Global Biodegradable Superabsorbent Materials Market - Key Trends and Drivers Summarized

What Are Biodegradable Superabsorbent Materials, and Why Are They Significant?

Biodegradable superabsorbent materials (BSAMs) are a groundbreaking development in absorbent technology, providing high-performance absorbency while addressing environmental concerns associated with conventional superabsorbents. Traditional superabsorbent polymers (SAPs), widely used in products such as diapers, sanitary pads, and agricultural soil enhancers, are typically derived from non-renewable petroleum sources and are designed to be long-lasting. While their absorbency is highly effective, these SAPs contribute significantly to long-term environmental waste, as they do not easily degrade in natural settings. In response to growing concerns about plastic waste and pollution, biodegradable superabsorbent materials have emerged as a more eco-friendly alternative. Unlike traditional SAPs, BSAMs are created from renewable, natural resources such as cellulose, starch, and chitosan, and they are engineered to decompose after disposal through microbial activity. This biodegradability allows BSAMs to minimize their environmental impact by breaking down more quickly under natural conditions. As awareness of sustainability grows globally, BSAMs are gaining recognition as a solution for reducing the environmental footprint of single-use products, offering the high absorbency necessary for consumer and industrial applications while supporting a circular economy and a reduced reliance on fossil fuels. By aligning with global efforts to address plastic pollution and waste, biodegradable superabsorbent materials are increasingly becoming a focus for industries committed to sustainable innovation.How Are Biodegradable Superabsorbent Materials Produced, and What Applications Do They Serve?

Biodegradable superabsorbent materials are primarily produced from renewable biopolymers like cellulose, starch, and chitosan, each of which can be modified to create highly absorbent and water-retentive structures. The production process often involves chemically or physically altering these natural polymers to enhance their absorbency and retention capacities. For example, cellulose-based superabsorbents, derived from plant fibers, undergo chemical crosslinking to create a robust network that can absorb large amounts of liquid relative to its weight. Starch, another common base material sourced from corn and potatoes, can also be modified to form superabsorbent structures that are suitable for use in hygiene products, packaging, and agriculture. Chitosan, derived from the shells of crustaceans, is particularly valued for its biodegradability and inherent antimicrobial properties, which make it ideal for wound care products and sanitary applications where hygiene is paramount. The applications for BSAMs are broad and varied. In personal care, they are used to develop eco-friendly diapers, sanitary pads, and incontinence products that naturally degrade after use, providing a sustainable option for single-use items. In agriculture, BSAMs are used as water-retentive soil additives that help reduce the need for frequent irrigation, promoting more efficient water use and supporting crop growth in arid regions. By addressing a wide range of needs across diverse industries, BSAMs demonstrate the versatility and promise of sustainable materials, offering viable alternatives to traditional superabsorbents that meet performance standards while being environmentally responsible.What Challenges Are Associated with Biodegradable Superabsorbent Materials?

Despite the promise of biodegradable superabsorbent materials, their development and widespread adoption are hindered by several challenges, primarily concerning production cost, performance optimization, and scalability. The cost of producing BSAMs remains higher than that of traditional petroleum-based superabsorbents, as renewable raw materials and the additional processing steps required to modify these biopolymers tend to be more expensive. This cost premium can be a significant barrier in price-sensitive markets like personal hygiene products, where large-scale production and affordability are key concerns. Additionally, while BSAMs offer excellent absorbency and biodegradability, achieving the same level of durability and liquid retention as conventional SAPs can be challenging. For instance, in products like diapers and sanitary pads, the material must not only absorb liquid effectively but also retain it under pressure without leaking. This resilience, which conventional SAPs can easily maintain, is more difficult to achieve with some biodegradable materials. Scalability also poses a considerable challenge, as BSAM production requires consistent access to renewable raw materials, which can be influenced by factors such as crop yields, seasonal availability, and competition from other industries, like biofuels and bioplastics. The variability in raw material supply can create supply chain inconsistencies, affecting both cost and production capacity. These challenges highlight the need for continued research and development to improve the cost-efficiency, performance, and scalability of BSAMs, ensuring they can compete effectively with traditional superabsorbents in both consumer and industrial applications.What Drives the Growth of the Biodegradable Superabsorbent Materials Market?

The growth of the biodegradable superabsorbent materials market is being fueled by rising environmental awareness, regulatory initiatives, and advancements in biopolymer technology that are making these materials increasingly viable as sustainable alternatives. Public and governmental concern over the long-term ecological impact of single-use plastics and non-biodegradable products has led to the introduction of regulations limiting plastic use and encouraging sustainable alternatives, particularly in industries like personal care and agriculture, where superabsorbents are widely used. Businesses, facing pressure to align with sustainable practices and respond to the demands of environmentally conscious consumers, are investing in BSAMs to replace traditional SAPs in products like diapers, sanitary pads, and agricultural water retention solutions. Consumer demand for sustainable options has accelerated, driven by growing awareness of plastic pollution and a desire for eco-friendly products that offer both performance and environmental responsibility. Technological advancements in biopolymer science have further propelled the market, enabling the development of BSAMs with improved absorbency, durability, and cost-efficiency. For instance, research into alternative feedstocks, such as agricultural byproducts and algae, has reduced dependence on food-based resources like corn and potato starch, enhancing the sustainability of BSAMs and expanding raw material availability. The expansion of composting infrastructure and advancements in waste management systems are supporting the adoption of biodegradable materials, as these facilities provide the controlled conditions necessary for efficient degradation of BSAMs. Together, these factors are driving rapid growth in the biodegradable superabsorbent materials market, positioning BSAMs as a crucial component of efforts to reduce environmental waste and promote sustainable development across a variety of industries.Report Scope

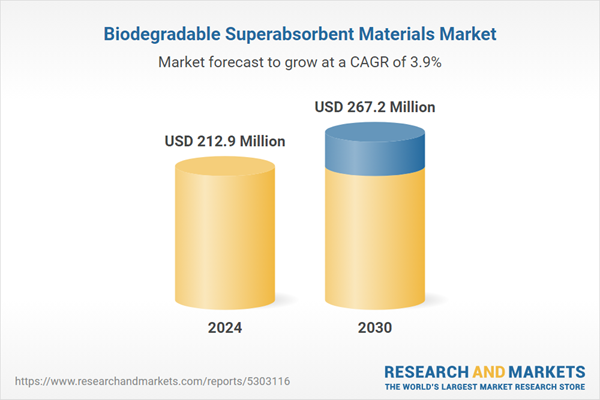

The report analyzes the Biodegradable Superabsorbent Materials market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Product (Polyvinyl Alcohol (PVA), Polyitaconic Acid, Polysaccharides, Polypeptide); Application (Disposable Diapers, Adult Incontinence Products, Female Hygiene, Agriculture, Other Applications).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Polyvinyl Alcohol (PVA) segment, which is expected to reach US$171.1 Million by 2030 with a CAGR of a 4%. The Polyitaconic Acid segment is also set to grow at 3.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $57.1 Million in 2024, and China, forecasted to grow at an impressive 3.7% CAGR to reach $42.4 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Biodegradable Superabsorbent Materials Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Biodegradable Superabsorbent Materials Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Biodegradable Superabsorbent Materials Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Amereq Inc, Archer Daniels Midland Company, BASF SE, Exotech Bio Solutions Ltd., Itaconix Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 16 companies featured in this Biodegradable Superabsorbent Materials market report include:

- Amereq Inc

- Archer Daniels Midland Company

- BASF SE

- Exotech Bio Solutions Ltd.

- Itaconix Corporation

- JRM Chemical, Inc.

- Nippon Shokubai Co., Ltd.

- Nuoer Chemical Australia Pty Ltd.

- SNF Floerger

- TryEco LLC

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Amereq Inc

- Archer Daniels Midland Company

- BASF SE

- Exotech Bio Solutions Ltd.

- Itaconix Corporation

- JRM Chemical, Inc.

- Nippon Shokubai Co., Ltd.

- Nuoer Chemical Australia Pty Ltd.

- SNF Floerger

- TryEco LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 122 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 212.9 Million |

| Forecasted Market Value ( USD | $ 267.2 Million |

| Compound Annual Growth Rate | 3.9% |

| Regions Covered | Global |