Global Cold Flow Improvers Market - Key Trends & Drivers Summarized

Why Are Cold Flow Improvers Essential in the Petroleum and Diesel Industries?

Cold flow improvers play a critical role in the petroleum and diesel industries by enhancing the flow properties of fuels at low temperatures, preventing gelling, clogging, and other operational issues. In colder climates, diesel and other fuels can form wax crystals that cause blockages in pipelines, fuel injectors, and storage tanks, leading to engine failures and increased maintenance costs. Cold flow improvers work by modifying the crystal structure of paraffin in fuels, reducing their size and preventing them from aggregating and blocking fuel systems. This technology ensures that fuels remain pumpable and functional even in sub-zero temperatures, making it essential for industries that rely on heavy machinery, transport fleets, and diesel engines operating in cold environments. With the growing global demand for efficient fuel performance, cold flow improvers have become an indispensable solution, helping industries avoid costly downtime and maintain operational efficiency regardless of seasonal temperature changes.How Are Technological Advancements Shaping Cold Flow Improvers?

Technological advancements are significantly enhancing the performance, efficiency, and environmental compatibility of cold flow improvers. Innovations in chemical engineering have led to the development of advanced polymer-based additives that provide more effective cold flow properties, catering to the diverse needs of various fuel types, including biodiesel blends, ultra-low sulfur diesel (ULSD), and renewable diesel. These modern cold flow improvers are formulated to offer low-temperature operability without compromising fuel quality, making them compatible with high-performance engines. Additionally, manufacturers are increasingly focusing on eco-friendly formulations that reduce harmful emissions, aligning with global regulatory standards for fuel additives. Bio-based cold flow improvers are also emerging as a sustainable alternative, designed to perform well in renewable diesel and biodiesel blends. The integration of cold flow improvers with digital monitoring systems in large fuel storage facilities allows for real-time tracking of fuel temperatures and cold flow characteristics, enabling better management and preventive maintenance. These technological advancements ensure that cold flow improvers not only support optimal fuel performance but also align with the industry's shift toward sustainable and efficient fuel solutions.Which Industries Are Driving Demand for Cold Flow Improvers Beyond Fuel Production?

While fuel production remains the primary industry for cold flow improvers, several other sectors are driving demand as they encounter similar challenges with low-temperature fuel performance. The automotive and transportation industries, particularly heavy-duty truck fleets, require cold flow improvers to ensure reliable engine performance in cold climates, minimizing the risk of downtime and maintenance issues. The marine industry, which relies on diesel fuel for shipping operations, also adopts cold flow improvers to maintain fuel flow in harsh, cold environments encountered in oceanic transport. Agriculture, construction, and mining sectors, which operate large diesel-powered equipment in remote or high-altitude locations, benefit from cold flow improvers to prevent equipment malfunctions and maintain productivity in winter months. Even the aviation industry has specific requirements for cold flow improvers to ensure that aviation fuels, especially in jet engines operating in low temperatures, remain stable and fluid. This cross-industry adoption demonstrates the versatile and indispensable role of cold flow improvers in enabling reliable fuel use across diverse applications and environments.What's Driving Growth in the Cold Flow Improvers Market?

The growth in the cold flow improvers market is driven by several factors, including the rising demand for ultra-low sulfur diesel (ULSD) and biodiesel, advancements in additive technology, and regulatory requirements for efficient fuel performance. With the shift toward cleaner, sulfur-reduced fuel options like ULSD and biodiesel, the need for effective cold flow improvers has increased, as these fuels tend to have higher pour points and are more susceptible to gelling in cold conditions. Technological advancements in polymer additives and bio-based cold flow improvers have further propelled market growth, offering solutions that are more effective and environmentally friendly, aligning with the industry's sustainability goals. Stringent regulations in colder regions, which require fuels to meet specific low-temperature operability standards, have also driven adoption as companies strive to comply with these requirements to avoid operational risks and penalties. Moreover, the growing infrastructure for cold storage and long-distance transport has created a demand for reliable additives that ensure fuel stability over extended periods. These factors collectively underscore the strong growth trajectory of the cold flow improvers market, as industries prioritize solutions that support fuel efficiency, environmental standards, and operational reliability in challenging cold climates.Report Scope

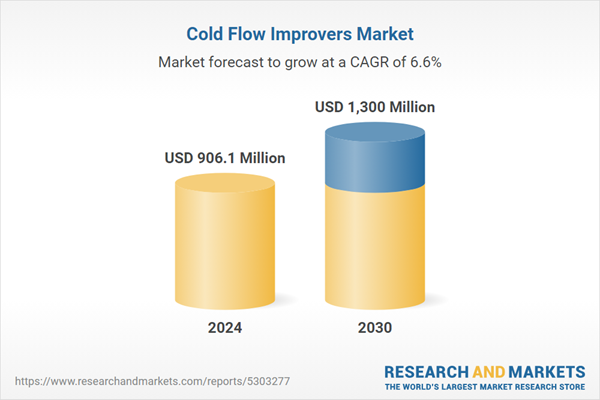

The report analyzes the Cold Flow Improvers market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Polyalkyl Methacrylate, Ethylene Vinyl Acetate, Polyalpha Olefin, Other Types); Application (Diesel Fuel, Lubricating Oil, Aviation Fuel, Other Applications); End-Use (Automotive, Aerospace & Defense, Other End-Uses).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Polyalkyl Methacrylate segment, which is expected to reach US$490.7 Million by 2030 with a CAGR of a 7.4%. The Ethylene Vinyl Acetate segment is also set to grow at 6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $233.3 Million in 2024, and China, forecasted to grow at an impressive 10.3% CAGR to reach $323.4 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Cold Flow Improvers Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Cold Flow Improvers Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Cold Flow Improvers Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Afton Chemicals, Baker Hughes, BASF, Bell Performance, Cestoil Chemical and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 47 companies featured in this Cold Flow Improvers market report include:

- Afton Chemicals

- Baker Hughes

- BASF

- Bell Performance

- Cestoil Chemical

- Chevron Oronite

- Clariant AG

- Drof Ketal

- Ecolab

- Evonik Industries

- Infineum International Limited

- Innospec

- Lubrizol Corporation

- Tianhe Chemicals

- Total

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Afton Chemicals

- Baker Hughes

- BASF

- Bell Performance

- Cestoil Chemical

- Chevron Oronite

- Clariant AG

- Drof Ketal

- Ecolab

- Evonik Industries

- Infineum International Limited

- Innospec

- Lubrizol Corporation

- Tianhe Chemicals

- Total

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 386 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 906.1 Million |

| Forecasted Market Value ( USD | $ 1300 Million |

| Compound Annual Growth Rate | 6.6% |

| Regions Covered | Global |