Global Eco-Friendly Food Packaging Market - Key Trends & Drivers Summarized

Eco-friendly food packaging is increasingly becoming a vital aspect of the food and beverage industry, driven by growing environmental concerns and consumer demand for sustainable products. This type of packaging is designed to minimize environmental impact, using materials that are biodegradable, recyclable, or made from renewable resources. Common materials used in eco-friendly packaging include plant-based plastics, recycled paper, and biodegradable polymers. These materials not only reduce waste but also decrease the carbon footprint associated with the production and disposal of packaging. Innovations such as edible packaging and compostable containers are also emerging, offering even more sustainable options. This shift towards sustainable packaging is part of a broader effort to address the pollution and waste generated by traditional plastic packaging, which has long been a significant environmental challenge.The implementation of eco-friendly food packaging involves adopting new technologies and practices that prioritize sustainability without compromising the safety and quality of food products. Advanced manufacturing techniques, such as the use of nanotechnology and bio-based materials, are being developed to enhance the durability and functionality of eco-friendly packaging. These innovations ensure that the packaging can effectively protect food products, extending their shelf life and maintaining their freshness. Moreover, companies are investing in research and development to create packaging solutions that are not only environmentally friendly but also cost-effective. This includes exploring the use of alternative raw materials and optimizing production processes to reduce energy consumption and waste. As a result, eco-friendly packaging is becoming more accessible and practical for a wide range of food products, from fresh produce to processed goods.

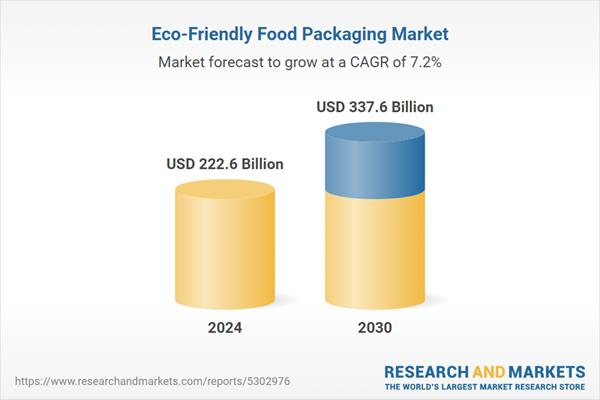

The growth in the eco-friendly food packaging market is driven by several factors, reflecting changing consumer preferences, regulatory pressures, and technological advancements. One significant driver is the increasing consumer awareness of environmental issues and the demand for sustainable products. Consumers are more informed and concerned about the impact of plastic waste and are actively seeking products with minimal environmental footprints. Regulatory policies and initiatives aimed at reducing plastic waste and promoting recycling are also propelling the market forward. Governments and organizations worldwide are implementing stricter regulations and offering incentives for the adoption of sustainable packaging solutions. Additionally, technological advancements in materials science and packaging technology are enabling the development of more effective and affordable eco-friendly packaging options. The growing trend of corporate social responsibility (CSR) among companies further supports market growth, as businesses strive to meet sustainability goals and enhance their brand image by adopting eco-friendly practices. These factors collectively drive the robust expansion of the eco-friendly food packaging market, ensuring its continued evolution and adoption across the food industry.

Report Scope

The report analyzes the Eco-Friendly Food Packaging market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Recycled Content Packaging, Degradable Packaging, Reusable Packaging); Material (Paper & Paperboard, Plastic, Metal, Glass, Other Materials); Application (Food, Alcoholic Beverages, Non-Alcoholic Beverages).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Recycled Content Packaging segment, which is expected to reach US$146.6 Billion by 2030 with a CAGR of 6.6%. The Degradable Packaging segment is also set to grow at 7.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $50.5 Billion in 2024, and China, forecasted to grow at an impressive 9.3% CAGR to reach $45.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Eco-Friendly Food Packaging Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Eco-Friendly Food Packaging Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Eco-Friendly Food Packaging Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Amcor plc, Ball Corporation, BASF SE, Berry Global, Inc., Crown Holdings, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 131 companies featured in this Eco-Friendly Food Packaging market report include:

- Amcor plc

- Ball Corporation

- BASF SE

- Berry Global, Inc.

- Crown Holdings, Inc.

- Elopak AS

- GWP Group

- Huhtamäki Oyj

- Mondi plc

- Pactiv Evergreen Inc.

- PaperFoam B.V.

- Printpack, Inc.

- Smurfit Kappa Group

- Sonoco Products Company

- Swedbrandgroup

- Tetra Pak

- WestRock Company

- WINPAK LTD.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Amcor plc

- Ball Corporation

- BASF SE

- Berry Global, Inc.

- Crown Holdings, Inc.

- Elopak AS

- GWP Group

- Huhtamäki Oyj

- Mondi plc

- Pactiv Evergreen Inc.

- PaperFoam B.V.

- Printpack, Inc.

- Smurfit Kappa Group

- Sonoco Products Company

- Swedbrandgroup

- Tetra Pak

- WestRock Company

- WINPAK LTD.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 434 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 222.6 Billion |

| Forecasted Market Value ( USD | $ 337.6 Billion |

| Compound Annual Growth Rate | 7.2% |

| Regions Covered | Global |