Global Military Trucks Market - Key Trends and Drivers Summarized

How Are Military Trucks Supporting Ground Operations?

Military trucks are a critical component of ground operations, providing the transportation and logistical support needed to move personnel, equipment, and supplies across challenging terrain. These trucks are designed to operate in extreme conditions, including rough terrains, harsh climates, and combat zones, ensuring that military forces can maintain mobility and operational readiness in any environment. Military trucks come in various configurations, including light, medium, and heavy-duty vehicles, each designed for specific tasks, such as troop transport, cargo delivery, and equipment recovery. The demand for military trucks is growing as defense organizations seek to modernize their fleets and enhance mobility in combat and support missions. Advanced military trucks are equipped with modern technologies, such as GPS navigation systems, communication equipment, and autonomous driving capabilities, to improve operational efficiency and reduce the risk to personnel. Additionally, military trucks are being developed with increased payload capacity, improved fuel efficiency, and enhanced protection against threats such as mines and improvised explosive devices (IEDs).What Technological Advancements Are Shaping the Military Trucks Market?

Several key advancements are shaping the military trucks market, including the development of hybrid and electric vehicles, autonomous driving systems, and advanced armor technologies. The shift towards hybrid and electric military trucks is being driven by the need for more fuel-efficient and environmentally sustainable vehicles. These trucks offer extended range and reduced fuel consumption, making them ideal for long-range missions in remote areas where fuel resupply is limited. Electric military trucks are also quieter than traditional diesel-powered vehicles, providing a tactical advantage in stealth operations. Autonomous driving technologies are another significant trend in the military trucks market. Unmanned military trucks can be used for supply convoys, reducing the risk to personnel in dangerous environments. Additionally, advancements in armor technologies are enhancing the survivability of military trucks by providing better protection against ballistic threats, mines, and IEDs. Modern military trucks are also equipped with active protection systems that can detect and neutralize incoming threats, improving the safety of troops and cargo.How Do Market Segments Define the Growth of Military Trucks?

Types of military trucks include light, medium, and heavy-duty trucks, with heavy-duty trucks accounting for the largest market share due to their use in transporting heavy equipment and supplies. Light-duty trucks, used primarily for troop transport and reconnaissance missions, are also experiencing significant growth as military forces focus on mobility and rapid response capabilities. In terms of payload capacity, military trucks are categorized by their ability to carry specific weight loads, ranging from light trucks with payloads under 2.5 tons to heavy trucks that can carry over 10 tons. The heavy-duty segment is expected to see the highest growth due to the increasing need for transporting large equipment and supplies in combat and logistics operations. Applications of military trucks include troop transport, cargo delivery, and equipment recovery, with cargo delivery representing the largest market segment.What Factors Are Driving the Growth in the Military Trucks Market?

The growth in the military trucks market is driven by several factors, including the modernization of military fleets, the increasing demand for fuel-efficient and autonomous vehicles, and the need for enhanced mobility in ground operations. As defense organizations focus on improving the mobility and logistics capabilities of their forces, the demand for advanced military trucks is rising. The development of hybrid and electric military trucks is also contributing to market growth, as these vehicles offer greater range and fuel efficiency. Additionally, the increasing adoption of autonomous driving technologies and advanced armor systems is enhancing the operational capabilities and survivability of military trucks, creating new opportunities for growth in the market.Report Scope

The report analyzes the Military Trucks market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Truck Type (Heavy, Light, Medium); Transmission Type (Automatic, Semi-Automatic, Manual); Application (Cargo / Logistics, Troop, Utility).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Heavy Trucks segment, which is expected to reach 9.9 Thousand Units by 2030 with a CAGR of a 4.2%. The Light Trucks segment is also set to grow at 3.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at 5 Thousand Units in 2024, and China, forecasted to grow at an impressive 5.9% CAGR to reach 4.9 Thousand Units by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Military Trucks Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Military Trucks Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Military Trucks Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Arquus, General Dynamics, Iveco S.p.A., Krauss-Maffei Wegmann, Mercedes-Benz AG and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Military Trucks market report include:

- Arquus

- General Dynamics

- Iveco S.p.A.

- Krauss-Maffei Wegmann

- Mercedes-Benz AG

- Mitsubishi Heavy Industries

- Oshkosh Corporation, Inc.

- Rheinmetall AG

- Tata Motors

- Tatra Trucks A.S.

- Textron Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Arquus

- General Dynamics

- Iveco S.p.A.

- Krauss-Maffei Wegmann

- Mercedes-Benz AG

- Mitsubishi Heavy Industries

- Oshkosh Corporation, Inc.

- Rheinmetall AG

- Tata Motors

- Tatra Trucks A.S.

- Textron Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 375 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

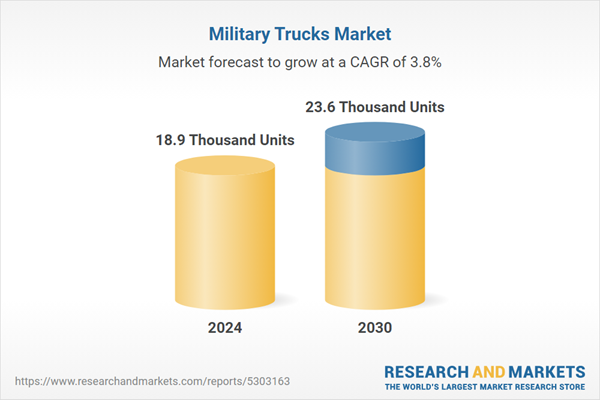

| Estimated Market Value in 2024 | 18.9 Thousand Units |

| Forecasted Market Value by 2030 | 23.6 Thousand Units |

| Compound Annual Growth Rate | 3.8% |

| Regions Covered | Global |