Global Connected Ships Market - Key Trends & Drivers Summarized

What Are Connected Ships, and How Are They Shaping the Future of Maritime Operations?

Connected ships are vessels equipped with advanced connectivity technologies, such as satellite communication, IoT sensors, and integrated software, enabling real-time data exchange between the ship, crew, and onshore management. These ships are designed to optimize maritime operations by providing insights into navigation, fuel consumption, engine performance, and cargo management. Connected ships enable remote monitoring, predictive maintenance, and automation, enhancing operational efficiency and safety while reducing environmental impact. For commercial shipping companies, connected ships are invaluable for route optimization, fuel management, and regulatory compliance, positioning them as the future of smart maritime operations.The importance of connected ships lies in their potential to transform the shipping industry by improving efficiency, safety, and sustainability. By collecting and analyzing real-time data, connected ships can optimize fuel usage, reduce operational costs, and minimize emissions, supporting the global shift toward greener shipping practices. Additionally, connected ships enhance safety by allowing real-time monitoring of equipment health, cargo conditions, and weather patterns, ensuring that vessels can navigate safely through adverse conditions. As the maritime industry adapts to digital transformation, connected ships are becoming essential for shipping companies focused on operational excellence and environmental responsibility.

How Are Technological Advancements Transforming Connected Ships?

Technological advancements are rapidly enhancing the capabilities of connected ships, making them more reliable, efficient, and environmentally friendly. The integration of satellite-based communication systems has improved connectivity for ships operating in remote areas, enabling constant communication between vessels and onshore teams. IoT and big data analytics provide ships with real-time information on engine performance, fuel consumption, and environmental conditions, which can be used to optimize operations and prevent potential issues through predictive maintenance. Additionally, advanced navigation systems equipped with AI algorithms help optimize routes, reducing fuel consumption and emissions.Autonomous capabilities are also emerging in connected ships, with technologies that support semi-autonomous navigation and remote-controlled operations, reducing the need for human intervention. Edge computing allows data to be processed on the ship itself, ensuring real-time responsiveness even in areas with limited connectivity. Cybersecurity advancements are another critical area, as the digitalization of ships brings increased risks of cyber threats; thus, connected ships now integrate robust cybersecurity protocols to protect sensitive data and prevent unauthorized access. These advancements make connected ships more efficient, safe, and aligned with the maritime industry's sustainability goals, positioning them as central to the future of global shipping.

What Are the Key Applications of Connected Ships Across Maritime Operations?

Connected ships have multiple applications in maritime operations, supporting navigation, safety, cargo management, and maintenance. In navigation, real-time connectivity enables route optimization based on weather conditions, fuel efficiency, and traffic patterns, helping ships to minimize fuel costs and reach destinations faster. For safety, connected ships provide real-time monitoring of vessel integrity, engine health, and environmental factors, allowing for immediate response to potential issues and enhanced situational awareness. Predictive maintenance applications help reduce downtime by identifying maintenance needs before equipment failure, improving fleet availability and reliability.In cargo management, connected ships allow for real-time monitoring of cargo conditions, including temperature, humidity, and shock levels, which is critical for perishable and high-value goods. Port integration is another growing application, where connected ships coordinate with port infrastructure to streamline docking, loading, and unloading, reducing turnaround times and improving overall efficiency. For environmental compliance, connected ships use data to monitor emissions, ensuring adherence to international regulations and supporting corporate sustainability initiatives. These applications underscore the versatility and transformative impact of connected ships on maritime operations, enabling more efficient, safe, and sustainable shipping practices.

What Factors Are Driving Growth in the Connected Ships Market?

The growth in the connected ships market is driven by several factors, including the push for greater operational efficiency, the need for regulatory compliance, and advancements in maritime technology. Rising fuel costs and environmental regulations have increased the demand for connected ships, as real-time data and predictive analytics help optimize fuel consumption and reduce emissions. Technological advancements, such as IoT, AI, and satellite communication, have made it possible to monitor and optimize ship performance, reducing downtime and supporting safer, more efficient maritime operations. The shift towards autonomous and semi-autonomous vessels is also fueling demand, as connected ship technology enables remote operation and automation.Additionally, the increasing focus on cybersecurity in maritime operations has driven investments in connected ship solutions that include robust security protocols. Shipping companies are also adopting connected ship technology to improve logistics and coordinate better with ports, enabling faster and more reliable shipping routes. Finally, the growing emphasis on sustainability and the need for reduced emissions in the maritime industry have made connected ships attractive for their ability to support greener shipping practices. Together, these factors contribute to the robust growth of the connected ships market, positioning it as a key element in the digital transformation of global shipping.

Report Scope

The report analyzes the Connected Ships market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Ship Type (Commercial, Defense); Installation Type (Onboard, Onshore); Application (Vessel Traffic Management, Fleet Health Operations, Fleet Operations).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Commercial Ship segment, which is expected to reach US$7.1 Billion by 2030 with a CAGR of a 3.8%. The Defense Ship segment is also set to grow at 4.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.3 Billion in 2024, and China, forecasted to grow at an impressive 3.6% CAGR to reach $1.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Connected Ships Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Connected Ships Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Connected Ships Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABB, Emerson, General Electric (GE), Hyundai Heavy Industries (HHI), Inmarsat and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Connected Ships market report include:

- ABB

- Emerson

- General Electric (GE)

- Hyundai Heavy Industries (HHI)

- Inmarsat

- Intelsat

- Iridium

- Jason

- Kongsberg Gruppen

- Marlink

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABB

- Emerson

- General Electric (GE)

- Hyundai Heavy Industries (HHI)

- Inmarsat

- Intelsat

- Iridium

- Jason

- Kongsberg Gruppen

- Marlink

Table Information

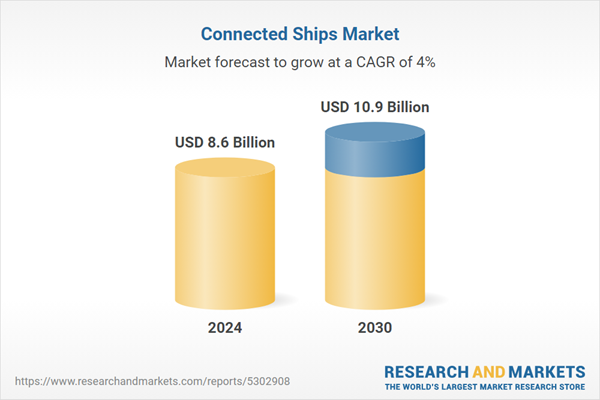

| Report Attribute | Details |

|---|---|

| No. of Pages | 164 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 8.6 Billion |

| Forecasted Market Value ( USD | $ 10.9 Billion |

| Compound Annual Growth Rate | 4.0% |

| Regions Covered | Global |