Global Digital Experience Platforms (DXP) Market - Key Trends & Drivers Summarized

What Role Do Digital Experience Platforms Play in Modern Customer Engagement?

Digital Experience Platforms (DXPs) are critical in enabling companies to deliver personalized, seamless interactions with customers across various digital channels, including websites, mobile apps, and social media. These platforms integrate content management, marketing automation, customer data management, and analytics to create a unified approach to customer engagement. In a highly competitive digital landscape, DXPs allow brands to adapt quickly to customer preferences, deliver consistent messaging, and create personalized experiences based on real-time data. As customer expectations for personalized, omni-channel engagement continue to rise, DXPs are becoming essential tools for businesses to differentiate their offerings and build customer loyalty.DXPs facilitate a centralized approach to managing digital touchpoints, providing companies with a holistic view of the customer journey. This enables businesses to streamline their marketing efforts, improve user engagement, and drive conversions. With the increasing demand for contextualized experiences, DXPs leverage AI and machine learning to provide personalized recommendations and tailored content that resonate with individual users. This approach not only enhances customer satisfaction but also enables companies to optimize their digital presence, maximize engagement, and ultimately, improve customer retention.

How Are Emerging Technologies Shaping the Digital Experience Platform Market?

Emerging technologies, such as artificial intelligence, machine learning, and cloud computing, are driving rapid advancements in Digital Experience Platforms. AI and machine learning are transforming how companies manage customer experiences by enabling data-driven personalization, automated content delivery, and predictive analytics. These tools allow DXPs to anticipate customer needs, provide relevant content at every interaction, and adjust strategies based on real-time engagement metrics. As AI-powered capabilities continue to evolve, DXPs are becoming more effective at personalizing experiences, improving engagement, and fostering customer loyalty across digital touchpoints.The adoption of cloud-based DXPs is also gaining momentum, as businesses seek scalable and flexible solutions that support remote access and faster deployment. Cloud DXPs reduce infrastructure costs and facilitate seamless integration with existing systems, making them accessible to businesses of all sizes. Additionally, the integration of Internet of Things (IoT) data within DXPs has enhanced the ability to provide context-aware experiences, especially in sectors like retail and smart homes. These technological advancements are reshaping the DXP market, allowing companies to leverage data more effectively and optimize their digital presence in real-time, meeting the growing demand for consistent and personalized customer experiences.

Growth in the Digital Experience Platform Market Is Driven by Several Factors

Growth in the Digital Experience Platform market is driven by the increasing demand for personalized, omni-channel customer engagement solutions across industries. As consumers interact with brands on multiple digital touchpoints, businesses require DXPs that provide a unified view of customer journeys, enabling seamless and cohesive experiences. The adoption of AI-driven analytics within DXPs has become crucial for creating data-informed, personalized experiences that increase engagement and customer loyalty. Moreover, the rise of mobile and social media as primary engagement channels has further accelerated the need for DXPs capable of managing diverse content across platforms.The transition to cloud-based DXPs is another significant driver, providing businesses with flexible, scalable options that support remote access and integrate seamlessly with other customer relationship management (CRM) and e-commerce systems. Regulatory changes surrounding data privacy and security, particularly in regions like Europe and North America, are shaping the DXP landscape by requiring companies to implement transparent and compliant data management practices. As businesses seek to enhance customer engagement and meet evolving consumer expectations, the DXP market is poised for continued expansion, offering companies the tools to manage and optimize digital interactions in a competitive environment.

Report Scope

The report analyzes the Digital Experience Platforms market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Component (Platform, Services); Vertical (Manufacturing, Retail, BFSI, IT & Telecom, Media & Entertainment, Other Verticals).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Digital Experience Platforms Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Digital Experience Platforms Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Digital Experience Platforms Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

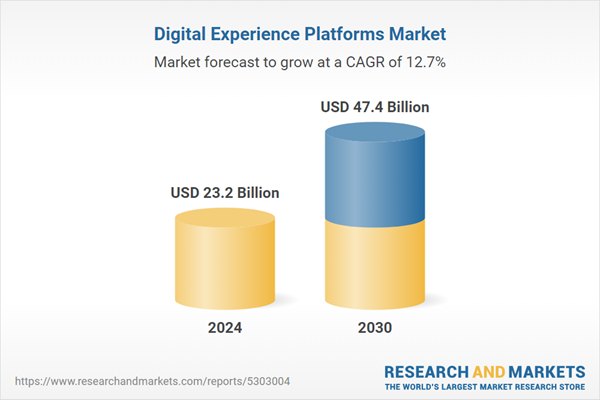

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Acquia, Adobe Systems, BloomReach, Inc., Censhare, Episerver and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 14 companies featured in this Digital Experience Platforms market report include:

- Acquia

- Adobe Systems

- BloomReach, Inc.

- Censhare

- Episerver

- IBM Corporation

- Jahia

- Kentico

- Liferay

- Microsoft Corporation

- Opentext

- Oracle Corporation

- Salesforce

- SAP SE

- SDL plc

- Sitecore

- Squiz

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Acquia

- Adobe Systems

- BloomReach, Inc.

- Censhare

- Episerver

- IBM Corporation

- Jahia

- Kentico

- Liferay

- Microsoft Corporation

- Opentext

- Oracle Corporation

- Salesforce

- SAP SE

- SDL plc

- Sitecore

- Squiz

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 257 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 23.2 Billion |

| Forecasted Market Value ( USD | $ 47.4 Billion |

| Compound Annual Growth Rate | 12.7% |

| Regions Covered | Global |