Global Compressed Air Treatment Equipment Market - Key Trends & Drivers Summarized

What Is Compressed Air Treatment Equipment, and Why Is It Crucial in Industrial Processes?

Compressed air treatment equipment is used to purify compressed air by removing contaminants such as moisture, oil, and dust particles, ensuring that the air meets specific quality standards required in industrial processes. Contaminant-free air is essential for maintaining the efficiency, safety, and longevity of compressed air systems, as impurities can cause damage to equipment, reduce process quality, and increase maintenance costs. Compressed air treatment equipment includes air dryers, filters, separators, and regulators, which are widely used across sectors like manufacturing, food and beverage, healthcare, and electronics. These systems are crucial for applications where clean, dry air is necessary, such as in pneumatic tools, conveyor systems, and precision manufacturing. The significance of compressed air treatment equipment lies in its ability to optimize the performance and safety of industrial processes. By removing contaminants, these systems prevent corrosion and wear on tools and machinery, reducing downtime and improving productivity. Additionally, industries such as pharmaceuticals, food processing, and electronics manufacturing have stringent quality standards for compressed air, as even small amounts of impurities can affect product quality and safety. Compressed air treatment equipment ensures compliance with these standards, supporting reliable, high-quality operations across a range of applications where clean air is essential.How Are Technological Advancements Impacting the Compressed Air Treatment Equipment Market?

Technological advancements are driving improvements in compressed air treatment equipment, enhancing its efficiency, performance, and environmental impact. One of the major innovations is the development of energy-efficient air dryers and filters that minimize energy consumption and reduce operating costs. Modern regenerative desiccant dryers, for example, use advanced control systems to optimize regeneration cycles, saving energy by only drying as needed. Additionally, advanced filtration systems with nano-fiber media offer higher filtration efficiency, removing finer particles while maintaining minimal pressure drop, which reduces energy use in compressed air systems.The rise of IoT-enabled compressed air treatment systems has also revolutionized maintenance and monitoring, allowing for remote tracking of system performance and predictive maintenance. IoT integration enables real-time monitoring of parameters such as pressure, temperature, and humidity, allowing operators to identify issues before they result in system downtime. This predictive capability improves reliability and minimizes unscheduled maintenance costs. Innovations in self-cleaning filters and smart moisture control technologies further contribute to system efficiency, making compressed air treatment equipment a vital component in modern, automated industrial environments. Together, these advancements enable industries to maintain high air quality standards while reducing energy costs and enhancing system performance.

What Are the Key Applications of Compressed Air Treatment Equipment Across Industries?

Compressed air treatment equipment is used across a diverse range of industries, each requiring clean, dry air to maintain process quality and equipment integrity. In the manufacturing sector, this equipment is essential for powering pneumatic tools, conveyor systems, and spray painting, where moisture and oil-free air ensure product consistency and prevent tool damage. In the food and beverage industry, compressed air treatment equipment ensures compliance with stringent hygiene standards by providing contaminant-free air for product handling, packaging, and air knives. Pharmaceuticals and healthcare also rely on high-quality compressed air for processes like capsule filling, inhaler manufacturing, and laboratory applications, where air purity is essential for product safety and patient health. In electronics manufacturing, compressed air treatment equipment plays a crucial role in producing clean air for sensitive processes like semiconductor production and circuit board assembly, where even minor contaminants can impact product performance. Additionally, automotive and aerospace industries use compressed air treatment systems to maintain quality in processes such as painting, assembly, and machining, ensuring smooth, uninterrupted operations. These varied applications highlight the versatility of compressed air treatment equipment, which supports quality, safety, and efficiency across sectors that depend on high-performance air systems.What Factors Are Driving Growth in the Compressed Air Treatment Equipment Market?

The growth in the compressed air treatment equipment market is driven by several factors, including the expansion of manufacturing activities, increasing quality standards, and advancements in air treatment technology. As industrial automation expands, the demand for clean, contaminant-free compressed air has risen, fueling the adoption of air treatment systems that ensure equipment reliability and process quality. Regulatory requirements for air quality, particularly in sectors like food and beverage, healthcare, and electronics, have also increased, making it essential for industries to invest in high-quality air treatment solutions. These regulations require the removal of contaminants to maintain product quality and comply with industry-specific standards. Technological advancements, such as energy-efficient dryers and IoT-enabled monitoring systems, are enhancing the functionality and cost-effectiveness of compressed air treatment equipment. The integration of predictive maintenance capabilities reduces downtime and extends equipment life, supporting the market's growth as industries seek reliable, low-maintenance solutions. Additionally, the push for energy efficiency and sustainability has accelerated demand for air treatment systems that minimize energy consumption and environmental impact. These factors collectively drive the adoption of compressed air treatment equipment, supporting its role as an essential component in modern industrial operations focused on quality, efficiency, and regulatory compliance.Report Scope

The report analyzes the Compressed Air Treatment Equipment market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Product (Dryers, Filters, Aftercooler, Other Products); End-Use (Food & Beverage, Pharmaceuticals, Chemical, Healthcare, Paper, Other End-Uses).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Dryers segment, which is expected to reach US$5.4 Billion by 2030 with a CAGR of a 6.6%. The Filters segment is also set to grow at 6.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.7 Billion in 2024, and China, forecasted to grow at an impressive 9.9% CAGR to reach $3.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Compressed Air Treatment Equipment Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Compressed Air Treatment Equipment Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Compressed Air Treatment Equipment Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Airfilter Engineering, Alpha-Pure, Atlas Copco Corporation, Beko Technologies, Boge Compressors and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 107 companies featured in this Compressed Air Treatment Equipment market report include:

- Airfilter Engineering

- Alpha-Pure

- Atlas Copco Corporation

- Beko Technologies

- Boge Compressors

- Chicago Pneumatic

- Compressed Air Parts Company (CAPCO)

- Donaldson Company, Inc.

- Gardner Denver, Inc.

- Gem Equipments Ltd.

- Hankison (SPX)

- Industrial Air Power (IAP)

- Ingersoll-Rand

- Ingersoll-Rand

- Kaeser Compressors, Inc.

- Mann+Hummel

- Mattei Compressors, Inc.

- Mikropor Filters

- Pentair plc

- Pneumatech, Inc.

- Precision Filtration Products

- Quincy Compressor LLC

- Sanmina Corporation

- Seneca Companies, Inc.

- Sullair LLC

- Sullivan-Palatek, Inc.

- Van Air Systems

- Walker Filtration

- Wilkerson Corporation

- ZEKS Compressed Air Solutions, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Airfilter Engineering

- Alpha-Pure

- Atlas Copco Corporation

- Beko Technologies

- Boge Compressors

- Chicago Pneumatic

- Compressed Air Parts Company (CAPCO)

- Donaldson Company, Inc.

- Gardner Denver, Inc.

- Gem Equipments Ltd.

- Hankison (SPX)

- Industrial Air Power (IAP)

- Ingersoll-Rand

- Ingersoll-Rand

- Kaeser Compressors, Inc.

- Mann+Hummel

- Mattei Compressors, Inc.

- Mikropor Filters

- Pentair plc

- Pneumatech, Inc.

- Precision Filtration Products

- Quincy Compressor LLC

- Sanmina Corporation

- Seneca Companies, Inc.

- Sullair LLC

- Sullivan-Palatek, Inc.

- Van Air Systems

- Walker Filtration

- Wilkerson Corporation

- ZEKS Compressed Air Solutions, Inc.

Table Information

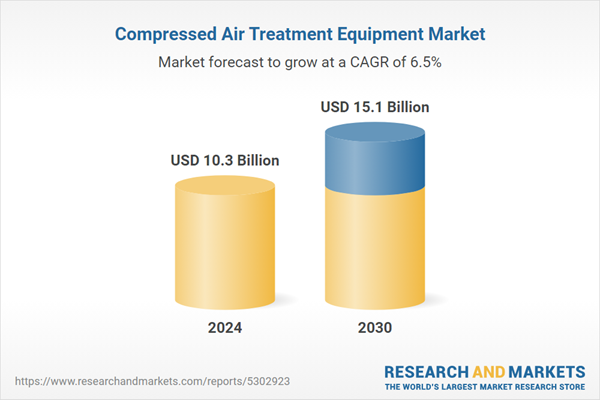

| Report Attribute | Details |

|---|---|

| No. of Pages | 356 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 10.3 Billion |

| Forecasted Market Value ( USD | $ 15.1 Billion |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Global |