Global Electric AC Motors Market - Key Trends & Drivers Summarized

Why Are Electric AC Motors Gaining Momentum Across Industries?

Electric AC motors are becoming essential in various industries due to their efficiency, durability, and versatility in powering diverse applications. Unlike DC motors, AC motors operate on alternating current, which makes them more energy-efficient and capable of maintaining consistent speeds under varying load conditions. As industries look to reduce operational costs and increase sustainability, AC motors offer a reliable solution that aligns with energy conservation goals. They are widely used in sectors like manufacturing, HVAC systems, and electric vehicles (EVs), where their efficiency reduces overall energy consumption. In the manufacturing sector, for instance, AC motors power essential equipment like conveyors, pumps, and compressors, driving continuous production with minimal downtime. As industries prioritize green energy solutions, the energy-saving potential of AC motors is becoming a critical factor for businesses aiming to lower their carbon footprint.Additionally, the flexibility of electric AC motors in adapting to various speeds and torque requirements makes them suitable for automation and robotics applications, which are increasingly prevalent in advanced manufacturing setups. These motors can be precisely controlled using variable frequency drives (VFDs), which adjust motor speed and energy use according to the load, further enhancing their efficiency. This adaptability is especially advantageous in industries with dynamic power requirements, such as automotive and aerospace, where energy usage varies significantly during different stages of production. The versatility, combined with their ability to support automation, positions AC motors as integral to the future of industrial development, aligning with the global shift toward electrification and automation.

What Technological Innovations Are Fueling the Growth of Electric AC Motors?

The electric AC motor market is witnessing rapid technological advancements that are enhancing motor efficiency, reducing energy losses, and improving overall performance. One major innovation is the development of high-efficiency motors that meet increasingly stringent energy standards, such as the IE4 and IE5 classifications, which are designed to minimize energy waste and maximize operational efficiency. Manufacturers are utilizing advanced materials, such as rare-earth magnets and high-quality copper wiring, which contribute to reducing electrical losses and improving torque. Furthermore, the incorporation of permanent magnet synchronous motors (PMSMs) in certain applications offers even greater efficiency and compact design, making them ideal for high-performance sectors like automotive and robotics. These technological advancements are allowing industries to meet both performance and environmental targets, positioning AC motors as a preferred choice across energy-conscious applications.The integration of IoT and smart technology into AC motors is another significant advancement, enabling real-time monitoring and predictive maintenance. Smart AC motors can detect changes in vibration, temperature, and energy consumption, alerting maintenance teams to potential issues before they lead to breakdowns. This capability is especially valuable in industries like manufacturing and power generation, where operational continuity is essential. Additionally, developments in variable frequency drives (VFDs) are enabling more precise control of motor speed, optimizing energy usage by matching the power output to the load requirements. These innovations not only extend the operational life of electric AC motors but also support the global push toward Industry 4.0, making them more adaptable to digital transformation initiatives in industrial environments.

What Are the Primary Applications of Electric AC Motors?

Electric AC motors are widely used across various industries, thanks to their efficiency and versatility. In the manufacturing industry, AC motors power essential equipment like pumps, compressors, and conveyor belts, ensuring reliable, continuous operation. The use of AC motors in HVAC systems is also significant, as these motors drive air conditioning units, ventilation systems, and industrial cooling fans, which are critical for maintaining ambient conditions in large-scale facilities. The versatility of AC motors in providing consistent and adjustable power makes them an ideal solution for applications requiring a steady speed, regardless of load. This capability is especially valuable in applications like water treatment plants and mining, where constant torque is required to maintain stable operations.In the transportation sector, particularly in electric vehicles and electric public transportation, AC motors play a pivotal role by delivering efficient power to drive systems, improving vehicle performance, and extending battery life. Their application in EVs is crucial, as AC motors provide the high efficiency and low maintenance required for electric drivetrains. Additionally, AC motors are now common in home appliances, robotics, and renewable energy systems, where their energy-efficient operation supports eco-friendly and automated applications. As the adoption of electric solutions expands, AC motors will continue to play an integral role across sectors, supporting the shift toward more sustainable and efficient power solutions.

What Is Driving Growth in the Electric AC Motors Market?

The growth in the electric AC motors market is driven by several key factors, including the increasing demand for energy-efficient solutions, advancements in automation, and the expansion of electric vehicle adoption. The global push toward reducing energy consumption and carbon emissions has led industries to prioritize energy-efficient equipment, making high-efficiency AC motors a preferred choice. Government regulations encouraging green energy use, such as the Minimum Energy Performance Standards (MEPS) and other energy efficiency codes, are also fueling the demand for high-efficiency AC motors that meet these requirements. Additionally, the trend toward industrial automation and robotics, especially in manufacturing and logistics, has created a strong demand for motors that can provide precise speed control and maintain efficiency under varying loads.Another significant growth driver is the rise of electric vehicles, which rely heavily on AC motors for propulsion. The EV market's growth has spurred the demand for compact, efficient motors that can deliver high torque and low noise, qualities that AC motors are well-suited to provide. Additionally, advances in smart and connected motor technologies are enhancing the appeal of AC motors, as they enable real-time monitoring and predictive maintenance, extending the equipment's operational lifespan. Together, these factors are driving robust demand for electric AC motors across a wide array of applications, solidifying their role as a cornerstone in the transition toward energy-efficient, sustainable industrial and consumer technologies.

Report Scope

The report analyzes the Electric AC Motors market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Induction AC Motors, Synchronous AC Motors); Voltage (Fractional HP Output, Integral HP Output); End-Use (Motor Vehicles, HVAC Equipment, Industrial Machinery, Household Appliances, Aerospace & Transportation, Other End-Uses).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

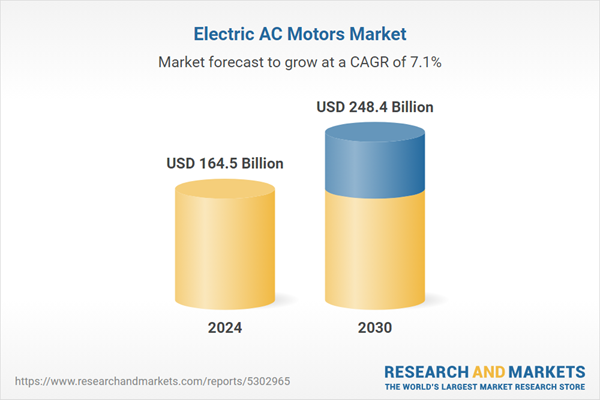

- Market Growth: Understand the significant growth trajectory of the Induction AC Motors segment, which is expected to reach US$161.4 Billion by 2030 with a CAGR of a 7.1%. The Synchronous AC Motors segment is also set to grow at 7.2% CAGR over the analysis period.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Electric AC Motors Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Electric AC Motors Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Electric AC Motors Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABB Limited, Allied Motion Technologies Inc., Ametek Inc., Asmo Co. Ltd., Baldor Electric Company Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 18 companies featured in this Electric AC Motors market report include:

- ABB Limited

- Allied Motion Technologies Inc.

- Ametek Inc.

- Asmo Co. Ltd.

- Baldor Electric Company Inc.

- Franklin Electric Co. Inc.

- Johnson Electric

- Kirloskar Electric Company

- Rockwell Automation Inc.

- Siemens AG

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABB Limited

- Allied Motion Technologies Inc.

- Ametek Inc.

- Asmo Co. Ltd.

- Baldor Electric Company Inc.

- Franklin Electric Co. Inc.

- Johnson Electric

- Kirloskar Electric Company

- Rockwell Automation Inc.

- Siemens AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 354 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 164.5 Billion |

| Forecasted Market Value ( USD | $ 248.4 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Global |