Global Body-in-White (BIW) Market - Key Trends & Drivers Summarized

What is Body-in-White (BIW) and How is it Critical to Vehicle Manufacturing?

Body-in-White (BIW) refers to the stage in automotive manufacturing when the vehicle's sheet metal components are welded together to form the basic skeleton of the car, before painting and assembly of other components such as the engine, interior, and trim. BIW is a crucial step in vehicle production, as it determines the structural integrity, safety, and weight of the final product. The design and materials used in the BIW process have a direct impact on the vehicle's crashworthiness, fuel efficiency, and overall performance. As automakers face increasing regulatory pressure to reduce emissions and improve fuel economy, BIW is at the forefront of innovation, particularly in terms of materials and manufacturing processes.Lightweight materials such as aluminum, high-strength steel, and advanced composites are being increasingly used in BIW manufacturing to reduce vehicle weight without compromising safety. Reducing the weight of the vehicle's body improves fuel efficiency and reduces carbon emissions, helping automakers meet stringent environmental regulations. At the same time, BIW processes are evolving with the adoption of advanced welding techniques, adhesives, and riveting methods to improve structural strength and durability. These innovations are making BIW manufacturing more efficient while enhancing the performance and safety of vehicles.

How are Lightweight Materials Influencing Body-in-White Manufacturing?

The increasing use of lightweight materials in Body-in-White (BIW) manufacturing is transforming the automotive industry by improving fuel efficiency, reducing emissions, and enhancing vehicle performance. Traditionally, steel was the primary material used in BIW construction due to its strength and affordability. However, as automakers strive to meet strict environmental regulations and consumer demand for more efficient vehicles, they are turning to lightweight materials such as aluminum, magnesium alloys, and carbon fiber-reinforced polymers (CFRP). These materials offer a higher strength-to-weight ratio, enabling automakers to reduce the overall weight of the vehicle while maintaining structural integrity and safety.Aluminum, in particular, is becoming a popular choice for BIW applications due to its corrosion resistance, recyclability, and ability to absorb impact energy in crashes. Many automakers, including luxury brands and electric vehicle manufacturers, are using aluminum in their BIW designs to improve performance and reduce weight. Additionally, high-strength steels are being developed to provide both strength and weight savings, allowing automakers to strike a balance between cost-effectiveness and efficiency. The adoption of these lightweight materials is also driving advancements in joining technologies, as traditional welding techniques may not be suitable for combining dissimilar materials like aluminum and steel. As a result, new methods such as laser welding, adhesives, and riveting are being employed in BIW manufacturing.

What Role Does BIW Play in Vehicle Safety and Crashworthiness?

Body-in-White (BIW) plays a critical role in determining the safety and crashworthiness of a vehicle by providing the structural framework that absorbs and dissipates impact energy during collisions. The design of the BIW must ensure that key areas of the vehicle, such as the passenger compartment, remain intact during a crash, while other areas are designed to crumple and absorb the force of the impact. This is achieved through the strategic placement of reinforcements, crumple zones, and the use of high-strength materials that can withstand the forces generated in a collision.Advanced simulation tools and crash testing methods are now being used in the BIW design process to optimize the structure for safety. Engineers can model various crash scenarios to assess how the BIW will perform under different conditions, allowing for the fine-tuning of the vehicle's structure before production begins. This process ensures that vehicles meet or exceed safety standards, providing protection to occupants in the event of a crash. As safety regulations become more stringent and consumer expectations for vehicle safety increase, BIW design is becoming increasingly sophisticated, with a focus on improving crash performance without adding unnecessary weight to the vehicle.

What Factors Are Driving the Growth of the Body-in-White Market?

The growth in the Body-in-White (BIW) market is driven by several key factors, including the rising demand for lightweight vehicles, advancements in materials technology, and the increasing focus on vehicle safety and efficiency. As automakers strive to meet fuel efficiency and emissions targets, particularly in light of stringent global regulations, the demand for lightweight BIW designs is growing. The shift toward electric vehicles (EVs) is also contributing to market growth, as EV manufacturers prioritize lightweight materials to improve battery efficiency and extend vehicle range.Advancements in materials such as high-strength steel, aluminum, and composites are playing a significant role in expanding the BIW market. These materials offer the strength needed for vehicle safety while reducing overall weight, making them an attractive option for automakers. In addition, the development of advanced manufacturing techniques, such as laser welding, adhesive bonding, and automated assembly processes, is enhancing the efficiency and precision of BIW production, leading to increased adoption in the automotive industry.

The growing emphasis on vehicle safety is another factor driving the BIW market. As safety regulations become more rigorous, automakers are investing in advanced BIW designs that optimize crash performance and ensure occupant protection. Furthermore, consumer demand for safer vehicles is pushing manufacturers to prioritize innovations in BIW construction. Finally, the rise of electric and autonomous vehicles is driving the need for more advanced BIW structures, which must accommodate new powertrain components and sensor systems while maintaining safety and performance standards.

Report Scope

The report analyzes the Body in White market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Construction Type (Monocoque, Frame Mounted); Material (Steel, Aluminum, CFRP, Other Materials); End-Use (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, Electric Vehicles).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Monocoque Construction segment, which is expected to reach US$68.6 Billion by 2030 with a CAGR of a 3.1%. The Frame Mounted Construction segment is also set to grow at 3.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $26.1 Billion in 2024, and China, forecasted to grow at an impressive 2.9% CAGR to reach $18.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Body in White Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Body in White Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Body in White Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aisin Seiki, Benteler International, CIE Automotive, Dura Automotive, Gestamp Automoción and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Body in White market report include:

- Aisin Seiki

- Benteler International

- CIE Automotive

- Dura Automotive

- Gestamp Automoción

- JBM Auto

- Kirchhoff Automotive

- Magna International

- Martinrea International

- Thyssenkrupp Group

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aisin Seiki

- Benteler International

- CIE Automotive

- Dura Automotive

- Gestamp Automoción

- JBM Auto

- Kirchhoff Automotive

- Magna International

- Martinrea International

- Thyssenkrupp Group

Table Information

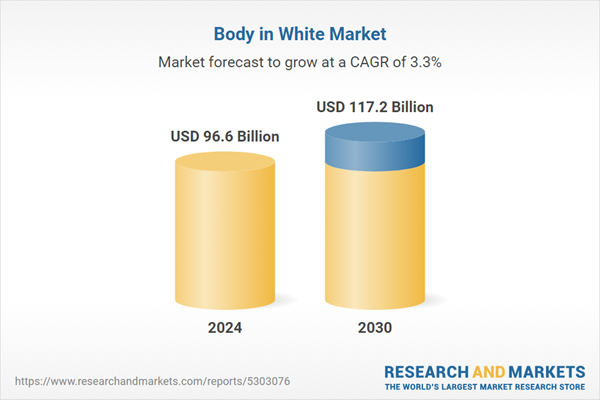

| Report Attribute | Details |

|---|---|

| No. of Pages | 228 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 96.6 Billion |

| Forecasted Market Value ( USD | $ 117.2 Billion |

| Compound Annual Growth Rate | 3.3% |

| Regions Covered | Global |