Global Computer Vision in Healthcare Market - Key Trends & Drivers Summarized

What Is Computer Vision in Healthcare, and Why Is It Transforming Medical Practice?

Computer vision in healthcare refers to the application of artificial intelligence (AI) and machine learning techniques to analyze medical images and other visual data, supporting diagnostics, treatment planning, and monitoring. By leveraging advanced algorithms, computer vision systems can detect patterns and anomalies in medical imaging data, such as X-rays, MRIs, CT scans, and pathology slides, with high precision and speed. These systems assist healthcare professionals by providing accurate diagnostic insights, streamlining workflows, and improving patient outcomes. Computer vision is particularly valuable in fields like radiology, oncology, ophthalmology, and surgery, where precision in image analysis is essential for accurate diagnoses and effective treatment planning. The transformative potential of computer vision in healthcare lies in its ability to process vast amounts of visual data quickly and consistently, reducing human error and enhancing clinical efficiency. For example, in radiology, AI-powered computer vision algorithms can detect early signs of diseases like cancer, heart disease, and neurological disorders, enabling faster and potentially life-saving interventions. Computer vision systems are also instrumental in surgical planning and intraoperative guidance, providing real-time visual data to surgeons. As the healthcare industry shifts towards precision medicine and data-driven care, computer vision technology is becoming an essential tool in advancing diagnostic accuracy, treatment personalization, and patient monitoring.How Are Technological Advancements Shaping Computer Vision in Healthcare?

Technological advancements are rapidly advancing computer vision applications in healthcare, improving their accuracy, speed, and accessibility. Deep learning, a subset of AI, has enabled the development of sophisticated neural networks that can analyze complex medical images with accuracy comparable to or even exceeding that of human experts. For instance, convolutional neural networks (CNNs) are widely used in image recognition tasks, making them ideal for applications like tumor detection, organ segmentation, and disease progression monitoring. Additionally, Generative Adversarial Networks (GANs) are being used to enhance image quality, which is particularly useful in low-resource settings where imaging equipment may not produce optimal clarity.Integrating computer vision with other medical technologies, such as electronic health records (EHRs) and wearable devices, is further enhancing its utility. Wearables with embedded cameras and sensors, for example, can use computer vision to monitor wound healing, skin lesions, or patient mobility, generating data that supports remote patient monitoring. The rise of cloud computing has also made computer vision more scalable, allowing healthcare providers to store and analyze large volumes of imaging data securely. These advancements enable computer vision applications to become more accurate, accessible, and versatile, supporting a broad range of healthcare services and improving patient outcomes.

What Are the Key Applications of Computer Vision in Healthcare?

Computer vision has a wide range of applications in healthcare, each contributing to enhanced diagnostic accuracy, treatment planning, and patient monitoring. In radiology, computer vision is used to analyze medical images, such as X-rays, MRIs, and CT scans, to detect abnormalities like tumors, fractures, and organ anomalies. These systems help radiologists identify subtle changes in imaging that may indicate early stages of diseases, supporting faster and more accurate diagnoses. In oncology, computer vision algorithms can segment tumor boundaries and measure growth rates over time, aiding in treatment planning and monitoring of cancer progression.In the field of ophthalmology, computer vision is used to detect retinal diseases, such as diabetic retinopathy and glaucoma, through fundus imaging. This early detection is critical in preventing vision loss and managing chronic conditions effectively. In surgery, computer vision plays a crucial role in robotic-assisted procedures, providing surgeons with real-time imaging data to guide incisions and navigate complex anatomical structures. Computer vision is also used in pathology, where AI-powered systems analyze biopsy slides for cellular abnormalities, reducing the workload on pathologists and increasing diagnostic accuracy. These applications highlight the versatility and impact of computer vision in improving diagnostic precision and patient care across various medical specialties.

What Factors Are Driving Growth in the Computer Vision in Healthcare Market?

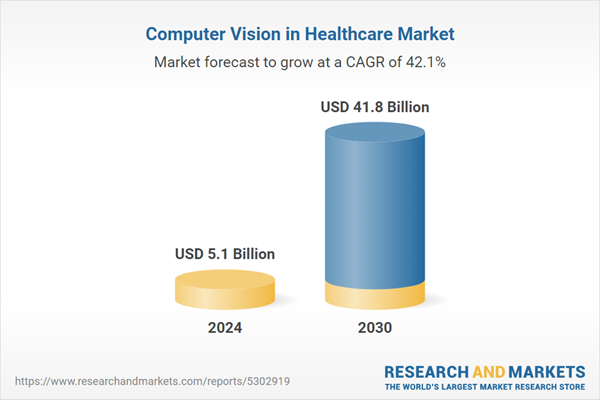

The growth in the computer vision in healthcare market is driven by several factors, including advancements in AI technology, rising demand for precision medicine, and an increased focus on improving diagnostic accuracy and efficiency. The rapid development of deep learning algorithms and high-performance computing has enabled more accurate and scalable computer vision solutions, making it possible to analyze large volumes of medical imaging data quickly. This is particularly valuable in specialties like radiology and oncology, where the demand for diagnostic imaging has surged, creating a need for efficient and accurate image analysis solutions. The shift towards precision medicine, which aims to tailor treatments to individual patients based on specific characteristics, has also propelled the adoption of computer vision in healthcare. By providing detailed insights into disease characteristics and progression, computer vision supports personalized treatment planning and outcome monitoring. Additionally, the integration of computer vision with telemedicine and remote monitoring has expanded its utility, enabling healthcare providers to monitor patients at home, improve access to care, and reduce healthcare costs. Regulatory support and funding for AI-driven healthcare innovations are further driving the market, as governments and institutions recognize the potential of computer vision to improve healthcare outcomes. Together, these factors underscore the significant growth potential of computer vision in healthcare, supporting its role as a transformative tool in modern medical practice.Report Scope

The report analyzes the Computer Vision in Healthcare market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Component (Software, Hardware, Services); Application (Medical Imaging & Diagnostics, Surgeries, Other Applications); End-Use (Healthcare Providers, Diagnostic Centers, Other End-Uses).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Software Component segment, which is expected to reach US$18.8 Billion by 2030 with a CAGR of a 40.6%. The Hardware Component segment is also set to grow at 42.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.6 Billion in 2024, and China, forecasted to grow at an impressive 38.6% CAGR to reach $5.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Computer Vision in Healthcare Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Computer Vision in Healthcare Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Computer Vision in Healthcare Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AiCure, Arterys, Inc., Basler AG, Google (A Subsidiary of Alphabet, Inc.), IBM and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Computer Vision in Healthcare market report include:

- AiCure

- Arterys, Inc.

- Basler AG

- Google (A Subsidiary of Alphabet, Inc.)

- IBM

- iCAD, Inc.

- Intel

- Microsoft

- NVIDIA

- Xilinx

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AiCure

- Arterys, Inc.

- Basler AG

- Google (A Subsidiary of Alphabet, Inc.)

- IBM

- iCAD, Inc.

- Intel

- Microsoft

- NVIDIA

- Xilinx

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 217 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 5.1 Billion |

| Forecasted Market Value ( USD | $ 41.8 Billion |

| Compound Annual Growth Rate | 42.1% |

| Regions Covered | Global |