Global Laboratory Proficiency Testing Market - Key Trends and Drivers Summarized

How Is Laboratory Proficiency Testing Ensuring Accuracy in Scientific Analysis?

Laboratory proficiency testing (PT) is a vital component in ensuring the accuracy, reliability, and consistency of laboratory results across various scientific fields, including clinical diagnostics, environmental testing, and food safety. PT programs assess a laboratory's ability to produce accurate results by comparing their performance against a standard or among peers. Laboratories participating in proficiency testing are provided with unknown samples that they must analyze, and the results are then compared to pre-established criteria or results from other laboratories. The need for quality assurance and stringent regulatory requirements has made proficiency testing a mandatory practice in accredited laboratories, contributing to overall improvements in testing accuracy and compliance with global standards.What Technological Innovations Are Shaping Laboratory Proficiency Testing?

Technological advancements are significantly improving the efficiency and scope of laboratory proficiency testing. Digital platforms now allow for faster and more secure exchange of test results between laboratories and proficiency testing providers. Automation is also playing a key role, with laboratories increasingly relying on automated testing systems to reduce human error and enhance the repeatability of results. Data analytics tools are being used to evaluate the results of proficiency tests, providing laboratories with insights into areas of improvement and helping them implement corrective actions more efficiently. Moreover, the rise of remote and cloud-based platforms for PT is allowing laboratories across different regions to easily participate in international testing programs, further promoting global standardization.How Do Market Segments Define the Growth of Laboratory Proficiency Testing?

Test types include clinical diagnostics, environmental testing, food safety, and pharmaceutical testing, with clinical diagnostics representing the largest segment due to the high regulatory scrutiny in this field. Industries served by proficiency testing programs range from healthcare and pharmaceuticals to environmental and industrial sectors, with healthcare and pharmaceuticals leading the market due to the growing demand for precise diagnostic testing. End-users include hospitals, research laboratories, and environmental testing facilities, with research laboratories driving demand as they seek to comply with international quality standards and maintain accreditation.What Factors Are Driving the Growth in the Laboratory Proficiency Testing Market?

The growth in the laboratory proficiency testing market is driven by several factors, including the increasing need for laboratory quality assurance, stringent regulatory requirements, and the rise of complex testing methodologies in areas such as genomics and precision medicine. As the demand for accurate and reliable testing results grows, laboratories are under greater pressure to participate in proficiency testing to maintain accreditation and meet regulatory standards. Technological advancements, such as automation and digital platforms, are also making PT programs more accessible and efficient, further encouraging adoption. Additionally, the globalization of laboratory services and the need for standardized testing practices across borders are fueling the expansion of the proficiency testing market.Report Scope

The report analyzes the Laboratory Proficiency Testing market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Technology (Cell Culture, Immunoassays, Polymerase Chain Reaction, Spectrometry, Chromatography, Other Technologies); Vertical (Hospitals, Pharma & Biotech Companies, Contract Research Organizations, Academic Research, Diagnostic Laboratories).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Cell Culture Technology segment, which is expected to reach US$726.6 Million by 2030 with a CAGR of a 5.8%. The Immunoassays Technology segment is also set to grow at 6.5% CAGR over the analysis period.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Laboratory Proficiency Testing Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Laboratory Proficiency Testing Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Laboratory Proficiency Testing Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Absolute Standards, American Proficiency Institute, AOAC International, Bio-Rad Laboratories, Bipea and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Laboratory Proficiency Testing market report include:

- Absolute Standards

- American Proficiency Institute

- AOAC International

- Bio-Rad Laboratories

- Bipea

- College of American Pathologists

- FAPAS (A Division of Fera Science Ltd.)

- LGC

- Merck

- NSI Lab Solutions

- QACS

- Randox Laboratories

- Waters Corporation

- Weqas

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Absolute Standards

- American Proficiency Institute

- AOAC International

- Bio-Rad Laboratories

- Bipea

- College of American Pathologists

- FAPAS (A Division of Fera Science Ltd.)

- LGC

- Merck

- NSI Lab Solutions

- QACS

- Randox Laboratories

- Waters Corporation

- Weqas

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 286 |

| Published | January 2026 |

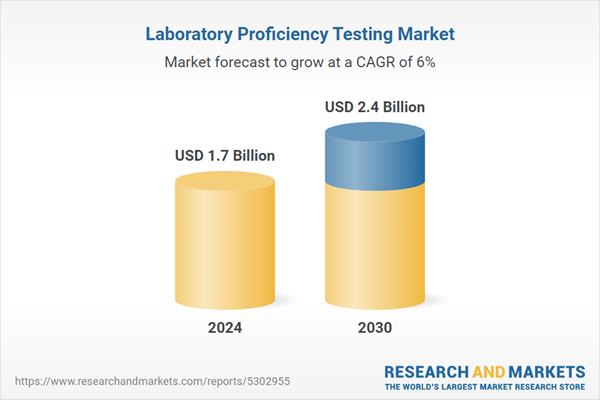

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.7 Billion |

| Forecasted Market Value ( USD | $ 2.4 Billion |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |