Global Bioanalytical Testing Services Market - Key Trends and Drivers Summarized

What Are Bioanalytical Testing Services, and Why Are They Vital?

Bioanalytical testing services are highly specialized analyses that measure drugs, metabolites, and other biologically significant molecules within complex biological matrices such as blood, plasma, urine, and tissues. These services are crucial to pharmaceutical development, playing a pivotal role in confirming the safety, efficacy, and quality of both drugs and biologics through every phase of research and development. By employing bioanalytical testing, scientists and regulatory bodies can obtain accurate data on how a drug interacts within the human body - essentially mapping out its pharmacokinetics (how the body absorbs, distributes, metabolizes, and excretes the drug) and pharmacodynamics (how the drug affects the body). Through methods like mass spectrometry, chromatography, and ligand-binding assays, bioanalytical testing services provide precise quantification of molecular concentrations, which enables critical decisions on dosage, therapeutic impact, and potential side effects. As the demand for novel and personalized medicine grows, bioanalytical testing is increasingly essential for guiding drug development, supporting safety evaluations, and ensuring regulatory compliance. In an era of rapid innovation, these services are indispensable for pharmaceutical companies seeking to bring safe, effective drugs to market while adhering to stringent quality standards.How Do Advanced Techniques Elevate the Standards of Bioanalytical Testing?

Over the years, bioanalytical testing has evolved significantly, with advanced techniques enabling higher levels of precision, sensitivity, and efficiency in analytical processes. Techniques such as mass spectrometry (MS) and liquid chromatography-mass spectrometry (LC-MS/MS) are foundational tools in modern bioanalysis, allowing scientists to detect and quantify minute concentrations of drugs and their metabolites in complex biological samples. These techniques are especially valuable for pharmacokinetic and pharmacodynamic assessments, as they provide robust, high-resolution data on how drugs behave within the body. Innovations like High-Resolution Mass Spectrometry (HRMS) add an additional layer of precision, enabling the identification of complex compound structures - a feature crucial for monitoring drug metabolism and tracking biomarkers over the course of disease progression or therapy. Ligand-binding assays, including Enzyme-Linked Immunosorbent Assays (ELISA) and radioimmunoassays, are indispensable for large molecule drugs like biologics and antibodies, where specificity and sensitivity are paramount. The adoption of automation and robotic systems for sample preparation has further advanced the field by streamlining workflows, reducing human error, and increasing throughput, which is especially valuable for managing the high sample volumes typical in clinical trials. Newer micro-sampling techniques now allow scientists to work with smaller sample sizes, making studies in sensitive populations, such as pediatrics, more feasible. Altogether, these technological advancements have not only increased the reliability and accuracy of bioanalytical data but have also enabled researchers to deliver results faster, supporting the complex decision-making processes that drive drug development and regulatory approval.What Challenges Do Bioanalytical Testing Labs Face?

Despite the critical importance of bioanalytical testing in drug development, laboratories in this field face numerous challenges, particularly around compliance, sample complexity, and the need for continuous technological investment. Stringent regulatory requirements set by organizations like the FDA, EMA, and other global regulatory bodies require bioanalytical labs to adhere to rigorous validation protocols to ensure that their data is reliable, reproducible, and in compliance with Good Laboratory Practice (GLP) standards. Meeting these standards requires substantial time and resources, as labs must maintain continuous quality control, thorough method validation, and detailed documentation for each step of the testing process. The complexity of biological samples further complicates testing; biological matrices such as blood, tissue, or urine contain numerous substances that can interfere with analytical results, requiring advanced sample preparation methods that add operational complexity and necessitate skilled technicians and sophisticated equipment. Additionally, as the field advances, bioanalytical labs are under constant pressure to invest in cutting-edge instruments, software, and staff training to remain competitive and compliant. The rise of biologics and other large molecules, which require highly sensitive and specific assays, also adds to the technical demands placed on these labs. Balancing these challenges while delivering high-quality, reproducible results remains an ongoing struggle, underscoring the need for a highly skilled workforce, rigorous protocols, and a willingness to adapt to emerging technologies and regulatory changes in this rapidly evolving field.What Drives the Growth of the Bioanalytical Testing Services Market?

The bioanalytical testing services market is experiencing robust growth due to several key factors, including the expanding pharmaceutical and biotechnology sectors, increasing demand for biologics and biosimilars, and a growing trend toward outsourcing. The rising development of new therapies in areas such as oncology, immunology, and rare diseases has led to greater demand for bioanalytical testing to support drug approvals and meet regulatory standards. Biologics and biosimilars, which are complex large-molecule drugs that require specialized testing, have also added layers of complexity to drug development and heightened the need for bioanalytical services that can deliver the necessary specificity and sensitivity. Many pharmaceutical and biotech companies are opting to outsource these testing services to contract research organizations (CROs) to reduce costs, focus on core R&D, and gain access to specialized expertise and technology. The rise of personalized medicine and biomarker-driven therapies has further fueled demand for bioanalytical testing, as these treatments often require detailed analyses to determine optimal dosing and efficacy on an individual level. Advances in high-throughput screening, automation, and data analytics have also contributed to market growth by enabling faster and more cost-effective testing, helping companies accelerate clinical trial timelines and regulatory submissions. As the need for precise, validated data continues to grow, bioanalytical testing services are expected to remain a crucial component of modern drug development, solidifying the market's position as an essential service within the pharmaceutical and biotech industries.Report Scope

The report analyzes the Bioanalytical Testing Services market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Molecule Type (Small, Large); Test Type (Bioavailability, Bioequivalence, Absorption Distribution Metabolism Excretion (ADME), Pharmacokinetics (PK), Pharmacodynamics (PD), Other Test Types); Workflow (Sample Analysis, Sample Preparation, Other Workflows).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Small Molecule Type segment, which is expected to reach US$4.7 Billion by 2030 with a CAGR of a 7.6%. The Large Molecule Type segment is also set to grow at 6% CAGR over the analysis period.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Bioanalytical Testing Services Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Bioanalytical Testing Services Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Bioanalytical Testing Services Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

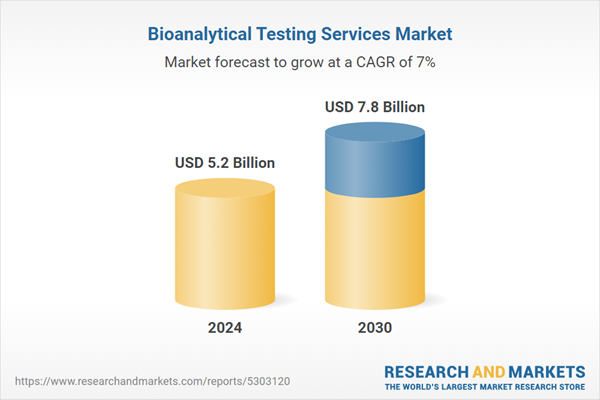

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Almac Group, Altasciences, Bioagilytix Labs, Celerion, Charles River and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Bioanalytical Testing Services market report include:

- Almac Group

- Altasciences

- Bioagilytix Labs

- Celerion

- Charles River

- Eurofins Scientific

- Frontage Labs

- Icon Plc

- Intertek Group Plc

- Iqvia Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Almac Group

- Altasciences

- Bioagilytix Labs

- Celerion

- Charles River

- Eurofins Scientific

- Frontage Labs

- Icon Plc

- Intertek Group Plc

- Iqvia Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 373 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 5.2 Billion |

| Forecasted Market Value ( USD | $ 7.8 Billion |

| Compound Annual Growth Rate | 7.0% |

| Regions Covered | Global |