Global Cold-End Exhaust System Aftermarket - Key Trends & Drivers Summarized

How Is the Cold-End Exhaust System Aftermarket Vital for Automotive Performance and Compliance?

The cold-end exhaust system aftermarket is essential for maintaining and improving vehicle performance, managing emissions, and ensuring compliance with increasingly stringent environmental regulations. This part of the exhaust system, which includes components like the muffler, tailpipe, and exhaust tips, plays a crucial role in minimizing noise pollution, reducing harmful emissions, and maintaining optimal fuel efficiency. Over time, these components are subject to wear and corrosion due to exposure to moisture, salt, and road debris, which can compromise their effectiveness. In older vehicles, the degradation of these parts often results in excessive noise, higher emissions, and even reduced engine efficiency. Thus, upgrading or replacing cold-end exhaust components has become a vital step in preserving vehicle functionality, especially as consumers and regulatory bodies emphasize the importance of emissions reduction and environmental responsibility. The aftermarket sector for cold-end exhaust systems has grown in response to these demands, offering a wide variety of replacement options that cater to different vehicle types, usage patterns, and consumer preferences. This includes systems specifically designed for fuel economy and emission reduction, as well as performance-focused options that enhance vehicle sound and appearance. From everyday passenger cars to heavy-duty commercial trucks, the aftermarket provides consumers with tailored solutions that help meet performance and regulatory standards without requiring the purchase of an entirely new vehicle. As a result, the cold-end exhaust aftermarket plays a dual role in the automotive ecosystem: it helps extend the lifespan and compliance of aging vehicles and offers a path for customization and improvement, making it an indispensable part of the broader automotive industry.How Are Technological Advancements Improving Cold-End Exhaust Systems?

Technological advancements in materials and design are transforming cold-end exhaust systems, making them more efficient, resilient, and customizable to suit various consumer demands. Innovations in materials, such as high-grade stainless steel, aluminized steel, and advanced alloy coatings, have increased the durability and resistance of these components to corrosion and wear. This has been particularly impactful in regions with harsh climates where road salt and moisture accelerate degradation. High-performance exhaust components now use advanced coatings, like ceramic or chrome, which not only add to the aesthetic appeal but also enhance heat resistance, ultimately extending the life of these components. Additionally, these advancements in materials are aligned with an industry shift towards more sustainable production practices, reducing the frequency of replacements and waste.Beyond material advancements, digital manufacturing technologies such as CAD (Computer-Aided Design) software and 3D printing have revolutionized the design and production of cold-end exhaust systems. These technologies enable manufacturers to optimize exhaust flow, reduce back pressure, and enhance sound characteristics with precision, offering a significant improvement in both efficiency and performance. Active noise control, a recent innovation in exhaust technology, allows drivers to customize the sound profile of their exhaust based on driving conditions or personal preferences. These improvements are not only satisfying consumer demand for customization but also ensuring better performance metrics, fuel efficiency, and emissions reduction. The intersection of materials science and digital design is pushing the boundaries of what cold-end exhaust systems can achieve, making them more adaptable and high-performing than ever.

Which Vehicles and Consumer Segments Are Driving Demand in the Cold-End Exhaust System Aftermarket?

The demand for cold-end exhaust components spans a diverse range of vehicles and consumer segments, from passenger cars to heavy-duty trucks and specialty vehicles. Automotive enthusiasts and performance-oriented consumers are significant contributors to this market, as they often seek upgrades that enhance the sound, appearance, and performance of their vehicles. These individuals may opt for high-end exhaust tips, resonators, and mufflers that produce a unique auditory experience while maintaining optimal functionality. The desire for vehicle customization among these consumers has led to a surge in aftermarket options that cater to different tastes, allowing them to enhance the aesthetics and auditory experience of their vehicles. Commercial and heavy-duty vehicle operators, such as fleet owners and logistics companies, also drive demand for cold-end exhaust systems. In this segment, durability, fuel efficiency, and emissions compliance are paramount. Cold-end exhaust systems with robust corrosion-resistant properties and enhanced longevity reduce the need for frequent replacements, translating to lower maintenance costs for fleet managers. Additionally, as regulations around emissions tighten, especially in urban areas, commercial operators are increasingly investing in aftermarket exhaust systems that help maintain compliance with environmental standards. This wide range of end-users, from individual consumers to commercial operators, highlights the versatility and critical role of the cold-end exhaust aftermarket in meeting the diverse needs of today's automotive landscape.What's Driving Growth in the Cold-End Exhaust System Aftermarket?

The growth in the cold-end exhaust system aftermarket is driven by several factors, including the rapid advancement of materials and manufacturing technologies, the expansion of vehicle fleets worldwide, and an increasing consumer interest in vehicle customization and performance enhancement. Material advancements, such as the development of corrosion-resistant alloys and high-temperature coatings, have significantly improved the durability and performance of aftermarket exhaust systems. These innovations not only meet the demands of extreme environments but also reduce the frequency of replacement, aligning with consumer preferences for longer-lasting products. Additionally, advancements in digital manufacturing techniques, like CAD and 3D printing, have allowed manufacturers to create exhaust systems with optimized airflow and reduced back pressure, directly appealing to performance-focused consumers who prioritize fuel efficiency and power. The global increase in vehicle ownership, particularly in developing regions, has fueled demand for aftermarket components as vehicles age and require replacement parts. Consumers are also showing a heightened interest in personalizing their vehicles, with cold-end exhaust systems offering an accessible entry point for customization. Exhaust upgrades enable drivers to modify sound, improve aesthetics, and enhance vehicle performance without altering fundamental mechanics, making them popular among consumers seeking both functionality and style. Additionally, as e-commerce platforms expand access to aftermarket parts, consumers have more options and information at their fingertips, allowing them to choose products that meet their specific requirements. Together, these drivers paint a positive growth trajectory for the cold-end exhaust system aftermarket, as innovation, consumer demand, and accessibility continue to shape the future of this dynamic sector.Report Scope

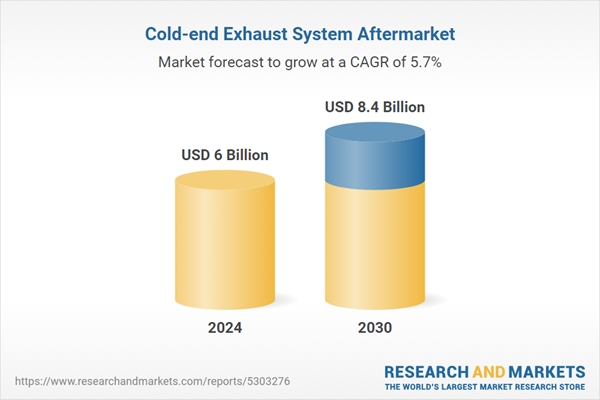

The report analyzes the Cold-end Exhaust System Aftermarket market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: System Outlook (Basic, Performance); End-Use (Passenger Cars, Commercial Vehicles).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Basic System segment, which is expected to reach US$5.4 Billion by 2030 with a CAGR of a 5.6%. The Performance System segment is also set to grow at 5.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.6 Billion in 2024, and China, forecasted to grow at an impressive 8.2% CAGR to reach $1.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Cold-end Exhaust System Aftermarket Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Cold-end Exhaust System Aftermarket Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Cold-end Exhaust System Aftermarket Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Bosal Group, Calsonic Kansei Corporation, Dynomax Ultra Flo, Eberspächer Exhaust Aftermarket GmbH & Co. KG, Faurecia and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Cold-end Exhaust System Aftermarket market report include:

- Bosal Group

- Calsonic Kansei Corporation

- Dynomax Ultra Flo

- Eberspächer Exhaust Aftermarket GmbH & Co. KG

- Faurecia

- Flowmaster, Inc.

- MagnaFlow

- Magneti Marelli S.p.A.

- Rogue Engineering

- Tenneco Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Bosal Group

- Calsonic Kansei Corporation

- Dynomax Ultra Flo

- Eberspächer Exhaust Aftermarket GmbH & Co. KG

- Faurecia

- Flowmaster, Inc.

- MagnaFlow

- Magneti Marelli S.p.A.

- Rogue Engineering

- Tenneco Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 273 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 6 Billion |

| Forecasted Market Value ( USD | $ 8.4 Billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Global |