Global Blockchain in Telecom Market - Key Trends & Drivers Summarized

How is Blockchain Transforming the Telecom Industry?

Blockchain technology is reshaping the telecommunications (telecom) industry by offering innovative solutions for improving data security, reducing fraud, and optimizing operational processes. Telecom companies, which manage vast amounts of sensitive data and oversee critical communications infrastructure, face constant challenges related to fraud, privacy breaches, and inefficient service delivery. Blockchain provides a decentralized, transparent, and secure ledger that can record and verify transactions and data exchanges across telecom networks. One of blockchain's most significant contributions to the telecom sector is its ability to combat fraud in areas such as roaming and identity management. With blockchain, telecom companies can create a secure and verifiable record of user identities and network usage, preventing fraudsters from manipulating data or engaging in unauthorized use of services.Blockchain also streamlines telecom operations, particularly in managing complex billing systems for services like roaming, data usage, and inter-carrier settlements. Smart contracts on blockchain can automatically calculate fees, enforce agreements, and trigger payments between telecom providers and their partners, reducing the time and administrative burden typically involved in these processes. This automation enhances efficiency and ensures accurate, timely payments for services rendered. Furthermore, blockchain can facilitate more transparent and secure communication infrastructure for the growing Internet of Things (IoT) ecosystem, helping telecom companies manage and monetize the vast networks of connected devices.

What Role Does Blockchain Play in Reducing Telecom Fraud and Enhancing Security?

Blockchain is emerging as a critical tool for reducing fraud and enhancing security in the telecom industry, where fraudulent activities cost billions of dollars annually. Telecom fraud, including SIM card fraud, identity theft, and international call fraud, is a pervasive issue that affects both service providers and customers. Blockchain combats this by creating an immutable, transparent record of transactions and user activities, making it nearly impossible for fraudsters to manipulate data or engage in unauthorized transactions. For instance, blockchain can secure user identity management systems, ensuring that only authorized users can access services and networks. With a decentralized approach to identity verification, telecom companies can reduce their reliance on centralized databases, which are often vulnerable to cyberattacks.Another area where blockchain is making an impact is in combating roaming fraud. When telecom customers travel abroad and use roaming services, fraudsters can exploit vulnerabilities in the billing and network handover processes to engage in unauthorized use of services, leading to revenue losses for providers. Blockchain's distributed ledger ensures real-time, transparent recording of roaming transactions, allowing telecom companies to verify usage and charges instantly, reducing the risk of fraud. In addition, blockchain enhances security by encrypting data transmitted across telecom networks, reducing the likelihood of data breaches and protecting customer privacy.

How Can Blockchain Optimize Telecom Operations and Data Management?

Blockchain is optimizing telecom operations and data management by automating key processes and improving data transparency. One of the most significant challenges telecom companies face is managing complex billing systems, particularly when it comes to services like roaming, inter-carrier settlements, and data usage. Traditional billing systems are often slow, inefficient, and prone to errors, leading to delayed payments and customer dissatisfaction. Blockchain streamlines these processes through smart contracts, which automatically execute agreements and payments based on predefined conditions. For instance, when a customer uses roaming services, a smart contract can automatically calculate the fees and trigger payments between the telecom providers involved, reducing delays and minimizing disputes.Blockchain also improves data management in telecom by providing a decentralized, secure platform for storing and sharing information. Telecom companies manage vast amounts of data, including customer profiles, call records, and network usage statistics. This data is often siloed in different systems, making it difficult to share and verify across the organization. Blockchain enables telecom providers to consolidate data in a single, tamper-proof ledger that all authorized parties can access. This enhances transparency, improves decision-making, and reduces operational inefficiencies. Furthermore, blockchain's secure data-sharing capabilities make it ideal for managing the growing number of IoT devices connected to telecom networks. With blockchain, telecom companies can track, monitor, and monetize IoT devices more efficiently, ensuring that data from these devices is accurate, secure, and accessible.

What Factors Are Driving the Growth of Blockchain in Telecom?

The growth in the blockchain in telecom market is driven by several factors, including the increasing demand for data security, the need to reduce fraud, and the growing complexity of telecom networks. As telecom companies handle more sensitive customer data and operate increasingly complex networks, the need for secure, efficient, and transparent systems is becoming critical. Blockchain provides a robust solution for securing data, preventing fraud, and streamlining telecom operations, making it an attractive option for service providers. The rise of 5G networks and the proliferation of IoT devices are also driving blockchain adoption, as telecom companies look for ways to manage and monetize the vast networks of connected devices that 5G will enable.Another key growth driver is the need for improved billing and settlement systems in telecom. Traditional systems are often slow, inefficient, and prone to errors, leading to disputes and revenue losses. Blockchain's smart contract capabilities automate these processes, ensuring accurate, timely payments and reducing administrative overhead. The growing threat of telecom fraud is also pushing companies to adopt blockchain solutions. Fraudulent activities such as SIM card cloning, international call fraud, and identity theft cost the telecom industry billions each year. Blockchain's ability to provide secure, immutable records of transactions and user identities is a powerful tool in combating these issues.

Additionally, regulatory support for blockchain in telecom is growing, as governments and industry bodies recognize the technology's potential to improve data security, reduce fraud, and enhance transparency. Telecom companies are increasingly partnering with blockchain startups and technology providers to develop innovative solutions that address the industry's challenges, further driving the market's growth.

Report Scope

The report analyzes the Blockchain in Telecom market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Provider (Infrastructure Providers, Application Providers, Middleware Providers); Application (OSS / BSS Processes, Identity Management, Payments, Connectivity Provisioning, Other Applications).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Regional Analysis

Gain insights into the U.S. market, valued at $1.3 Billion in 2024, and China, forecasted to grow at an impressive 74.2% CAGR to reach $15.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Blockchain in Telecom Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Blockchain in Telecom Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Blockchain in Telecom Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Abra, Auxesis Group, AWS, Bitfury, Blockchain Foundry and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 33 companies featured in this Blockchain in Telecom market report include:

- Abra

- Auxesis Group

- AWS

- Bitfury

- Blockchain Foundry

- Blockcypher

- Blocko

- Blockpoint

- Blockstream

- Cegeka

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abra

- Auxesis Group

- AWS

- Bitfury

- Blockchain Foundry

- Blockcypher

- Blocko

- Blockpoint

- Blockstream

- Cegeka

Table Information

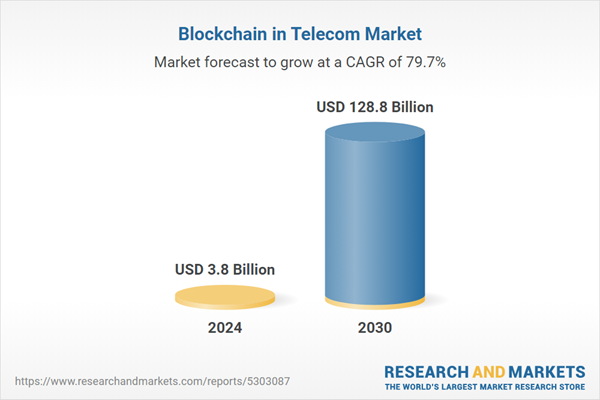

| Report Attribute | Details |

|---|---|

| No. of Pages | 137 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.8 Billion |

| Forecasted Market Value ( USD | $ 128.8 Billion |

| Compound Annual Growth Rate | 79.7% |

| Regions Covered | Global |