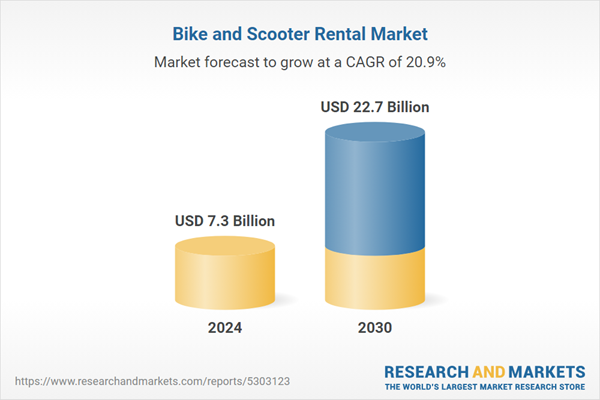

Global Bike and Scooter Rental Market - Key Trends and Drivers Summarized

Why Are Bike and Scooter Rentals Gaining Popularity in Cities?

Bike and scooter rentals have seen rapid adoption in urban centers around the world, driven by the increasing demand for convenient, eco-friendly, and flexible transportation options that align with the modern, on-the-go lifestyle of city dwellers. As urban areas grapple with mounting challenges such as traffic congestion, limited parking, and high pollution levels, micromobility solutions like bike and scooter rentals offer a sustainable and practical alternative for short-distance travel. These services are especially popular among younger demographics and environmentally conscious individuals who prioritize sustainability and often prefer the convenience of rentals over car ownership. Furthermore, bike and scooter rentals provide a convenient solution for bridging the “last mile” gap between public transportation hubs and final destinations, making it easier for commuters to complete their journeys efficiently without needing a car. The ease of use facilitated by mobile apps has also been a game-changer, allowing users to locate and unlock nearby bikes or scooters within minutes. These apps make the experience user-friendly and accessible, encouraging a broad user base that spans tourists, residents, and business travelers alike. The COVID-19 pandemic has also accelerated this shift, as many people now prefer individual, open-air transportation modes over crowded public transit, further embedding bike and scooter rentals into the urban transportation fabric.How Are Technology and Innovation Enhancing the Rental Experience?

Technological innovation has been instrumental in enhancing the user experience and operational efficiency of bike and scooter rentals, making them a seamless part of urban mobility. Central to this experience is the mobile app, which allows users to locate, unlock, and pay for rentals effortlessly, transforming what was once a cumbersome process into a quick and user-friendly transaction. Many rental services now incorporate GPS tracking into their vehicles, enabling users to find the nearest bike or scooter instantly and allowing providers to track fleet distribution and ensure vehicles are available in high-demand areas. The introduction of electric models, particularly electric scooters and e-bikes, has further expanded the appeal by making it easier for users to cover longer distances and navigate hills or rough terrain with minimal effort. Additionally, some companies have integrated advanced safety features into their scooters, such as automated braking systems, speed limiters, and in-app safety tutorials, to promote safer riding practices and reduce accident rates. From an operational perspective, data analytics and AI are increasingly used by rental providers to predict demand, optimize vehicle distribution, and schedule maintenance, ensuring that fleets remain readily accessible and in good condition. These advancements have collectively elevated the micromobility rental experience, attracting a larger and more diverse user base while enabling providers to scale operations efficiently.What Challenges Are Facing the Bike and Scooter Rental Industry?

Despite their rising popularity, bike and scooter rentals face a range of challenges, especially in terms of regulation, safety, and urban infrastructure. Regulatory compliance is one of the most pressing issues, as cities worldwide work to balance the benefits of micromobility with public safety and infrastructure demands. Unregulated use of rental scooters and bikes has led to issues with sidewalk congestion, improper parking, and accidents, prompting city governments to impose restrictions, such as capping the number of vehicles allowed per operator, designating specific parking zones, and mandating safety features on vehicles. Safety remains a critical concern, as electric scooters in particular have seen higher accident rates due to factors like speed, rider inexperience, and lack of protective equipment. In response, some companies have implemented speed limits, safety training modules within apps, and even provided helmet rentals, although these solutions are not universally adopted and vary widely by region. Infrastructure also poses a significant barrier to adoption, as many cities lack adequate bike lanes or designated parking areas, which can create friction between riders, pedestrians, and motorists. Furthermore, seasonality and weather can impact rental usage, leading to fluctuating demand that affects profitability. Collectively, these challenges underscore the need for collaborative efforts between cities and providers, continued investment in infrastructure, and adaptive business strategies that address both regulatory requirements and user safety.What Factors Are Fueling the Expansion of the Bike and Scooter Rental Market?

The growth in the bike and scooter rental market is fueled by several significant trends, including increasing urbanization, a heightened focus on sustainability, and rapid advancements in electric vehicle technology. As urban populations grow, more people are facing issues like traffic congestion, limited parking availability, and the high costs of car ownership, which has led many to seek out more efficient, cost-effective transportation alternatives. Bike and scooter rentals offer a flexible and affordable solution that allows users to bypass traffic and parking constraints, making them an appealing option for short-distance travel within cities. Environmental sustainability is another major factor, as both consumers and governments push for greener transportation solutions to reduce urban carbon emissions. Many city governments are actively promoting micromobility services as part of their environmental goals, offering incentives or forming partnerships with rental providers to encourage more sustainable commuting practices. The introduction of electric bikes and scooters has further accelerated market growth by enabling users to travel longer distances comfortably and efficiently, which has expanded the potential user base and made rentals attractive to a wider demographic. Changes in consumer behavior, particularly among younger, urban populations, have also contributed to this growth, as many prioritize on-demand access and flexibility over vehicle ownership, viewing micromobility as a more adaptable and convenient option. Moreover, advances in mobile technology and connectivity have streamlined the rental process, while data-driven insights and machine learning help providers manage their fleets more effectively, predict usage trends, and optimize for demand. These factors, coupled with regulatory support in many urban areas, are propelling the bike and scooter rental market forward, establishing it as a critical component of the evolving urban mobility landscape.Report Scope

The report analyzes the Bike and Scooter Rental market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Service Type (Pay As You Go, Subscription-based); Propulsion (Electric, Gasoline, Pedal); Vehicle Type (Bike, Scooter, Other Vehicle Types).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Pay As You Go Service segment, which is expected to reach US$13.4 Billion by 2030 with a CAGR of a 21.4%. The Subscription-based Service segment is also set to grow at 20.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.8 Billion in 2024, and China, forecasted to grow at an impressive 26.1% CAGR to reach $6.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Bike and Scooter Rental Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Bike and Scooter Rental Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Bike and Scooter Rental Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Beam, Bird, Blinkee.City, Bolt, Cityscoot and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Bike and Scooter Rental market report include:

- Beam

- Bird

- Blinkee.City

- Bolt

- Cityscoot

- COUP

- Ecooltra

- Emmy

- Hopr

- Jump

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Beam

- Bird

- Blinkee.City

- Bolt

- Cityscoot

- COUP

- Ecooltra

- Emmy

- Hopr

- Jump

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 372 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 7.3 Billion |

| Forecasted Market Value ( USD | $ 22.7 Billion |

| Compound Annual Growth Rate | 20.9% |

| Regions Covered | Global |