Global Digital Remittance Market - Key Trends & Drivers Summarized

How Are Digital Remittance Platforms Transforming Cross-Border Payments?

Digital remittance platforms are revolutionizing the cross-border payment landscape by offering a faster, more cost-effective, and user-friendly alternative to traditional money transfer methods. These platforms enable migrants and expatriates to send money to their home countries quickly through mobile apps, online portals, and digital wallets, eliminating the need for intermediaries and reducing transaction fees. The digital remittance process is seamless and secure, allowing users to transfer funds using their smartphones, making it especially valuable in regions where access to traditional banking is limited. For recipients, digital remittance platforms provide direct deposits into bank accounts, mobile wallets, or even cash pick-up options, enhancing convenience and accessibility.The shift from physical remittance services to digital platforms has been accelerated by the widespread adoption of smartphones and the increasing internet penetration worldwide. Digital remittance providers leverage advanced technologies, such as blockchain and end-to-end encryption, to ensure the security and transparency of transactions. Additionally, these platforms often provide real-time currency exchange rates, helping users make informed decisions and enabling them to send money with greater accuracy and control. Digital remittance platforms have transformed cross-border payments, empowering users with greater control over their finances and reducing the overall costs of remittance transactions.

How Are Emerging Technologies Driving Innovation in the Digital Remittance Market?

Emerging technologies like blockchain, artificial intelligence (AI), and machine learning are key drivers of innovation in the digital remittance market, enhancing security, efficiency, and transparency. Blockchain technology enables secure, decentralized transactions that reduce the need for intermediaries, cutting down on costs and processing times. By creating a transparent ledger, blockchain also minimizes the risks of fraud, ensuring that funds reach their intended recipients without delay. This transparency is particularly valuable in remittance markets, where trust is a critical factor for users sending money across borders.AI and machine learning contribute to digital remittance by optimizing transaction processes, providing fraud detection, and enabling personalized user experiences. These technologies analyze transaction data to detect suspicious patterns, flagging potential fraud and enhancing security for users. Additionally, AI-powered chatbots and virtual assistants streamline customer support, offering real-time assistance and guidance for users navigating digital remittance platforms. By improving speed, reducing costs, and ensuring compliance with regulatory standards, these emerging technologies are shaping a secure and user-friendly digital remittance market that caters to the evolving needs of global users.

Why Are Digital Remittance Platforms Gaining Popularity Among Migrants and Expats?

Digital remittance platforms are gaining popularity among migrants and expatriates due to their affordability, convenience, and accessibility. Compared to traditional money transfer services, digital remittance platforms offer significantly lower fees, which allows users to send more money to their families and communities. The convenience of using smartphones or online platforms to complete transactions also eliminates the need for in-person visits to banks or remittance outlets, making it a time-efficient option for users working abroad. Additionally, digital remittance platforms allow recipients to access funds directly through bank accounts, mobile wallets, or cash pick-up points, giving them flexibility and control over how they receive money.Furthermore, digital remittance services provide transparency in fees and exchange rates, enabling users to make informed decisions about their transactions. This is particularly beneficial for migrants and expatriates who send remittances regularly and seek reliable services that maximize the value of their transfers. With the growth of smartphone adoption and internet accessibility, digital remittance platforms have become an attractive option for users worldwide, especially in countries where banking infrastructure is limited. This popularity is expected to increase as digital remittance providers continue expanding their services to meet the evolving needs of migrants and expatriates across the globe.

How Is Digital Remittance Shaping the Future of Global Money Transfers?

Digital remittance is set to reshape the future of global money transfers by making transactions faster, more affordable, and increasingly accessible for users worldwide. As the adoption of digital wallets, mobile banking, and blockchain technology continues to grow, remittance platforms are expected to deliver even more secure and efficient cross-border transactions. Digital remittance providers are likely to leverage AI-driven analytics to offer personalized services, including tailored exchange rates and fee structures, further enhancing the user experience. By minimizing transaction costs and providing real-time access to funds, digital remittance is empowering underserved communities with greater financial inclusion and freedom.Additionally, digital remittance platforms are positioned to play a crucial role in promoting financial literacy and inclusion among unbanked populations. By making remittance services accessible via mobile devices, digital remittance platforms allow individuals without traditional bank accounts to participate in the financial system, helping to bridge the financial access gap in developing regions. As governments and regulatory bodies increasingly support digital financial services, digital remittance providers are set to drive global connectivity and strengthen economic ties across borders. In the future, digital remittance is likely to become the primary mode of international money transfer, revolutionizing how people send and receive funds globally.

Report Scope

The report analyzes the Digital Remittance market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Outward, Inward); Channel (Money Transfer Operators, Banks, Online Platforms, Other Channels); End-Use (Personal, Small Businesses, Migrant Labor Workforce, Other End-Uses).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Outward Remittance segment, which is expected to reach US$34.4 Billion by 2030 with a CAGR of a 10.9%. The Inward Remittance segment is also set to grow at 11.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $8.3 Billion in 2024, and China, forecasted to grow at an impressive 14.8% CAGR to reach $14.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Digital Remittance Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Digital Remittance Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Digital Remittance Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Azimo Limited, Digital Wallet Corporation, Flywire, InstaReM Pvt. Ltd., MoneyGram and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Digital Remittance market report include:

- Azimo Limited

- Digital Wallet Corporation

- Flywire

- InstaReM Pvt. Ltd.

- MoneyGram

- PayPal Holdings, Inc.

- Remitly, Inc.

- Ria Financial Services Ltd.

- Ripple

- SingX Pte Ltd.

- TNG Wallet

- TransferGo Ltd.

- TransferWise Ltd.

- Western Union Holdings, Inc.

- WorldRemit Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Azimo Limited

- Digital Wallet Corporation

- Flywire

- InstaReM Pvt. Ltd.

- MoneyGram

- PayPal Holdings, Inc.

- Remitly, Inc.

- Ria Financial Services Ltd.

- Ripple

- SingX Pte Ltd.

- TNG Wallet

- TransferGo Ltd.

- TransferWise Ltd.

- Western Union Holdings, Inc.

- WorldRemit Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 372 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

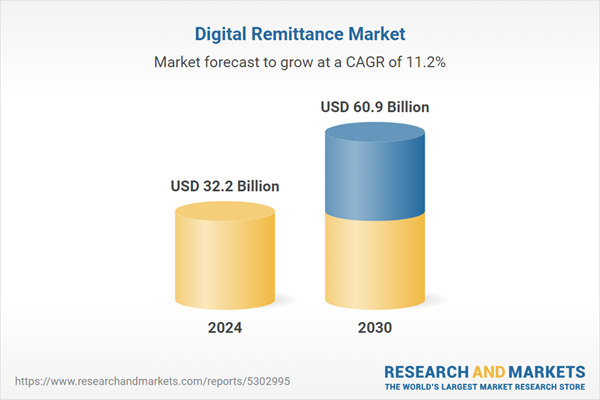

| Estimated Market Value ( USD | $ 32.2 Billion |

| Forecasted Market Value ( USD | $ 60.9 Billion |

| Compound Annual Growth Rate | 11.2% |

| Regions Covered | Global |