Global Ceiling Tiles Market - Key Trends & Drivers Summarized

What Are Ceiling Tiles, and Why Are They Crucial in Modern Construction?

Ceiling tiles are a vital component in modern construction, used to enhance the aesthetic appeal of interiors while providing functional benefits such as sound absorption, fire resistance, and thermal insulation. These tiles are available in a variety of materials, including mineral fiber, metal, gypsum, and wood, catering to both commercial and residential projects. Ceiling tiles are widely used in offices, retail spaces, healthcare facilities, educational institutions, and homes, offering flexibility in design and performance. Their role in improving indoor environments, both functionally and visually, makes them an essential element in the building materials market. The growing focus on sustainable construction practices has led to the increased use of eco-friendly and recyclable materials in ceiling tiles. In addition to their functional benefits, ceiling tiles can be customized with different finishes, textures, and designs, making them popular for interior designers and architects looking to create visually appealing spaces. As more buildings emphasize energy efficiency and green certifications, the demand for ceiling tiles that contribute to sustainable architecture, such as those made from recycled content or those with insulating properties that reduce energy consumption, has been on the rise.How Are Technological Innovations Impacting the Ceiling Tiles Market?

Technological advancements are significantly transforming the ceiling tiles market, enhancing both the performance and design possibilities of these products. Innovations in materials science have led to the development of lightweight, durable, and fire-resistant tiles that offer superior insulation and acoustic control. For instance, advancements in mineral fiber technology have improved sound absorption properties, making ceiling tiles more effective in creating acoustically controlled environments, which is particularly important in spaces such as offices, classrooms, and auditoriums. Moreover, fire-rated ceiling tiles, often made with gypsum or specialized mineral composites, are gaining popularity in commercial and industrial applications where safety is paramount. Another important technological development is the use of 3D printing and modular designs in ceiling tiles. This has allowed manufacturers to offer more intricate and customizable designs at lower production costs. 3D-printed ceiling tiles can replicate various textures, patterns, and finishes, offering architects and designers a broader range of aesthetic possibilities. Modular ceiling tiles, which allow for easier installation and replacement, are also becoming more popular, particularly in commercial spaces where flexibility and ease of maintenance are key concerns. Furthermore, advances in antimicrobial coatings are driving the adoption of ceiling tiles in healthcare and hospitality environments, where hygiene is a top priority.What Consumer and Industry Trends Are Driving the Demand for Ceiling Tiles?

Several consumer and industry trends are shaping the demand for ceiling tiles, particularly the growing emphasis on sustainable building materials and the rising importance of interior acoustics. As more companies and homeowners look to reduce their environmental impact, there is an increasing preference for ceiling tiles made from recycled and renewable materials. This trend is particularly strong in regions like North America and Europe, where green building certifications such as LEED (Leadership in Energy and Environmental Design) and BREEAM (Building Research Establishment Environmental Assessment Method) are influencing construction practices. Ceiling tiles that contribute to energy efficiency, through enhanced insulation and light reflectance, are also in high demand as they help reduce heating and cooling costs in large commercial spaces. In addition to sustainability, the rising importance of acoustics in commercial and residential buildings is driving demand for high-performance acoustic ceiling tiles. With the increasing focus on creating productive, comfortable workspaces, particularly in open-plan offices, the need for effective noise reduction has become crucial. Acoustic ceiling tiles, which help absorb sound and reduce echo, are becoming essential in these environments. The demand for aesthetically pleasing ceiling tiles has also surged, as property developers and interior designers seek to balance functionality with modern design trends. This has led to the rise of tiles with unique finishes, customizable designs, and integrated lighting solutions, providing greater flexibility in creating visually appealing interiors.Growth in the Ceiling Tiles Market Is Driven by Several Factors

Growth in the ceiling tiles market is driven by several factors, including technological advancements, increasing construction activities, and evolving consumer preferences for sustainable and aesthetically pleasing building materials. One of the key drivers is the rising demand for environmentally friendly building products. As sustainability becomes a major concern in the construction industry, manufacturers are developing ceiling tiles that meet green building standards, such as those made from recycled content or offering energy-saving benefits through improved thermal insulation. These tiles are particularly attractive to commercial building owners seeking to lower operating costs and achieve sustainability certifications. Technological innovations are also propelling the market forward, particularly in the areas of acoustic performance, fire resistance, and ease of installation. With the growing need for sound management in open offices, classrooms, and healthcare facilities, the demand for high-quality acoustic ceiling tiles continues to rise. The ability to offer fire-rated tiles that enhance safety in commercial and industrial settings is further contributing to market growth. Additionally, the development of modular and easy-to-install ceiling tiles is meeting the demands of construction professionals who prioritize time and cost efficiency in both new projects and renovations.Changing consumer preferences toward modern, aesthetically appealing interiors are also boosting the demand for ceiling tiles. Homeowners and developers alike are seeking ceiling solutions that enhance the visual appeal of spaces while providing functional benefits such as noise reduction and energy efficiency. The availability of customizable ceiling tiles, enabled by innovations in 3D printing and modular design, is giving consumers more options to personalize their interiors. These factors, combined with the growing construction activities in emerging markets and the expansion of commercial real estate projects globally, are expected to continue driving the growth of the ceiling tiles market in the coming years.

Report Scope

The report analyzes the Ceiling Tiles market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Product (Mineral Wool, Metal, Gypsum, Other Products); Application (Non-Residential, Residential, Industrial).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Regional Analysis

Gain insights into the U.S. market, valued at $2.4 Billion in 2024, and China, forecasted to grow at an impressive 13.4% CAGR to reach $3.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Ceiling Tiles Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Ceiling Tiles Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Ceiling Tiles Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Acoustic Ceiling Products, Llc., Acoustigreen, Armstrong World Industries, Inc., Burgess Cep, Byucksan Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Ceiling Tiles market report include:

- Acoustic Ceiling Products, Llc.

- Acoustigreen

- Armstrong World Industries, Inc.

- Burgess Cep

- Byucksan Corporation

- Ceilume

- Certainteed

- Georgia-Pacific

- Hil Limited

- Hunter Douglas

- Knauf

- Mada Gypsum

- Odenwald Faserplattenwerk GmbH

- Renhurst Ceilings Pty Ltd

- Rockfon

- Saint-Gobain Gyproc

- SAS International

- Shandong Huamei Building Materials Co., Ltd

- Techno Ceiling Products

- USG Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Acoustic Ceiling Products, Llc.

- Acoustigreen

- Armstrong World Industries, Inc.

- Burgess Cep

- Byucksan Corporation

- Ceilume

- Certainteed

- Georgia-Pacific

- Hil Limited

- Hunter Douglas

- Knauf

- Mada Gypsum

- Odenwald Faserplattenwerk GmbH

- Renhurst Ceilings Pty Ltd

- Rockfon

- Saint-Gobain Gyproc

- SAS International

- Shandong Huamei Building Materials Co., Ltd

- Techno Ceiling Products

- USG Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 288 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

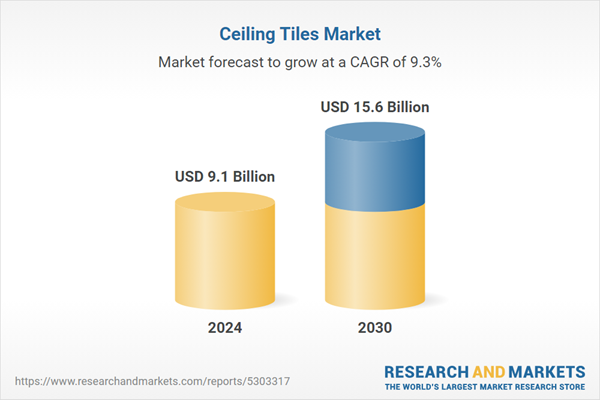

| Estimated Market Value ( USD | $ 9.1 Billion |

| Forecasted Market Value ( USD | $ 15.6 Billion |

| Compound Annual Growth Rate | 9.3% |

| Regions Covered | Global |