than general-purpose cranes has driven rental companies to expand their fleets and offer a more diverse range of equipment. This evolution has been further supported by the trend towards short-term, flexible rentals that allow companies to adapt their equipment needs as project requirements change.

What Factors Drive the Growth of the Cranes Rental Market?

The growth in the cranes rental market is driven by several factors, including the increasing pace of infrastructure development, growing emphasis on cost efficiency, and the rise of specialized construction projects. The boom in global infrastructure investments, particularly in emerging economies, has created substantial demand for cranes across projects such as roads, bridges, high-rise buildings, and industrial facilities. The cranes rental model provides construction companies with the ability to access a wide variety of cranes without incurring the significant capital expenditure associated with purchasing them outright, thus reducing financial risks and improving operational flexibility.The focus on cost efficiency and project management has also contributed to the growth of crane rentals. Renting cranes eliminates the costs related to storage, maintenance, insurance, and depreciation, allowing construction companies to allocate resources more effectively. The increasing use of advanced technology in crane operations, such as telematics and remote monitoring, has added significant value to rental services, providing customers with data-driven insights to optimize crane performance and enhance project safety. Furthermore, the adoption of stringent safety and environmental regulations has driven demand for modern, well-maintained crane fleets that meet regulatory standards, further encouraging companies to rent rather than purchase cranes.

Another key driver is the rising number of public-private partnerships (PPP) in infrastructure development, particularly in developing regions. These large-scale projects often require specialized lifting capabilities, making crane rentals an attractive option for meeting short-term but complex equipment needs. The increasing preference for modular and prefabricated construction, which requires cranes for the assembly of large components, has also boosted the market. The flexibility to choose cranes tailored to specific tasks, combined with the availability of advanced cranes equipped with the latest safety and efficiency technologies, underscores the growth trajectory of the cranes rental market as industries continue to prioritize operational agility and cost optimization.

Report Scope

The report analyzes the Cranes Rental market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Mobile Cranes, Fixed Cranes); Weight Lifting Capacity (Low, Low-Medium, Heavy, Extreme Heavy); End-Use (Building & Construction, Marine & Offshore, Mining & Excavation, Oil & Gas, Transportation, Other End-Uses).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Mobile Cranes segment, which is expected to reach US$53.1 Billion by 2030 with a CAGR of a 6.1%. The Fixed Cranes segment is also set to grow at 5.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $14.5 Billion in 2024, and China, forecasted to grow at an impressive 8.9% CAGR to reach $17.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Cranes Rental Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Cranes Rental Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Cranes Rental Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Action Construction Equipment Ltd., Ahern Rentals, Inc., Al Jaber Heavy Lift, ALE, All Erection & Crane Rental Corp. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 12 companies featured in this Cranes Rental market report include:

- Action Construction Equipment Ltd.

- Ahern Rentals, Inc.

- Al Jaber Heavy Lift

- ALE

- All Erection & Crane Rental Corp.

- Ameco

- Buckner Heavylift Cranes, LLC

- Deep South Crane and Rigging

- Hitachi Construction Machinery Co., Ltd.

- HSS Hire Service Group Plc

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Action Construction Equipment Ltd.

- Ahern Rentals, Inc.

- Al Jaber Heavy Lift

- ALE

- All Erection & Crane Rental Corp.

- Ameco

- Buckner Heavylift Cranes, LLC

- Deep South Crane and Rigging

- Hitachi Construction Machinery Co., Ltd.

- HSS Hire Service Group Plc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 354 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

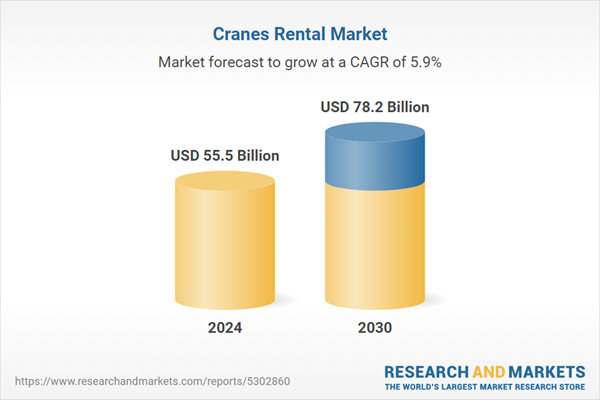

| Estimated Market Value ( USD | $ 55.5 Billion |

| Forecasted Market Value ( USD | $ 78.2 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |