Global Brewery Equipment Market - Key Trends & Drivers Summarized

How is Brewery Equipment Evolving with Technological Advancements?

The brewery equipment market is evolving rapidly as technological advancements streamline brewing processes, improve product quality, and increase production efficiency. Modern breweries, both large-scale and craft, are investing in advanced equipment to meet the growing demand for diverse beer styles, increase production capacity, and enhance automation. Technologies such as automated brewing systems, advanced fermentation tanks, and high-efficiency filtration systems are helping brewers control every aspect of the brewing process with precision. This ensures consistency, improves the efficiency of ingredients usage, and reduces labor and production costs.Automation is a significant trend in the brewery equipment market. Automated systems allow brewers to control temperature, pressure, pH levels, and timing remotely, ensuring that each batch of beer adheres to strict quality standards. These systems also reduce the risk of human error and allow for greater scalability in production. In addition to automation, innovations in brewing equipment design, such as modular brewhouses and compact fermentation units, are allowing breweries to maximize space and improve operational flexibility. With the growing emphasis on sustainability, modern brewing equipment is also being designed to minimize water and energy consumption, reduce waste, and ensure the efficient use of raw materials, such as hops, malt, and yeast.

What Role Does Brewery Equipment Play in Craft Brewing?

Brewery equipment plays a crucial role in the craft brewing industry by enabling small and independent brewers to produce high-quality, innovative beer styles on a smaller scale while maintaining control over the brewing process. Unlike mass-produced beers, craft beers are often made in limited batches with a focus on unique flavors, aromas, and ingredients. As a result, craft brewers rely on specialized brewing equipment that allows for precision in mashing, boiling, fermentation, and conditioning processes. Craft brewers also require equipment that can be adapted to smaller production volumes without compromising the quality or consistency of the beer.Fermentation tanks, mash tuns, and wort kettles designed for craft brewing are typically smaller and more customizable, allowing brewers to experiment with different ingredients, such as new hop varieties, fruits, or spices. Equipment such as dry-hopping tanks, whirlpool separators, and microfiltration systems enable craft brewers to enhance the clarity, flavor, and aroma of their beers, which are key differentiators in the craft beer market. Moreover, as consumer preferences for locally brewed and artisanal beers grow, the demand for compact and versatile brewery equipment tailored to craft brewing continues to rise. This trend is particularly evident in the rise of microbreweries and brewpubs, which rely on smaller-scale brewing equipment to meet local demand and maintain a focus on quality and innovation.

How is Sustainability Shaping the Future of Brewery Equipment?

Sustainability is becoming a significant focus in the brewery equipment market, as breweries seek to reduce their environmental impact by minimizing energy and water usage, lowering emissions, and managing waste more efficiently. Beer production is resource-intensive, particularly in terms of water and energy consumption, and many breweries are looking for ways to adopt greener practices. Equipment manufacturers are responding to this demand by designing more energy-efficient brewhouses, water-recycling systems, and waste management solutions. These innovations not only help breweries meet environmental regulations but also reduce operational costs by optimizing resource use.Water conservation is one of the key areas of focus in sustainable brewery operations. Modern brewery equipment, such as closed-loop water systems and advanced filtration technologies, allows breweries to recycle and reuse water, significantly reducing their water footprint. In addition, energy-efficient brewing systems, such as heat recovery units and solar-powered brewhouses, help minimize energy consumption during the brewing process. Waste reduction is another important aspect of sustainability in brewing, with breweries investing in equipment that facilitates the recycling of spent grains, yeast, and hops for use as animal feed, bioenergy, or compost. As consumer demand for eco-friendly and sustainably produced beverages grows, breweries are increasingly adopting environmentally conscious practices, driving further innovation in brewery equipment.

What Factors Are Driving the Growth of the Brewery Equipment Market?

The growth of the brewery equipment market is driven by several factors, including the rising demand for craft beer, the expansion of the global beer market, and the increasing focus on automation and sustainability in brewing processes. Craft beer, in particular, has been a major growth driver, as consumers seek more diverse and innovative beer styles. The growing popularity of microbreweries, brewpubs, and small-scale craft breweries has led to increased demand for specialized brewing equipment that caters to smaller production volumes while maintaining high-quality standards. Additionally, as beer consumption continues to rise in emerging markets, large breweries are investing in new equipment to expand their production capacity and meet consumer demand.Technological advancements in brewery equipment, particularly in automation, are also contributing to market growth. Automated systems allow breweries to increase production efficiency, reduce labor costs, and maintain consistency across large batches of beer. Sustainability concerns are another key factor driving growth, as breweries seek to reduce their environmental impact through the adoption of energy-efficient and water-saving equipment. Government incentives for adopting sustainable practices, along with rising consumer demand for eco-friendly products, are encouraging breweries to invest in greener equipment. With these trends, the brewery equipment market is expected to continue its expansion, fueled by innovation, increasing demand for craft beer, and the need for more sustainable brewing solutions.

Report Scope

The report analyzes the Brewery Equipment market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Macrobrewery, Craft Brewery); Mode of Operation (Automatic, Semi-Automatic, Manual).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Macrobrewery Equipment segment, which is expected to reach US$17.7 Billion by 2030 with a CAGR of a 6.6%. The Craft Brewery Equipment segment is also set to grow at 6.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $5.7 Billion in 2024, and China, forecasted to grow at an impressive 10% CAGR to reach $7.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Brewery Equipment Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Brewery Equipment Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Brewery Equipment Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Alfa Laval, Criveller Group, Della Toffola, GEA Group, Hypro Group and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 33 companies featured in this Brewery Equipment market report include:

- Alfa Laval

- Criveller Group

- Della Toffola

- GEA Group

- Hypro Group

- Kaspar Schulz

- Krones Group

- Meura SA

- Ningbo Lehui International Engineering Equipment Co., Ltd.

- Paul Mueller

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Alfa Laval

- Criveller Group

- Della Toffola

- GEA Group

- Hypro Group

- Kaspar Schulz

- Krones Group

- Meura SA

- Ningbo Lehui International Engineering Equipment Co., Ltd.

- Paul Mueller

Table Information

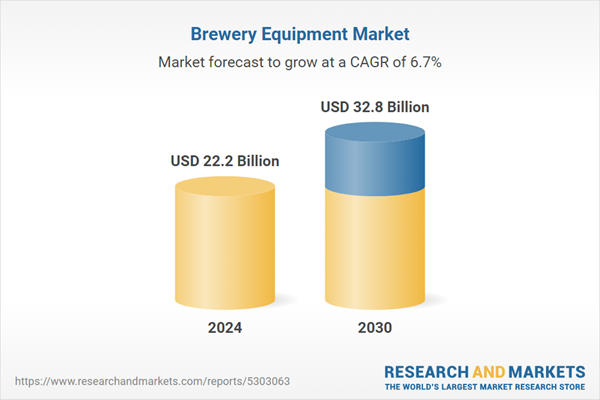

| Report Attribute | Details |

|---|---|

| No. of Pages | 267 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 22.2 Billion |

| Forecasted Market Value ( USD | $ 32.8 Billion |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | Global |