Global Cloud Computing in Education Market - Key Trends & Drivers Summarized

Why Is Cloud Computing Transforming the Education Sector?

Cloud computing has become a transformative force in education, enabling institutions to modernize their infrastructure, support remote learning, and improve accessibility to learning resources. By hosting resources on the cloud, educational institutions can offer students and teachers access to data, applications, and learning materials from any location, reducing the need for physical infrastructure and on-campus facilities. For schools and universities, cloud computing provides a scalable and flexible solution that supports diverse learning styles and needs, from K-12 to higher education and specialized training programs. Cloud solutions enable collaboration through real-time document sharing, virtual labs, and online classrooms, fostering a more inclusive and adaptable learning environment. Furthermore, as educational institutions increasingly adopt hybrid and online learning models, cloud computing offers a reliable platform for delivering uninterrupted education, even in times of crisis, such as during the COVID-19 pandemic. This capability to offer high-quality, on-demand education is positioning cloud computing as an essential component in modernizing education and ensuring equitable access to learning for students globally.How Are Technological Advancements in Cloud Computing Enhancing Education?

Advancements in cloud computing technologies are significantly enhancing educational tools and resources, making learning more interactive, personalized, and data-driven. Artificial Intelligence (AI) and machine learning (ML) integrated with cloud systems enable personalized learning experiences, where AI-driven platforms can recommend content based on a student's learning pace and preferences. Cloud-enabled data analytics allow institutions to track student performance and engagement in real-time, enabling teachers to intervene proactively and provide personalized support. Interactive tools like virtual labs and simulations hosted on the cloud offer experiential learning that would otherwise require costly physical setups, allowing students to engage in hands-on activities in fields like science, engineering, and medicine from anywhere. Additionally, cloud-based collaboration platforms support project-based learning by allowing students and teachers to work together in real-time, regardless of their physical location. Cybersecurity features have also advanced, ensuring that sensitive data is protected as students and faculty access resources remotely. These technological enhancements have made cloud computing more robust, supporting an interactive, secure, and adaptable learning environment that responds to the needs of both educators and students.Which Educational Institutions Are Leading the Adoption of Cloud Computing?

While universities and higher education institutions initially led the adoption of cloud computing, K-12 schools and specialized training centers are increasingly embracing the technology to support digital learning and resource management. In higher education, cloud platforms are widely used for administrative tasks, digital libraries, and virtual labs, allowing universities to streamline their operations and provide students with access to extensive learning resources. Community colleges and vocational institutions are also leveraging cloud solutions to offer flexible and accessible programs, particularly beneficial for adult learners and working students. In K-12 education, cloud computing is helping schools implement Learning Management Systems (LMS) that manage student records, enable online assignments, and facilitate parent-teacher communication. Public school districts, facing budgetary constraints, are finding cloud computing cost-effective for managing data and supporting distance learning. Furthermore, training centers and corporate education programs are adopting cloud-based platforms to provide upskilling and reskilling programs, especially in high-demand fields like technology, healthcare, and management. This expansion across different education segments underscores the versatility and growing importance of cloud computing in supporting diverse learning needs and operational requirements.What's Driving Growth in the Cloud Computing in Education Market?

The growth in the cloud computing in education market is driven by several factors, including the rise of digital learning, advancements in cloud-based educational tools, and the need for cost-effective infrastructure. The shift toward digital and hybrid learning models, accelerated by the COVID-19 pandemic, has made cloud computing essential for delivering flexible and accessible education. Advancements in cloud technology, such as AI-driven analytics, virtual classrooms, and cybersecurity solutions, have made cloud computing more appealing by enhancing the quality and security of remote learning. Cost-effectiveness is another significant driver, as cloud solutions reduce the need for on-site servers and IT infrastructure, making digital transformation more accessible for schools with limited budgets. Increasing demand for personalized and experiential learning experiences, such as virtual labs and real-time collaboration tools, has further supported market growth as cloud platforms can deliver these resources efficiently. Additionally, the rising need for data storage and management in large educational institutions has increased the adoption of cloud-based data solutions, as they provide scalability and streamlined operations. Together, these drivers reflect the growing demand for cloud computing in education as institutions seek versatile, cost-effective solutions that support modern teaching and learning needs.Report Scope

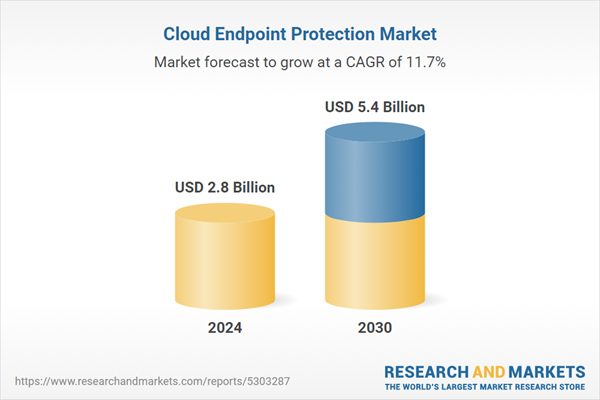

The report analyzes the Cloud Endpoint Protection market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Component (Solutions, Services); Vertical (BFSI, IT & Telecom, Healthcare, Manufacturing, Media & Entertainment, Government & Defense, Other Verticals).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Cloud Endpoint Protection Solutions segment, which is expected to reach US$3.5 Billion by 2030 with a CAGR of a 11.4%. The Cloud Endpoint Protection Services segment is also set to grow at 12.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $769.2 Million in 2024, and China, forecasted to grow at an impressive 11% CAGR to reach $836.9 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Cloud Endpoint Protection Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Cloud Endpoint Protection Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Cloud Endpoint Protection Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Avast, Bitdefender, Carbon Black, Cisco Systems, Commvault and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Cloud Endpoint Protection market report include:

- Avast

- Bitdefender

- Carbon Black

- Cisco Systems

- Commvault

- Comodo

- Cososys

- Crowdstrike

- Endgame

- Eset

- Fireeye

- Fortinet

- F-Secure Corporation

- K7 Computing

- Kaspersky Lab

- Malwarebytes

- Mcafee

- Palo Alto Networks

- Panda Security

- Sentinelone

- Sophos

- Symantec

- Trend Micro

- Vipre Security

- Webroot

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Avast

- Bitdefender

- Carbon Black

- Cisco Systems

- Commvault

- Comodo

- Cososys

- Crowdstrike

- Endgame

- Eset

- Fireeye

- Fortinet

- F-Secure Corporation

- K7 Computing

- Kaspersky Lab

- Malwarebytes

- Mcafee

- Palo Alto Networks

- Panda Security

- Sentinelone

- Sophos

- Symantec

- Trend Micro

- Vipre Security

- Webroot

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 178 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.8 Billion |

| Forecasted Market Value ( USD | $ 5.4 Billion |

| Compound Annual Growth Rate | 11.7% |

| Regions Covered | Global |