Global Biological Wastewater Treatment Market - Key Trends & Drivers Summarized

How Does Biological Wastewater Treatment Work and Why Is It Essential?

Biological wastewater treatment is an environmentally friendly process that uses microorganisms to break down organic contaminants in wastewater. Unlike chemical treatments that rely on synthetic compounds, biological treatment leverages naturally occurring bacteria and enzymes to transform pollutants into harmless byproducts such as water, carbon dioxide, and biomass. This process occurs in various stages: primary treatment removes large particles, secondary treatment involves biological processes to degrade organic matter, and tertiary treatment polishes the water for safe discharge or reuse. Primary types of biological treatment include aerobic, anaerobic, and anoxic processes, each targeting specific contaminants based on oxygen requirements. Aerobic treatment, commonly used in municipal facilities, requires oxygen to support the bacteria that consume organic matter, while anaerobic treatment, favored for industrial use, operates without oxygen to break down high-strength waste into methane, which can be harvested for energy. As urbanization increases and industrial operations expand, biological treatment's role becomes critical for managing wastewater sustainably, protecting water resources, and ensuring compliance with environmental regulations.What Are the Major Technological Innovations Transforming Biological Wastewater Treatment?

Technological advancements in biological wastewater treatment are revolutionizing the industry, enabling higher efficiency, reduced costs, and better scalability. One major development is the advent of membrane bioreactors (MBRs), which combine biological treatment with membrane filtration to produce high-quality effluent suitable for reuse. MBR technology reduces the footprint of treatment plants, lowers sludge production, and can handle fluctuations in water quality, making it ideal for urban and industrial applications. Another key innovation is the integration of moving bed biofilm reactors (MBBRs), which use biofilm carriers to increase the surface area for microbial growth, allowing for more effective contaminant degradation. Artificial intelligence (AI) and machine learning algorithms are also increasingly applied to optimize treatment processes, enabling real-time monitoring and automated adjustments to improve efficiency. Additionally, anaerobic treatment technologies are being improved with advanced reactors and biogas recovery systems that transform organic waste into renewable energy. These innovations not only make biological wastewater treatment more adaptable and cost-effective but also enhance its environmental impact by reducing greenhouse gas emissions and promoting energy neutrality.What Are the Key Applications and Benefits Across Various Sectors?

Biological wastewater treatment is widely used across multiple sectors, each leveraging it for specific benefits based on wastewater composition and treatment needs. Municipal wastewater treatment facilities rely on biological processes to treat domestic sewage, ensuring safe discharge into natural water bodies or even reclaiming water for non-potable uses like irrigation and industrial cooling. In the industrial sector, food and beverage manufacturers, pulp and paper mills, and chemical processing plants utilize biological treatment to manage high-strength waste rich in organic matter. The anaerobic digestion process in industrial facilities not only treats wastewater but also generates biogas, which can be converted into electricity or heat, creating a circular economy model. In agriculture, biological treatment plays a critical role in managing runoff and manure wastewater, preventing nutrient pollution in nearby water bodies. Specialized treatment systems, such as constructed wetlands, serve as low-energy, natural biological solutions in remote areas or facilities with minimal infrastructure. Additionally, the rapid growth of aquaculture has spurred the use of biological systems for nutrient control, improving water quality and supporting sustainable fish farming practices. Across these sectors, biological wastewater treatment enhances water quality, supports water reuse initiatives, and minimizes environmental impact, aligning with global sustainability goals.What Drives the Growth of the Biological Wastewater Treatment Market?

The growth in the biological wastewater treatment market is driven by several factors, including technological advancements, increasing regulations, and a rising emphasis on sustainability. Rapid urbanization and industrialization are primary drivers, as they increase the volume of wastewater that requires effective and sustainable treatment. Stringent environmental regulations worldwide are compelling industries and municipalities to adopt biological treatment technologies that meet compliance standards without harming the environment. Additionally, advancements in biofiltration and AI-driven process optimization are making biological treatment systems more efficient, scalable, and affordable, encouraging their adoption in both high - and low-income regions. The growing interest in water reuse, particularly in water-scarce areas, is another critical driver as biological treatment processes produce high-quality effluent that can be safely reused, addressing water scarcity challenges in a sustainable way. In sectors like food and beverage and aquaculture, consumer demand for eco-friendly practices and products is prompting industries to invest in biological treatment solutions to minimize their environmental footprint. Lastly, the increasing adoption of decentralized treatment systems, particularly in remote or rural areas, is expanding the market, as biological systems offer adaptable, low-energy solutions for smaller communities or facilities with limited infrastructure. These factors together underscore the pivotal role of biological wastewater treatment in sustainable water management, supporting the transition towards cleaner and more resilient water infrastructure globally.Report Scope

The report analyzes the Biological Wastewater Treatment market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Process Type (Aerobic, Anaerobic); End-Use (Industrial, Municipal).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Regional Analysis

Gain insights into the U.S. market, valued at $2.9 Billion in 2024, and China, forecasted to grow at an impressive 8.3% CAGR to reach $3.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Biological Wastewater Treatment Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Biological Wastewater Treatment Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Biological Wastewater Treatment Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aquatech International, Aqwise, Biogill, Biokube, Bioshaft Water Technology, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 38 companies featured in this Biological Wastewater Treatment market report include:

- Aquatech International

- Aqwise

- Biogill

- Biokube

- Bioshaft Water Technology, Inc.

- Bishop Water Technologies Inc.

- Bluetector AG

- Bluewater Bio Limited

- Condorchem Envitech, S.L.

- DAS Environmental Expert GmbH

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aquatech International

- Aqwise

- Biogill

- Biokube

- Bioshaft Water Technology, Inc.

- Bishop Water Technologies Inc.

- Bluetector AG

- Bluewater Bio Limited

- Condorchem Envitech, S.L.

- DAS Environmental Expert GmbH

Table Information

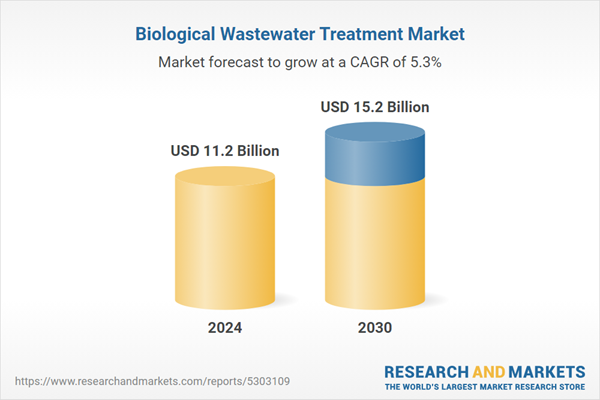

| Report Attribute | Details |

|---|---|

| No. of Pages | 269 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 11.2 Billion |

| Forecasted Market Value ( USD | $ 15.2 Billion |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Global |