Global Control Valves Market - Key Trends & Drivers Summarized

What Are Control Valves, and Why Are They Vital in Industrial Operations?

Control valves are mechanical devices that regulate the flow, pressure, or temperature of fluids - liquids, gases, or steam - within a system by adjusting the size of the flow passage. These valves play a critical role in various industrial applications, including oil and gas, water treatment, pharmaceuticals, and manufacturing, where precise control of fluid dynamics is essential. By modulating flow rates in real time, control valves help maintain process stability, efficiency, and safety, enabling operators to meet specific production goals while adhering to quality standards. Control valves are commonly used alongside sensors, transmitters, and controllers in automated systems to ensure seamless process control, reducing manual intervention and improving operational consistency.Control valves are indispensable in industries where fluid control impacts both product quality and operational safety. For instance, in the oil and gas sector, control valves regulate the pressure and flow of hydrocarbons within pipelines, preventing surges and leakages that could lead to safety hazards or environmental issues. In water treatment facilities, these valves manage water flow through various treatment stages, ensuring that treated water meets required safety standards before distribution. By enabling precise fluid control, control valves enhance operational efficiency, lower energy consumption, and support sustainable practices, making them essential to modern industry processes across sectors.

How Are Technological Advancements Shaping the Control Valves Market?

Technological advancements are driving the control valve market forward, particularly with the integration of smart technologies like the Industrial Internet of Things (IIoT), artificial intelligence (AI), and machine learning (ML). The development of 'smart' control valves, which are equipped with sensors and connectivity features, enables remote monitoring and real-time data analysis, improving the accuracy of fluid control. With smart control valves, operators can monitor valve performance and detect potential issues - such as leaks, wear, or blockages - before they lead to downtime. Additionally, predictive maintenance solutions powered by AI and ML algorithms analyze valve data to predict failures or maintenance needs, reducing operational disruptions and extending equipment lifespan.The integration of IIoT and automation has led to the rise of advanced control systems where control valves are interconnected within a plant's overall automation network. This connectivity enables centralized control, where operators can monitor and adjust multiple valves from a single interface, improving operational flexibility and response times. Advances in materials, such as high-performance alloys and corrosion-resistant coatings, are also enhancing control valve durability, allowing them to perform reliably in harsh environments, such as chemical processing or offshore drilling. The increasing adoption of these technological advancements highlights the market's shift toward smart, automated control systems that improve process efficiency and operational resilience, especially in demanding industrial applications.

Where Are Control Valves Primarily Used, and How Is Demand Evolving?

Control valves are used extensively in industries where the precise control of fluid flow is critical to operations, such as oil and gas, water and wastewater treatment, power generation, food and beverage, and pharmaceuticals. In the oil and gas industry, control valves manage flow rates and pressure in pipelines, refining processes, and offshore platforms, where stability and safety are crucial. In water treatment plants, control valves adjust water flow through filtration, chlorination, and desalination stages, ensuring safe and efficient treatment processes. The power generation industry relies on control valves to manage steam flow in turbines, maintaining temperature and pressure to optimize energy output and efficiency.Demand for control valves is growing due to increased automation in these sectors and the push for process optimization. In industries like pharmaceuticals and food and beverage, where stringent regulations require consistent quality control, the ability of control valves to precisely regulate flow and maintain production parameters is invaluable. As countries worldwide invest in infrastructure development, particularly in water and wastewater management, demand for control valves is expected to rise significantly. Additionally, the expansion of renewable energy projects, such as solar and geothermal, where fluid control plays an essential role, is further driving demand. The growing focus on environmental sustainability and energy efficiency is pushing industries to adopt advanced control valves, reflecting an ongoing shift towards automation and improved process efficiency.

What Factors Drive the Control Valves Market's Growth?

The growth of the control valves market is driven by several key factors, including increased industrial automation, rising investments in infrastructure, and the demand for energy efficiency and environmental sustainability. As industries embrace automation to enhance productivity and reduce operational costs, control valves have become critical for maintaining precise fluid control within automated systems. This trend is particularly strong in the oil and gas, water treatment, and power generation sectors, where control valves ensure safety, stability, and efficiency. Additionally, global investment in infrastructure development - such as water management facilities, energy plants, and industrial factories - is boosting demand for control valves, especially in emerging markets across Asia-Pacific, the Middle East, and Latin America.Environmental regulations and the drive for energy efficiency are also key drivers, as companies seek ways to minimize waste and reduce their environmental impact. Advanced control valves that offer improved efficiency, reduce emissions, and support cleaner operations are increasingly sought after in industries under pressure to comply with environmental standards. Technological advancements, including the integration of smart features, predictive maintenance, and IIoT connectivity, further fuel market growth by enhancing valve performance and reliability. Lastly, the shift towards renewable energy sources, which often require precise fluid control, is opening new applications for control valves, particularly in solar, wind, and geothermal energy projects. Together, these drivers underscore the vital role of control valves in modern industry, highlighting their importance in supporting efficient, sustainable, and safe operations across a range of applications.

Report Scope

The report analyzes the Control Valves market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Component (Actuators, Valve Body, Other Components); Type (Rotary Valves, Linear Valves); End-Use (Oil & Gas, Water & Wastewater Treatment, Energy & Power, Pharmaceuticals, Food & Beverage, Chemicals, Other End-Uses).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Actuators Component segment, which is expected to reach US$11.9 Billion by 2030 with a CAGR of a 15.1%. The Valve Body Component segment is also set to grow at 13.9% CAGR over the analysis period.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Control Valves Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Control Valves Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Control Valves Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Alfa Laval, Apollo Valves, Avcon Controls, Avk Holding A/S, Cameron - (Schlumberger Company) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Control Valves market report include:

- Alfa Laval

- Apollo Valves

- Avcon Controls

- Avk Holding A/S

- Cameron - (Schlumberger Company)

- Christian Bürkert

- Crane Co.

- Curtiss-Wright Corporation

- Dwyer Instruments

- Emerson

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Alfa Laval

- Apollo Valves

- Avcon Controls

- Avk Holding A/S

- Cameron – (Schlumberger Company)

- Christian Bürkert

- Crane Co.

- Curtiss-Wright Corporation

- Dwyer Instruments

- Emerson

Table Information

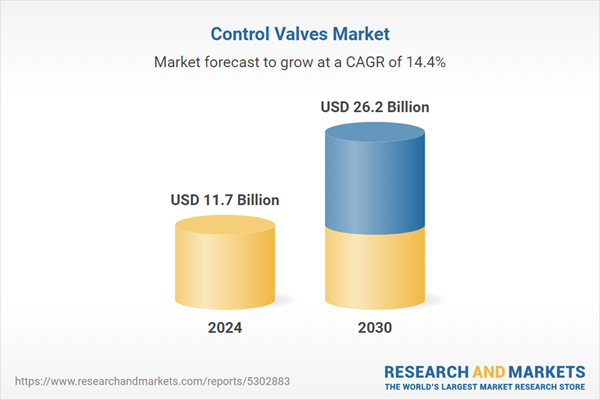

| Report Attribute | Details |

|---|---|

| No. of Pages | 384 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 11.7 Billion |

| Forecasted Market Value ( USD | $ 26.2 Billion |

| Compound Annual Growth Rate | 14.4% |

| Regions Covered | Global |