Global Composites Market - Key Trends & Drivers Summarized

What Are Composites and Why Are They Crucial in Advanced Manufacturing?

Composites are engineered materials made by combining two or more constituent materials with different physical or chemical properties to achieve superior performance characteristics. Common composite materials include carbon fiber-reinforced polymer (CFRP), fiberglass, and thermoplastics, which are known for their high strength-to-weight ratio, durability, and resistance to environmental factors. Composites are used extensively in industries like aerospace, automotive, construction, marine, and renewable energy, where lightweight and high-strength materials are essential. By using composites, manufacturers can create products that meet stringent performance requirements while reducing overall weight, which is especially beneficial in applications where fuel efficiency and structural integrity are crucial, such as in aircraft and electric vehicles. The importance of composites lies in their ability to be tailored to specific applications, offering properties like high impact resistance, thermal stability, and corrosion resistance that outperform traditional materials like metal or plastic. In aerospace, for example, carbon fiber composites are used in aircraft fuselages, wings, and components to reduce weight and improve fuel efficiency. In the construction industry, composites are used in bridges, building reinforcements, and insulation, offering durability and longevity. As industries continue to innovate and seek materials that support both sustainability and performance, composites have become an indispensable material for advanced manufacturing.How Are Technological Advancements Influencing the Composites Market?

Technological advancements are rapidly transforming the composites market, enabling higher performance, greater versatility, and expanded application potential. One significant development is the use of automation in composite manufacturing, particularly through automated fiber placement (AFP) and automated tape laying (ATL) technologies. These processes allow for the precise placement of composite fibers, resulting in stronger, lighter structures that can be produced faster and at lower cost. Another breakthrough is the development of bio-based and recyclable composites, which address environmental concerns and support sustainability goals by offering alternatives to petroleum-based materials. Advanced composites with nano-reinforcements, such as graphene-enhanced polymers, provide exceptional strength and conductivity, opening new applications in electronics and energy storage. Innovations in 3D printing are also transforming composite manufacturing, enabling complex geometries that were previously unattainable, particularly in industries like aerospace and medical devices. Additionally, advancements in resin systems, such as fast-curing and fire-resistant resins, have expanded the application of composites in sectors where safety and rapid production are critical. These technological advancements are driving growth in the composites market, as they enhance the properties of composite materials and make them more accessible to a wider range of industries.What Are the Key Applications of Composites Across Industries?

Composites are widely applied across various industries, each benefiting from the unique properties that composites offer. In the aerospace industry, composites are used in structural components like fuselages, wings, and interior panels, where their lightweight properties help reduce fuel consumption and improve aircraft performance. The automotive sector also heavily relies on composites, particularly in electric vehicles, where lightweight materials contribute to increased battery range and overall vehicle efficiency. Carbon fiber composites, in particular, are used in high-performance automotive parts like chassis and body panels to reduce weight while maintaining structural strength.In the renewable energy sector, composites play a critical role in the construction of wind turbine blades, which require materials that can withstand stress, high-speed rotation, and harsh environmental conditions. The marine industry benefits from composites' corrosion resistance, using them in boat hulls, decks, and offshore structures. Additionally, in construction, composites are used for infrastructure projects, such as bridge reinforcements and building facades, where they provide durability, weather resistance, and low maintenance requirements. The versatility and adaptability of composites allow them to meet the unique needs of each industry, supporting innovation and improved performance across a wide array of applications.

What Factors Are Driving Growth in the Composites Market?

The growth in the composites market is driven by several factors, including increasing demand for lightweight materials, advancements in manufacturing technologies, and growing environmental awareness. As industries like aerospace, automotive, and renewable energy prioritize fuel efficiency and carbon reduction, the demand for lightweight, high-strength materials such as composites has surged. Technological advancements, such as automated manufacturing processes and the development of bio-based composites, have expanded the market by making composite production more cost-effective and environmentally friendly. The rise of electric vehicles and renewable energy projects further accelerates demand, as these sectors rely heavily on composites for efficient, durable solutions. Environmental regulations and sustainability goals are also key drivers, as composites enable companies to meet environmental standards without compromising performance. Additionally, increased R&D investment in next-generation composites, such as nano-reinforced materials and recyclable composites, is creating new opportunities for high-performance applications. The rapid adoption of composite materials in construction, infrastructure, and consumer goods underscores their value as a versatile, high-performance material that meets the evolving needs of modern manufacturing. Together, these factors contribute to a robust growth trajectory for the composites market, driven by industry innovation and the pursuit of sustainable material solutions.Report Scope

The report analyzes the Composites market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Product (Glass Fiber Composites, Carbon Fiber Composites, Other Products); End-Use (Automotive & Transportation, Electrical & Electronics, Wind Energy, Pipes & Tanks, Construction & Infrastructure, Marine, Other End-Uses).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Glass Fiber Composites segment, which is expected to reach US$100.1 Billion by 2030 with a CAGR of a 5.9%. The Carbon Fiber Composites segment is also set to grow at 6.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $30.7 Billion in 2024, and China, forecasted to grow at an impressive 9% CAGR to reach $37.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Composites Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Composites Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Composites Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Basf SE, Binani Industries Ltd., Chongqing Polycomp International Corporation, Dowaksa, Gaffco Ballistics and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 247 companies featured in this Composites market report include:

- Basf SE

- Binani Industries Ltd.

- Chongqing Polycomp International Corporation

- Dowaksa

- Gaffco Ballistics

- Gurit

- Henkel Ag & Co. KGAA

- Hexcel Corporation

- Hexion

- Honeywell International Inc.

- Huntsman International LLC.

- Jushi Group Co., Ltd.

- Kineco Kaman Composites - India Private Limited

- Mitsubishi Chemical Holdings Corporation

- Nippon Electric Glass Co. Ltd.

- Owens Corning

- Renegade Materials Corporation

- Sgl Group

- Solvay

- Taishan Fiberglass Inc.(CTG)

- Teijin Limited

- Toray Industries, Inc.

- Trex Company, Inc.

- Upm Biocomposites

- Weyerhaeuser Company

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Basf SE

- Binani Industries Ltd.

- Chongqing Polycomp International Corporation

- Dowaksa

- Gaffco Ballistics

- Gurit

- Henkel Ag & Co. KGAA

- Hexcel Corporation

- Hexion

- Honeywell International Inc.

- Huntsman International LLC.

- Jushi Group Co., Ltd.

- Kineco Kaman Composites – India Private Limited

- Mitsubishi Chemical Holdings Corporation

- Nippon Electric Glass Co. Ltd.

- Owens Corning

- Renegade Materials Corporation

- Sgl Group

- Solvay

- Taishan Fiberglass Inc.(CTG)

- Teijin Limited

- Toray Industries, Inc.

- Trex Company, Inc.

- Upm Biocomposites

- Weyerhaeuser Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 496 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

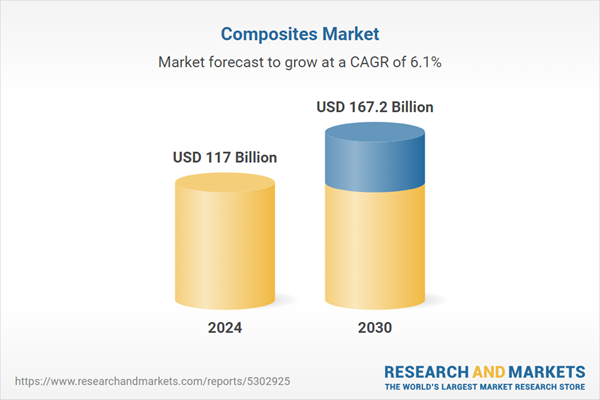

| Estimated Market Value ( USD | $ 117 Billion |

| Forecasted Market Value ( USD | $ 167.2 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |