Global Blood Glucose Monitoring Systems Market - Key Trends & Drivers Summarized

How Are Blood Glucose Monitoring Systems Evolving with Technological Advancements?

The blood glucose monitoring (BGM) systems market is undergoing significant evolution due to advancements in technology, which are making glucose monitoring more accurate, convenient, and user-friendly for patients with diabetes. Traditional methods of monitoring blood glucose levels, such as finger-prick tests, are being replaced by continuous glucose monitoring (CGM) systems that offer real-time tracking of glucose levels with minimal invasiveness. CGM systems use sensors inserted under the skin to measure glucose levels continuously, allowing patients and healthcare providers to monitor trends and fluctuations more accurately. This shift from intermittent to continuous monitoring is improving diabetes management by enabling timely interventions and more personalized treatment plans.Wearable devices integrated with CGM technology are also gaining popularity, providing patients with a convenient, non-invasive way to track their blood glucose levels throughout the day. These devices are often connected to mobile apps, allowing users to view their glucose data in real-time, receive alerts about dangerous fluctuations, and share information with their healthcare providers. Additionally, advancements in artificial intelligence (AI) and data analytics are enhancing the accuracy of blood glucose monitoring systems by enabling predictive modeling, which can anticipate glucose fluctuations and help patients take preventive measures.

What Impact Do CGM Systems Have on Diabetes Management?

Continuous Glucose Monitoring (CGM) systems are having a profound impact on diabetes management by offering more detailed and real-time data on glucose levels, allowing patients to take proactive steps in managing their condition. Unlike traditional blood glucose meters, which require multiple finger-stick tests throughout the day, CGM systems provide a continuous stream of data, enabling users to monitor glucose trends and patterns. This real-time monitoring allows patients to identify how different activities, meals, and medications affect their glucose levels, helping them make informed decisions about their diet, exercise, and insulin use.CGM systems also enhance safety for patients by sending alerts when glucose levels are too high or too low, helping to prevent dangerous episodes of hyperglycemia or hypoglycemia. This feature is particularly beneficial for patients with type 1 diabetes, who are at greater risk of sudden glucose fluctuations. CGM systems also enable healthcare providers to access detailed glucose data over time, allowing for more accurate assessments and adjustments to treatment plans. By improving the quality and frequency of glucose data, CGM systems are transforming diabetes care and improving outcomes for millions of patients worldwide.

How Is Data Integration with Mobile Apps and AI Improving Blood Glucose Monitoring?

Data integration with mobile apps and AI is significantly improving the functionality of blood glucose monitoring systems, making diabetes management more convenient and personalized. Many modern glucose monitors and CGM devices are now equipped with Bluetooth technology, allowing them to sync with smartphone apps where users can track and manage their glucose levels. These apps often provide visual charts, historical data, and trend analysis, helping users understand their glucose patterns over time. Some apps also allow users to log meals, physical activity, and medications, providing a holistic view of their diabetes management.AI-powered algorithms are enhancing the predictive capabilities of blood glucose monitoring systems by analyzing historical data and predicting future glucose levels based on past trends. This can help patients anticipate glucose spikes or drops and adjust their behavior or insulin dosing accordingly. AI is also being used to develop closed-loop insulin delivery systems, also known as artificial pancreas systems, which automatically adjust insulin levels in response to real-time glucose readings. These advancements in data integration and AI are making blood glucose monitoring more proactive, reducing the burden on patients and improving overall diabetes management.

What Factors Are Driving the Growth of the Blood Glucose Monitoring Systems Market?

The growth in the blood glucose monitoring systems market is driven by several factors, including the increasing prevalence of diabetes worldwide, advancements in glucose monitoring technology, and the growing adoption of wearable devices. As the global incidence of diabetes continues to rise, particularly in developing countries, there is a growing demand for effective glucose monitoring solutions that help patients manage their condition. The shift from traditional finger-stick testing to continuous glucose monitoring (CGM) systems is a key growth driver, as these devices offer more accurate, real-time data and reduce the need for invasive testing.Technological advancements, such as the integration of CGM systems with mobile apps, AI, and data analytics, are also driving market growth by making glucose monitoring more convenient, accurate, and personalized. The growing popularity of wearable devices is another factor contributing to the expansion of the market, as consumers increasingly prefer non-invasive, connected solutions for managing their health. In addition, the aging population and the rise in sedentary lifestyles and unhealthy diets are leading to an increased prevalence of type 2 diabetes, further fueling the demand for blood glucose monitoring systems.

Regulatory support and reimbursement policies for CGM systems are also driving adoption, particularly in developed markets such as North America and Europe. Healthcare providers and insurance companies are recognizing the value of CGM systems in improving diabetes management and reducing the long-term costs associated with diabetes complications. Finally, increasing awareness about diabetes and the importance of glucose monitoring is leading to greater adoption of these systems, as patients become more proactive in managing their condition and preventing complications.

Report Scope

The report analyzes the Blood Glucose Monitoring Systems market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Product (Self-Monitoring, Continuous); Testing Site (Fingertip Testing, Alternate Site Testing); Patient Care Setting (Self / Home Care, Hospitals & Clinics); Application (Type 1 Diabetes, Type 2 Diabetes, Other Applications).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Self-Monitoring Systems segment, which is expected to reach US$21.4 Billion by 2030 with a CAGR of a 9.4%. The Continuous Monitoring Systems segment is also set to grow at 10.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $5.9 Billion in 2024, and China, forecasted to grow at an impressive 13.2% CAGR to reach $9.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Blood Glucose Monitoring Systems Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Blood Glucose Monitoring Systems Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Blood Glucose Monitoring Systems Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Abbott Laboratories, Acon Laboratories, Arkray, Ascensia Diabetes Care, B. Braun Melsungen and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Blood Glucose Monitoring Systems market report include:

- Abbott Laboratories

- Acon Laboratories

- Arkray

- Ascensia Diabetes Care

- B. Braun Melsungen

- Dexcom

- F. Hoffmann-La Roche

- Lifescan

- Medtronic

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abbott Laboratories

- Acon Laboratories

- Arkray

- Ascensia Diabetes Care

- B. Braun Melsungen

- Dexcom

- F. Hoffmann-La Roche

- Lifescan

- Medtronic

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 456 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 22.6 Billion |

| Forecasted Market Value ( USD | $ 40 Billion |

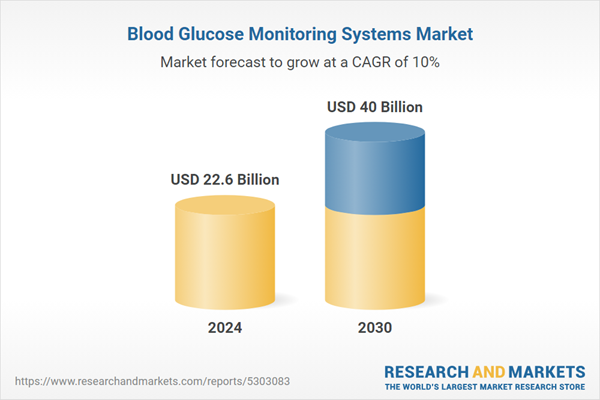

| Compound Annual Growth Rate | 10.0% |

| Regions Covered | Global |