Global Battery Additives Market - Key Trends and Drivers Summarized

Why Are Battery Additives Critical in Modern Energy Storage?

Battery additives have become essential in modern energy storage, playing a pivotal role in enhancing battery performance, extending lifespan, and ensuring safety across a wide range of applications. Additives are specialized chemicals or materials introduced into the battery's electrolyte, electrodes, or separators to improve specific operational parameters, making batteries more efficient and resilient. In lithium-ion batteries, for instance, additives can significantly increase energy density, enhance charge acceptance, reduce internal resistance, and stabilize the electrolyte even at higher voltages, which is crucial for optimal performance. These improvements enable batteries to charge faster, last longer, and deliver more consistent energy output. Furthermore, battery additives are critical in addressing issues like thermal runaway, dendrite formation, and capacity degradation - common problems that can lead to reduced lifespan and safety risks, especially in high-demand applications such as electric vehicles, renewable energy storage, and consumer electronics. With the exponential growth in the battery market, particularly in sectors focused on electrification and sustainable energy solutions, the demand for advanced additives has surged. By optimizing battery stability and safety, these additives allow manufacturers to meet the pressing need for powerful, reliable, and durable batteries that can operate under diverse conditions, fueling further innovation in energy storage technology.How Are Battery Additives Tailored to Different Battery Technologies?

Battery additives are carefully formulated to meet the specific requirements of various battery chemistries, each with distinct demands for performance, durability, and stability. In lithium-ion batteries, for example, additives like film-forming agents help create a stable solid electrolyte interphase (SEI) layer on the anode, preventing unwanted side reactions and enhancing capacity retention. This stabilization is critical in ensuring that lithium-ion batteries maintain consistent performance over hundreds of charge cycles. Within lithium-ion battery categories, different chemistries like lithium iron phosphate (LFP) and nickel-cobalt-manganese (NCM) have unique needs, often requiring additives to boost thermal stability, suppress degradation, and enhance cycle life - qualities essential for batteries in electric vehicles where longevity and safety are paramount. In contrast, lead-acid batteries, widely used in automotive and backup power systems, benefit from carbon-based additives that reduce sulfation and improve charge acceptance, which prolongs the battery's life and enables more efficient charging. Emerging battery technologies, such as solid-state and lithium-sulfur batteries, require entirely new additive approaches. These technologies promise higher energy densities but face challenges like dendrite formation and stability at high capacities. For solid-state batteries, researchers are exploring additives that can stabilize the solid electrolyte interface, a key to achieving the higher energy densities these batteries offer. Tailoring additives to specific chemistries has become instrumental in advancing the unique capabilities of each battery technology, optimizing them for applications ranging from consumer electronics to industrial energy storage.What Role Does Technology Play in Developing Effective Battery Additives?

Technological advancements have revolutionized the development and effectiveness of battery additives, allowing researchers to engineer highly specific solutions that significantly improve battery safety, durability, and performance. Advanced materials science and nanotechnology enable the precise design of additives on a molecular scale, providing tailored solutions for issues like thermal stability, conductivity, and chemical compatibility. Nanoparticle additives, for example, are used to create stable SEI layers on battery anodes, preventing the capacity fade that commonly occurs over repeated charging cycles. These nanoparticles not only improve the battery's lifespan but also help maintain stable performance, a critical factor for applications such as electric vehicles, where consistent energy output is vital. Artificial intelligence (AI) and machine learning have also become integral to additive design, enabling researchers to analyze vast datasets and predict the behavior of potential additives across various battery chemistries. This data-driven approach accelerates the discovery of novel additives and allows for rapid experimentation, significantly shortening development times and enhancing additive effectiveness. Furthermore, advanced analytical tools like in situ electron microscopy and spectroscopy give researchers real-time insights into how additives interact with battery components throughout the charge and discharge cycles. By understanding these interactions at the molecular level, scientists can design additives that enhance performance, improve energy density, and prevent degradation, driving battery technology beyond its current limitations and meeting the increasing demands of modern energy storage systems.What Are the Key Drivers of Growth in the Battery Additives Market?

The growth in the battery additives market is driven by several factors, including the rising demand for high-performance, reliable batteries across multiple sectors, continuous technological advancements in additive design, and increasing regulatory and environmental pressures. As industries such as electric vehicles (EVs), renewable energy storage, and consumer electronics experience exponential growth, there is a critical need for batteries that can deliver long cycle life, rapid charging capabilities, and stability under intensive use. Battery additives are essential in addressing these requirements by helping to mitigate challenges such as capacity fade, voltage instability, and electrolyte degradation, which directly impact battery lifespan and performance. Regulatory and safety standards are also significant growth drivers; with stricter regulations around battery safety, particularly in large-scale applications like EVs and grid storage, manufacturers are compelled to use additives that reduce risks associated with thermal runaway and ensure safer battery operation. Furthermore, as the global focus shifts toward decarbonization and sustainable energy solutions, there is increasing interest in developing eco-friendly additives that support battery recycling processes and reduce environmental impact. This shift is particularly relevant in the EV and renewable energy sectors, where sustainable practices are integral to long-term growth. The trend toward cleaner, greener additive solutions aligns well with the broader goals of the energy transition. Investments in research and development continue to yield innovations in additive technology, such as bio-derived and low-toxicity additives, which support both performance enhancements and environmental goals. Together, these factors underscore the expansive potential of the battery additives market, driven by the need for safer, more efficient, and durable batteries that align with the electrification and sustainability objectives of industries worldwide.Report Scope

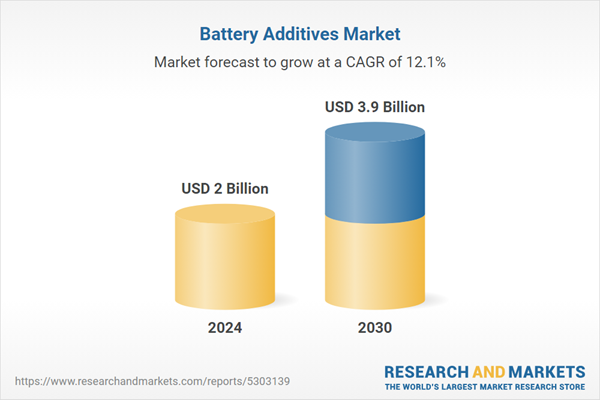

The report analyzes the Battery Additives market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Application (Lead-acid Batteries, Lithium-ion Batteries, Other Applications).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Lead-acid Batteries Application segment, which is expected to reach US$1.7 Billion by 2030 with a CAGR of a 12.1%. The Lithium-ion Batteries Application segment is also set to grow at 13.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $509.6 Million in 2024, and China, forecasted to grow at an impressive 15.7% CAGR to reach $925.9 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Battery Additives Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Battery Additives Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Battery Additives Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 3M, Altana, Borregaard, Cabot Corporation, Hammond Group and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Battery Additives market report include:

- 3M

- Altana

- Borregaard

- Cabot Corporation

- Hammond Group

- HOPAX

- Imerys

- Orion Engineered Carbons

- Penox

- SGL Group

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M

- Altana

- Borregaard

- Cabot Corporation

- Hammond Group

- HOPAX

- Imerys

- Orion Engineered Carbons

- Penox

- SGL Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 184 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2 Billion |

| Forecasted Market Value ( USD | $ 3.9 Billion |

| Compound Annual Growth Rate | 12.1% |

| Regions Covered | Global |