Global Clinical Trial Imaging Market - Key Trends & Drivers Summarized

Why Is Imaging Essential in Clinical Trials?

Imaging has become an indispensable tool in clinical trials, providing accurate and quantifiable data on the efficacy and safety of new treatments. Clinical trial imaging involves the use of advanced imaging modalities such as MRI, CT scans, PET scans, and ultrasound to monitor biological responses to investigational drugs or devices. Imaging allows researchers to assess changes in anatomy, tissue composition, and molecular activity, offering clear insights into disease progression and treatment impact. In oncology trials, for instance, imaging is used to measure tumor size and growth rates, while in neurology studies, it helps monitor structural changes in the brain and neurological function. This visual data enables researchers to detect changes that might be invisible to other assessment methods, enhancing the trial's reliability and providing evidence to support regulatory submissions. As trials grow increasingly complex, the role of imaging has expanded beyond basic assessments, helping researchers make data-driven decisions, reduce trial risks, and improve the overall precision of study outcomes.How Are Technological Advancements Transforming Clinical Trial Imaging?

Technological advancements in imaging are revolutionizing the clinical trial landscape, making imaging faster, more accurate, and more detailed than ever before. AI and machine learning are key drivers of this transformation, as they allow for automated image analysis, quantification, and pattern recognition. With AI-powered software, researchers can identify and measure even subtle changes over time, improving the precision of treatment assessments. Advanced imaging modalities, such as functional MRI (fMRI) and positron emission tomography (PET), provide deeper insights into physiological processes and molecular pathways, making them invaluable for trials studying complex diseases like cancer and neurodegenerative disorders. Cloud computing and digital storage advancements have also facilitated real-time image sharing and collaboration across global trial sites, ensuring that data can be reviewed and analyzed remotely by experts. Additionally, 3D imaging and digital biomarkers have emerged as critical tools in clinical trials, allowing for highly detailed visualization and quantification of disease markers. These advancements not only streamline the imaging process but also enhance the accuracy and consistency of trial data, making imaging a central component in the development of new therapies.Which Therapeutic Areas Are Driving Demand for Clinical Trial Imaging?

The demand for clinical trial imaging is growing across multiple therapeutic areas, including oncology, neurology, cardiology, and musculoskeletal disorders. Oncology remains the largest driver, as imaging is essential for tracking tumor growth, metastasis, and response to novel cancer treatments. Advanced imaging techniques, such as PET and MRI, provide the detailed views needed to monitor tumor behavior and treatment efficacy. In neurology, imaging is crucial for evaluating brain structure, function, and degeneration in conditions like Alzheimer's disease, Parkinson's, and multiple sclerosis. Clinical trials in cardiology also heavily rely on imaging to assess cardiac function, blood flow, and structural changes in heart tissue, which are critical in evaluating new drugs or interventions for heart disease. Furthermore, clinical trials studying musculoskeletal disorders, such as osteoarthritis and rheumatoid arthritis, use imaging to monitor bone and joint changes over time. This diverse demand for clinical trial imaging underscores its versatility and critical role in advancing research across high-stakes therapeutic areas where detailed, quantifiable data is essential to developing effective treatments.What's Driving Growth in the Clinical Trial Imaging Market?

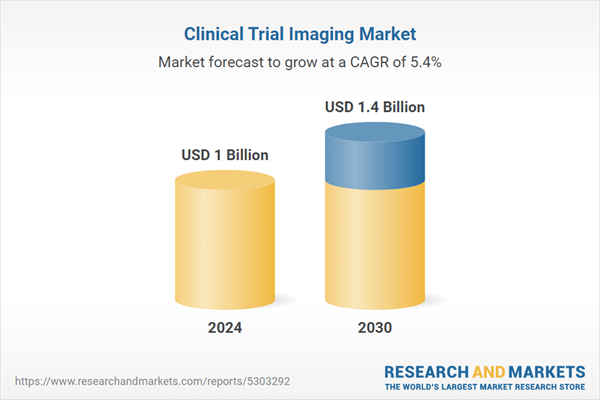

The growth in the clinical trial imaging market is driven by several factors, including the increasing complexity of clinical trials, advancements in imaging technology, and the rising prevalence of chronic diseases. As clinical trials become more complex, with demands for precise and real-time data, imaging provides a reliable solution for monitoring and quantifying patient responses, making it essential in trials for complex diseases like cancer, neurological disorders, and cardiovascular diseases. Technological advancements, particularly in AI-driven image analysis and remote data sharing, have made imaging faster and more accessible, improving trial efficiency and accuracy. The growing prevalence of chronic and degenerative diseases, especially in aging populations, has also led to a surge in demand for clinical trials, fueling the need for imaging to track disease progression and therapeutic impact. Additionally, regulatory authorities increasingly recognize imaging as a reliable endpoint in clinical trials, encouraging its use and adoption across various studies. The rise of decentralized trials and telemedicine, which allow imaging to be conducted remotely and integrated into digital trial workflows, further supports market growth by expanding access to imaging for diverse patient populations. These drivers collectively indicate a robust growth trajectory for the clinical trial imaging market as it evolves to meet the demands of modern medical research.Report Scope

The report analyzes the Clinical Trial Imaging market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Service (Project & Data Management, Operational Imaging Services, Reading & Analytical Services, Clinical Trial Design & Consultation Services, System & Technology Support Services); End-Use (Contract Research Organizations, Biotechnology & Pharmaceutical Companies, Medical Devices Manufacturers, Academic & Government Research Institutes, Other End-Uses).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Project & Data Management Service segment, which is expected to reach US$472.8 Million by 2030 with a CAGR of a 6.2%. The Operational Imaging Services segment is also set to grow at 4.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $276.1 Million in 2024, and China, forecasted to grow at an impressive 9.2% CAGR to reach $316.5 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Clinical Trial Imaging Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Clinical Trial Imaging Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Clinical Trial Imaging Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Bioclinica, Inc., Biomedical Systems Corporation, Biotelemetry, Inc., Cardiovascular Imaging Technologies, LLC, ERT Clinical and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 12 companies featured in this Clinical Trial Imaging market report include:

- Bioclinica, Inc.

- Biomedical Systems Corporation

- Biotelemetry, Inc.

- Cardiovascular Imaging Technologies, LLC

- ERT Clinical

- Icon PLC

- Image Core Lab

- Intrinsic Imaging LLC

- Ixico PLC

- Lyscaut Medical Imaging Company

- Medical Metrics

- Navitas Life Sciences

- Parexel International Corporation

- Perspectum Diagnostics

- Prism Clinical Imaging

- Quotient Sciences

- Radiant Sage LLC

- Resonance Health

- Worldcare Clinical, LLC

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Bioclinica, Inc.

- Biomedical Systems Corporation

- Biotelemetry, Inc.

- Cardiovascular Imaging Technologies, LLC

- ERT Clinical

- Icon PLC

- Image Core Lab

- Intrinsic Imaging LLC

- Ixico PLC

- Lyscaut Medical Imaging Company

- Medical Metrics

- Navitas Life Sciences

- Parexel International Corporation

- Perspectum Diagnostics

- Prism Clinical Imaging

- Quotient Sciences

- Radiant Sage LLC

- Resonance Health

- Worldcare Clinical, LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 261 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1 Billion |

| Forecasted Market Value ( USD | $ 1.4 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |