Global BFSI Security Market - Key Trends and Drivers Summarized

Why Is Security Essential in the BFSI Sector?

Security is paramount in the BFSI (Banking, Financial Services, and Insurance) sector, as it safeguards sensitive financial data, protects against fraud, and ensures the integrity of financial transactions. Given the vast amounts of data handled daily - ranging from customer personal information to transaction records and financial assets - BFSI institutions are prime targets for cyberattacks and fraud schemes. Breaches and unauthorized access can have severe consequences, including financial loss, reputational damage, and legal repercussions. Additionally, the rise of digital banking, mobile apps, and online financial services has expanded the attack surface, making robust security solutions essential to protect against cyber threats. Security protocols in the BFSI sector typically encompass data encryption, multifactor authentication, access control, and intrusion detection systems to create a multi-layered defense against unauthorized access. With increasing regulatory requirements around data protection, BFSI institutions are mandated to implement stringent security measures, reinforcing the trust customers place in them. In an era where financial interactions are predominantly digital, security in the BFSI sector not only preserves operational integrity but also maintains consumer confidence in financial institutions.How Is BFSI Security Adapting to New Threats and Digital Transformation?

As the BFSI sector undergoes rapid digital transformation, security approaches are evolving to meet new threats arising from advancements in technology and the growing sophistication of cybercriminals. The widespread adoption of mobile banking, cloud services, and digital wallets has introduced new vulnerabilities, requiring BFSI institutions to invest in adaptive and proactive security solutions. Threat intelligence, which involves real-time monitoring of emerging threats and suspicious activities, has become crucial for identifying potential risks before they escalate into serious breaches. Artificial intelligence (AI) and machine learning (ML) are increasingly integrated into BFSI security, enabling real-time analysis of transaction patterns to detect anomalies and potential fraud. Endpoint security solutions protect the expanding number of access points in mobile banking, ATMs, and remote work devices used by employees. Identity verification technologies, such as biometrics and behavioral analytics, have also been widely adopted to enhance customer authentication and minimize risks associated with identity theft. As the BFSI sector continues to digitize, the shift toward AI-powered, real-time, and adaptive security measures is critical to staying ahead of cyber threats, supporting both the security of digital platforms and the trust of customers.What Role Does Regulatory Compliance Play in BFSI Security?

Regulatory compliance is a foundational aspect of BFSI security, as it sets stringent guidelines and standards for data protection, transaction transparency, and risk management. Regulations such as the General Data Protection Regulation (GDPR), Payment Card Industry Data Security Standard (PCI DSS), and Anti-Money Laundering (AML) laws mandate that BFSI institutions implement comprehensive security measures to protect customer data and maintain transaction integrity. Non-compliance with these regulations can lead to substantial fines, reputational damage, and legal consequences, making compliance a top priority for BFSI organizations. To meet these standards, BFSI institutions must adopt security measures like encryption, access control, and continuous monitoring of transactions to detect and prevent fraudulent activities. Regulatory requirements also drive the adoption of secure data management practices, where customer data is stored, processed, and transferred with high levels of protection. Compliance mandates further underscore the importance of periodic security audits, vulnerability assessments, and incident response plans, which help institutions identify and address potential weaknesses. By aligning security strategies with regulatory requirements, BFSI institutions not only reduce risk but also enhance operational transparency, strengthen customer trust, and create a robust framework for handling sensitive financial data securely.What Is Driving the Growth in the BFSI Security Market?

The growth in the BFSI security market is driven by several key factors, including the rising frequency of cyberattacks, regulatory demands, technological advancements, and the increasing adoption of digital financial services. As cyber threats become more sophisticated, the BFSI sector faces heightened risk from ransomware, phishing, identity theft, and malware attacks that specifically target financial systems. This escalating threat landscape has compelled BFSI institutions to prioritize security investments to safeguard their infrastructure and data, thereby fueling demand for advanced security solutions. Additionally, compliance with stringent regulatory standards around data protection and financial transparency has created a market need for specialized security services and technologies, such as data encryption, multifactor authentication, and advanced monitoring systems. Technological advancements, particularly in artificial intelligence, machine learning, and blockchain, are also shaping BFSI security strategies, as these innovations enhance real-time threat detection, automate risk analysis, and streamline identity verification processes. With the rapid growth of digital banking, mobile payments, and online financial services, there is an increasing reliance on cloud security, endpoint protection, and robust data protection measures to address the expanded attack surface. Furthermore, as customers become more aware of privacy and security issues, they expect BFSI institutions to provide secure and trustworthy digital experiences. These factors, combined with the evolving cyber threat landscape and regulatory pressures, drive continuous growth in the BFSI security market, with institutions striving to adopt comprehensive, proactive, and compliant security solutions that protect both their infrastructure and their customers.Report Scope

The report analyzes the BFSI Security market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Information Security, Physical Security); End-Use (Banks, Insurance Companies, Other End-Uses).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Information Security segment, which is expected to reach US$131.6 Billion by 2030 with a CAGR of a 13.4%. The Physical Security segment is also set to grow at 11.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $24.9 Billion in 2024, and China, forecasted to grow at an impressive 16.6% CAGR to reach $48.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global BFSI Security Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global BFSI Security Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global BFSI Security Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Booz Allen Hamilton, Inc., Cisco Systems, Inc., Computer Sciences Corporation, EMC Corporation, Honeywell International, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 38 companies featured in this BFSI Security market report include:

- Booz Allen Hamilton, Inc.

- Cisco Systems, Inc.

- Computer Sciences Corporation

- EMC Corporation

- Honeywell International, Inc.

- IBM Corporation

- Mcafee, Inc. (Intel Security Group)

- Sophos Group PLC.

- Symantec Corporation

- Trend Micro Incorporated

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Booz Allen Hamilton, Inc.

- Cisco Systems, Inc.

- Computer Sciences Corporation

- EMC Corporation

- Honeywell International, Inc.

- IBM Corporation

- Mcafee, Inc. (Intel Security Group)

- Sophos Group PLC.

- Symantec Corporation

- Trend Micro Incorporated

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 272 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

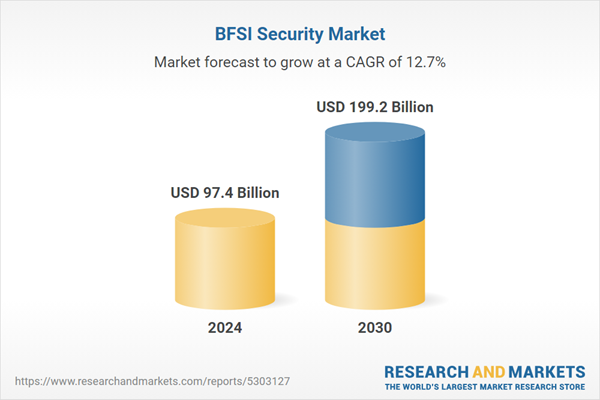

| Estimated Market Value ( USD | $ 97.4 Billion |

| Forecasted Market Value ( USD | $ 199.2 Billion |

| Compound Annual Growth Rate | 12.7% |

| Regions Covered | Global |