Global Commercial Flooring Market - Key Trends & Drivers Summarized

Why Is Commercial Flooring a Key Element in Business and Institutional Spaces?

Commercial flooring plays a critical role in the functionality, aesthetics, and durability of business and institutional spaces, from hospitals and schools to office buildings and retail centers. Unlike residential flooring, commercial flooring solutions are designed to withstand high traffic, heavy loads, and frequent cleaning, making durability and resilience top priorities for commercial settings. Additionally, commercial flooring must meet safety standards, providing slip resistance and ease of maintenance in spaces where hygiene and safety are critical, such as healthcare facilities and educational institutions. Beyond function, aesthetics also play a central role, as the appearance of flooring can impact customer impressions and employee morale. For example, luxury vinyl tiles (LVT) and polished concrete are popular choices that provide a sleek, modern look while maintaining durability and ease of upkeep. In retail and hospitality, the right flooring can create inviting, comfortable environments that align with brand aesthetics and improve customer satisfaction. Likewise, in corporate settings, flooring can contribute to a professional atmosphere, supporting an image of quality and competence. Environmental sustainability has also become a key consideration, with businesses increasingly choosing eco-friendly materials such as recycled carpet tiles, bamboo, or cork flooring that have low VOC emissions. As companies prioritize longevity, aesthetics, and sustainability in commercial spaces, the role of commercial flooring has become multifaceted, serving as a foundation for functional, welcoming, and eco-conscious environments.How Are Technological Advancements Enhancing Commercial Flooring?

Technological advancements in materials and manufacturing are driving the evolution of commercial flooring, enhancing performance, durability, and customization options. One of the most notable innovations is the rise of luxury vinyl tile (LVT), which mimics the appearance of natural materials like wood and stone but offers superior resistance to scratches, stains, and moisture. This makes LVT an ideal choice for high-traffic areas in offices, hotels, and retail spaces. Additionally, advancements in wear layers and UV-cured finishes have improved flooring resilience, allowing it to withstand intense use while maintaining its appearance. These technologies reduce the need for frequent maintenance and replacement, making them more cost-effective in the long run. Beyond materials, digital printing and customization capabilities have transformed the aesthetics of commercial flooring, enabling manufacturers to offer custom patterns, textures, and colors that cater to brand-specific designs. Digital printing can reproduce highly realistic visuals, allowing architects and designers to achieve a unique look without compromising durability. Innovations in modular flooring systems, such as interlocking tiles and carpet tiles, have also streamlined installation and replacement processes, reducing downtime and labor costs. Sustainable technology is another focus area, with advancements in bio-based materials and recyclable flooring products catering to the rising demand for eco-friendly options. These innovations enable the commercial flooring industry to meet the complex demands of modern businesses and institutions that seek high-quality, customizable, and sustainable flooring solutions.Which Industries Are Leading Demand for Commercial Flooring Beyond Corporate Offices?

While corporate offices are significant consumers of commercial flooring, other sectors such as healthcare, education, retail, and hospitality are driving demand due to their unique needs for durability, hygiene, and aesthetics. In healthcare, flooring must withstand rigorous cleaning protocols and provide slip resistance, while materials like antimicrobial vinyl and rubber are preferred for their ease of cleaning and infection control. Educational institutions, from K-12 schools to universities, rely on durable, sound-absorbing flooring that can withstand heavy foot traffic, support noise reduction, and create a comfortable learning environment. Carpet tiles, vinyl, and rubber flooring are common choices in these settings, where comfort and longevity are essential. The retail sector, particularly in high-end stores and shopping centers, seeks aesthetically pleasing flooring that aligns with brand identity and creates a welcoming atmosphere. Luxury vinyl and polished concrete are popular for their visual appeal and durability. The hospitality industry, including hotels, restaurants, and event spaces, prioritizes flooring that offers comfort, elegance, and easy maintenance. Carpet tiles and luxury vinyl are widely used in lobbies and guest rooms, while hard-surface options are preferred for dining areas and event spaces. This cross-industry demand underscores the versatility of commercial flooring, as it adapts to diverse functional, aesthetic, and safety needs in spaces that cater to public use and high occupancy.What's Driving Growth in the Commercial Flooring Market?

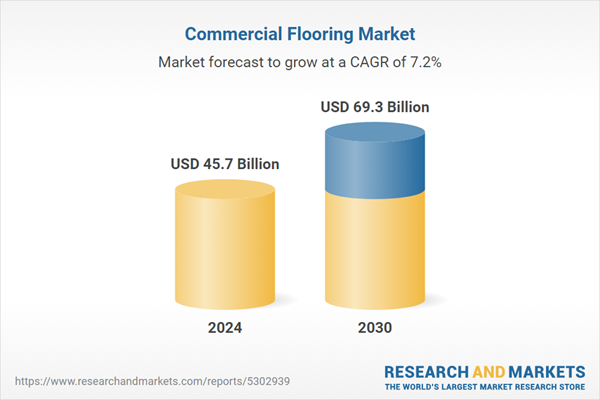

The growth in the commercial flooring market is driven by several factors, including increased construction activity in commercial spaces, technological advancements, and rising consumer preference for sustainable materials. The expansion of commercial construction, particularly in emerging markets, has fueled demand for flooring solutions that balance durability with cost-effectiveness. Technological advancements in manufacturing, such as digital printing and wear-resistant finishes, have made it possible to offer flooring with high-end aesthetics and low maintenance, catering to businesses that prioritize appearance and longevity. The shift towards modular flooring systems, such as carpet tiles and interlocking vinyl, has further boosted the market, as these solutions are easy to install, replace, and customize. Growing environmental awareness among consumers has also driven demand for eco-friendly flooring options, with manufacturers increasingly producing flooring made from recycled, bio-based, or low-VOC materials. This trend has been particularly strong in regions with stringent environmental regulations, where businesses seek flooring solutions that help reduce their carbon footprint. Additionally, the rise of open-plan and multipurpose commercial spaces has increased demand for flooring that can withstand heavy use and adapt to various functions. Together, these drivers underscore the strong growth trajectory of the commercial flooring market, as businesses prioritize functional, aesthetic, and sustainable solutions that enhance their spaces and align with modern design and environmental standards.Report Scope

The report analyzes the Commercial Flooring market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Product (Soft Coverings, Resilient, Non-Resilient, Seamless, Wood & Laminates); Application (Commercial Buildings, Leisure & Hospitality, Retail, Education, Public Buildings, Healthcare).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Soft Coverings segment, which is expected to reach US$29.1 Billion by 2030 with a CAGR of a 6.8%. The Resilient Flooring segment is also set to grow at 7.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $11.8 Billion in 2024, and China, forecasted to grow at an impressive 10.7% CAGR to reach $16.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Commercial Flooring Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Commercial Flooring Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Commercial Flooring Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Amtico, Armstrong World Industries, Changzhou Liberty Diseno New Material Co., Ltd. (CNBM), Congoleum, Florim USA and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Commercial Flooring market report include:

- Amtico

- Armstrong World Industries

- Changzhou Liberty Diseno New Material Co., Ltd. (CNBM)

- Congoleum

- Florim USA

- Flowcrete (RPM)

- Forbo International SA

- Gerflor

- Hanwha

- Interface Inc.

- IVC Group

- J+J Flooring Group

- James Halstead Plc.

- LG Hausys

- Mannington

- Milliken & Company

- Mohawk Group

- Roppe Corporation

- Shaw Industries Group, Inc.

- Tarkett

- The Armstrong Flooring, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Amtico

- Armstrong World Industries

- Changzhou Liberty Diseno New Material Co., Ltd. (CNBM)

- Congoleum

- Florim USA

- Flowcrete (RPM)

- Forbo International SA

- Gerflor

- Hanwha

- Interface Inc.

- IVC Group

- J+J Flooring Group

- James Halstead Plc.

- LG Hausys

- Mannington

- Milliken & Company

- Mohawk Group

- Roppe Corporation

- Shaw Industries Group, Inc.

- Tarkett

- The Armstrong Flooring, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 300 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 45.7 Billion |

| Forecasted Market Value ( USD | $ 69.3 Billion |

| Compound Annual Growth Rate | 7.2% |

| Regions Covered | Global |